Bangladesh found its foreign currency reserves strained amid the global recession, post-COVID-19, and the escalating fuel costs due to the Russia-Ukraine conflict. In response, the IMF agreed to extend a $4.7 billion loan to Bangladesh in January 2023, imposing strict conditions to ensure economic stability. These conditions, synonymous with harsh austerity measures, aimed to rectify fiscal imbalances and stabilize the economy, ensuring solvency and meeting repayment obligations. However, to ensure economic stability, it is crucial to prioritize raising funds from domestic sources, including boosting tax revenue.

Journey Towards Effective Tax Administration

Despite missing targets for Net International Reserves (NIR) and tax revenue, Bangladesh received further loan installments, contingent on several reforms: reducing tax rebates, adjusting fuel prices, bolstering foreign currency reserves, rationalizing subsidies, and addressing defaulted loans.

Tax reform is crucial, as past exemptions hindered growth. The IMF urged Bangladesh to significantly boost tax revenues annually, setting targets much higher than previous government estimates. Achieving these targets requires unprecedented growth in tax revenue, a daunting challenge given the average 12% year-on-year increase since 2018.

You can also read: Bangladesh’s Banking Sector Faces Tk 5.50 Trillion Non-Performing Loans Surge

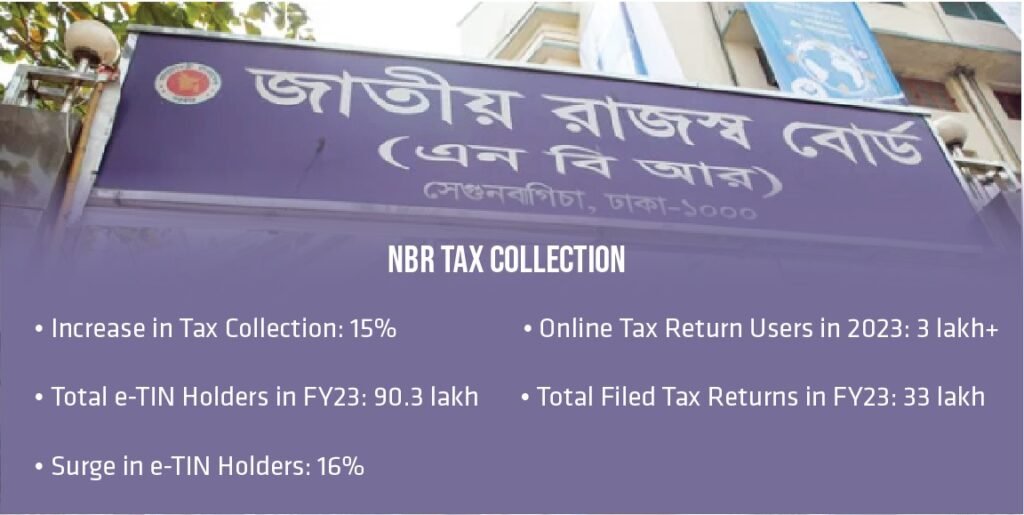

The National Board of Revenue (NBR) witnessed a notable 15% increase in tax collection during the initial nine months of the current fiscal year, a strategic move to align with IMF conditions swiftly. Key reforms, such as expanding the taxpayer base to one crore by 2026 through streamlined IT administration and simplified tax codes, have been set in motion. The transition to online tax return submissions saw over 3 lakh individuals embracing digital platforms in 2023 alone.

The surge in digital taxpayer-identification numbers (e-TIN) holders by 16% in FY23, totaling 90.3 lakh, with 33 lakh successfully filing tax returns, underscores a paradigm shift towards income and value-added taxes, in line with IMF’s push for trade liberalization.

To sustain progress, the government should prioritize increasing Taxpayer Identification Number (TIN) registrations and compliance, drawing inspiration from systems like the UK’s national insurance number. National campaigns, especially in rural areas, can drive registrations. A centralized electronic taxpayer database and measures to curb corruption are vital. Requiring tax return proof for government services and facilitating online submissions with automatic tax certificate issuance will boost compliance.

Balancing Conditions with Citizens’ Well-being

In revenue, eliminating tax exemptions in income tax, VAT, and tariffs is critical. The NBR estimates exemptions at Tk1,78,200 crore, 3.5% of GDP in FY24, urging swift action to boost revenue.

A recent study by the PRI illuminates Bangladesh’s potential to harness an additional Tk65,000 crore in tax revenue, a boon achievable through a mere 2% expansion of the tax net and enhanced compliance with personal income tax. The promise of redirecting this windfall into development sectors, as advocated by the PRI, could propel GDP growth by 0.2%, signaling a crescendo of prosperity on the horizon.

Revenue Enhancement:

- Exemptions (Tk 1,78,200 crore, 3.5% of GDP)

- Additional Tax Revenue Suggested (Tk 65,000 crore)

Impact of Elevating Tax-GDP Ratio:

- Increase in Real GDP (0.51%)

- Poverty Alleviation (4% reduction)

Such a stride would elevate the nation’s tax-GDP ratio to 10.4%, amplifying real GDP by 0.51% and alleviating poverty among the most vulnerable households by a striking 4%. Channeling this newfound tax bounty into essential civic services—healthcare, education, and robust infrastructure—is paramount for sustained economic vitality.

In the debate over IMF loans, seen as both a cure-all and a burden, the reality is clear: each loan comes with stringent conditions, often impacting citizens’ well-being in the short term.

