With the right policy support and addressing key challenges, stakeholders believe Bangladesh’s furniture industry can emulate the success of its garment exports, emerging as a significant foreign exchange earner and contributing further to the country’s economic growth.

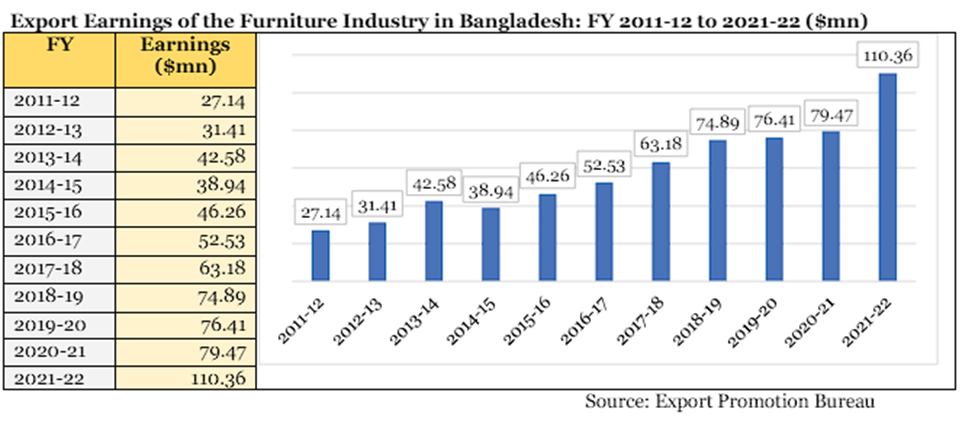

Bangladesh, one of the modern era’s economic marvels, has witnessed remarkable growth over the past decade. The furniture industry emerges as one of the most promising and potentially burgeoning sectors in terms of export volume. Sources from the Export Promotion Bureau reveal that this sector’s contribution to the export basket has been boosting at an increasing rate since the last decade.

You can also read: Bangladesh’s Digital Gender Gap Requires Inclusive Connectivity

The furniture industry, following ready-made garments, stands out as one of the most labor-intensive sectors in the country, engaging 25 lakh (2.5 million) people across more than 40,000 small and large organizations nationwide. With an annual turnover exceeding Tk 35,000 crore (approximately $3.5 billion) in the domestic market, significant strides have been made, leading to the development of major brands within the country’s furniture industry.

However, through comprehensive government support and strategic planning across short, medium, and long-term horizons, Bangladesh’s furniture industry can realistically aim to cement its position among the top five global exporters within the next ten years.

Current Export Performance

Despite the domestic industry’s progress, stakeholders are now setting their sights on the global market. Selim H Rahman, president of the Bangladesh Furniture Industry Owners Association and chairman and managing director of HATIL, shared that while 95% of the country’s furniture demand is being met by domestically produced furniture, their current objective is to penetrate the international market. “It requires cooperation from the government,” he added.

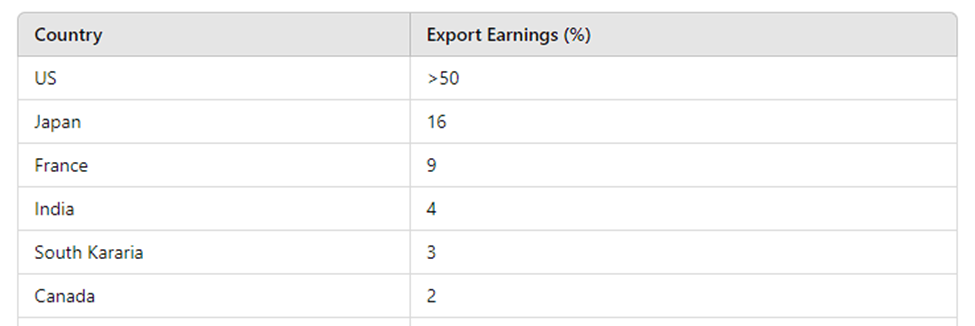

During the last fiscal year (2023), Bangladesh achieved significant furniture exports totaling $110 million to 61 countries. The US-led as the primary importer, comprising over 50% of export earnings. Japan followed at 16%, with France at 9%, India at 4%, South Korea at 3%, and Canada at 2%, while the rest were distributed among Saudi Arabia, Spain, and other nations.

Bangladesh’s Furniture Exports (2023) – $110 million to 61 countries

The government has taken the initiative to identify the bottlenecks and constraints faced by stakeholders in the highly promising furniture industry. A recent study by the Bangladesh Investment Development Authority (BIDA) underscores the considerable prospects for furniture exports, identifying factors such as the abundance and availability of labor, capital inflows, technological advantages, and global market demand as potential catalysts for growth. The study also highlights the need for tariff reductions and policy support, including provisions for bonded warehouse facilities for raw material imports.

According to the BIDA study, the current global trade volume of furniture stands at $650 billion, with exports amounting to $328.64 billion. China leads in furniture exports, with a value of about $139.48 billion, while Bangladesh ranks 36th, exporting furniture worth $110.36 million per year.

As stakeholders remain optimistic about the industry’s growth potential, government support in addressing key bottlenecks could pave the way for Bangladesh’s furniture industry to emerge as a significant foreign exchange earner, rivaling the country’s renowned ready-made garment sector.

Bonded warehouse facility to speed up export

Bangladesh’s furniture sector, which caters to both domestic and international markets, faces a hurdle in accessing bonded warehouse facilities due to its partial export-oriented status. This limitation impedes the sector’s growth and competitiveness. To address this issue, the Bangladesh Investment Development Authority (BIDA) is advocating for bonded warehouse facilities tailored for partial exporters. The Bangladesh Furniture Industries Owners Association (BFIOA) has formally proposed the inclusion of duty bond facilities in the national budget for 2023-24, alongside an equivalent bank guarantee, aiming to accelerate the sector’s progress.

However, local manufacturers believe they can still turn the tide within the next five years and propel earnings as high as near to garment shipments. To compete more effectively with global peers, they are seeking a bonded warehouse facility to offset the high import duty on raw materials, which currently ranges from 55 percent to 100 percent.

“We are now looking to secure a larger pie of the global market, but our products are priced out of competition,” said Salim H Rahman, chairman of the Bangladesh Furniture Industries Owners Association and chief of exporter Hatil Furniture. He believes a bonded warehouse facility would lead to a manifold increase in export earnings within the next five years, driven by strong international demand.

Learning from Vietnam’s Success

BIDA’s examination of the tariff structure on the import of raw materials for furniture production in Bangladesh and Vietnam reveals a significant contrast. The Vietnamese government’s imposition of low tariffs on raw material imports has been a key factor in the growth of the furniture industry. In contrast, Bangladesh faces challenges in furniture exports due to the elevated costs of raw materials.

To enhance the country’s furniture sector exports, in line with the successful model implemented by Vietnam, BIDA’s report recommends a reduction in duty rates to a reasonable level or even the consideration of duty-free imports for raw materials intended for the exportable furniture sector.

Furniture Industry in Bangladesh

The furniture industry in Bangladesh has transformed from a traditional cottage-based industry to a mechanized, mass production-oriented industry since the early 1990s. Furniture businesses have grown with modern machinery, innovative designs, and the use of diverse materials such as wood, processed wood, melamine board, Medium Density Fiberboard (MDF), particleboard, and steel. Bangladesh now produces a wide variety of international standard and quality furniture, and local consumers are increasingly choosing domestic furniture over foreign products.