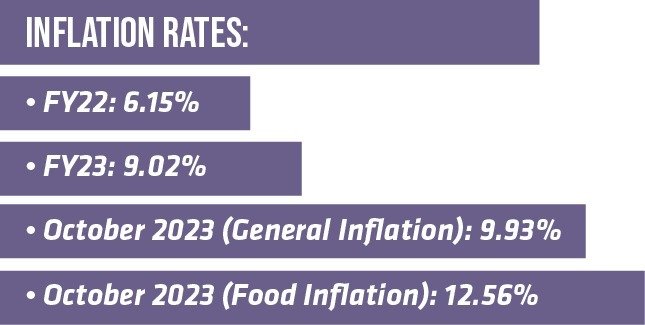

Inflationary pressures since 2022 threaten living standards, with FY23 seeing a sharp rise to 9.02% from 6.15% in FY22 and 5.56% in FY21. October 2023 recorded general inflation at 9.93%, with food inflation at 12.56%. The 28% devaluation of the taka since the summer of 2022 adds to the uncertainty, challenging economic resilience.

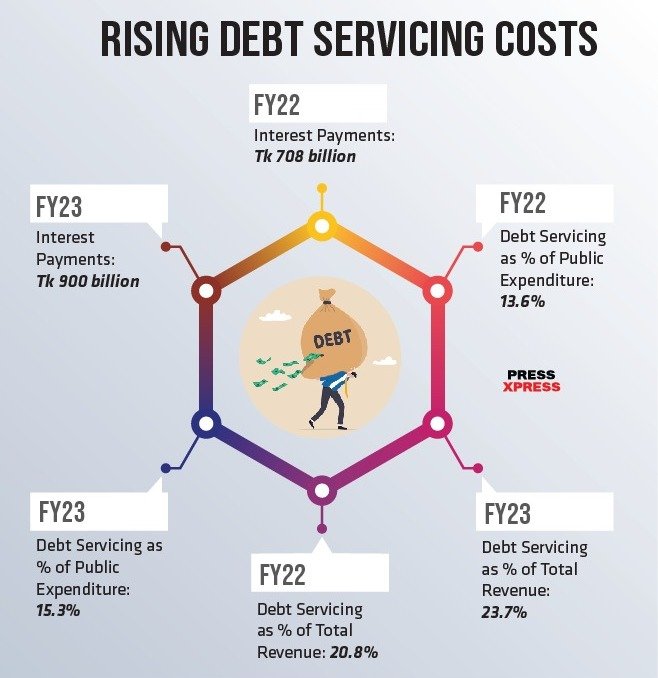

Rising debt servicing costs pose a significant challenge, with interest payments reaching Tk 900 billion in the outgoing fiscal year—13.6% of total public expenditure and 20.8% of total revenue, marking a substantial increase from FY22.

The depreciation of the Bangladeshi taka against the US dollar doubles the burden of external debt servicing, expected to escalate further in FY24.

Debt Servicing Dilemma

The proliferation of market-based interest rates on foreign loans poses significant challenges, with truncated maturities and grace periods leading to an expedited increase in debt servicing costs.

Domestic borrowing from the central bank surged to Tk980 billion in FY23, exacerbating inflationary pressures and economic challenges.

The government’s progress in meeting IMF loan targets is mixed, with advancements in some areas but lingering concerns in others, leaving uncertainty about future outcomes.

The IMF’s prescribed tax revenue target for FY23, a mere Tk3456 billion, saw the government falter, collecting Tk3390 billion, falling short by Tk66 billion—a disheartening shortfall. Similarly, the target for net international reserves, pegged at US$25.3 billion, floundered as unofficial reports revealed a shortfall of around US$7 billion, plunging to approximately US$18 billion by September 2023—a stark reminder of the uphill battle ahead.

Monetary policy reforms in Bangladesh include adopting an interest rate corridor system and aligning foreign exchange reserves with IMF standards, showcasing commitment to economic resilience.

On the fiscal front, the National Board of Revenue (NBR) aims to boost revenue through various measures: increasing taxes on property and consumer goods, removing exemptions in certain sectors, and expanding the use of EFD/SDC machines for tax monitoring.

These concerted efforts yield tangible results, evidenced by a 16% surge in digital taxpayer-identification numbers (e-TIN) holders in FY23, with over 9.03 million individuals possessing TINs and 3.3 million filing tax returns online—a testament to the nation’s burgeoning digital transformation.

Bangladesh faces a pivotal moment, needing robust fiscal reforms for stability. Despite efforts, missing the IMF’s FY23 tax revenue target by Tk66 billion highlights the tough road ahead.

The NBR’s efforts are commendable, but FY24’s tax revenue growth target of 20.40% (and the national budget’s 33% target) pose challenges, given modest growth averaging 12% annually since 2018.

As import restrictions persist and growth prospects wane, achieving revenue mobilization at a rate exceeding 20% appears increasingly unattainable. Yet, meeting the IMF’s FY24 tax revenue target and the national budget’s revenue goals demands growth rates of approximately 21% and 33%, respectively, signaling an uphill battle.

A 2-percentage-point rise in the tax-GDP ratio from personal income taxes, redistributed through spending, could boost real GDP by 0.51 percentage points and reduce poverty among the lowest quintile households by 4 percentage points—a clear link between fiscal policy and socioeconomic progress.

Together with other steps, reforming state-owned enterprises (SOEs) is also crucial for improving financial performance and easing the fiscal burden. Implementing budget constraints, refining pricing policies, and enhancing corporate governance can unlock SOEs’ revenue potential, benefiting government finances.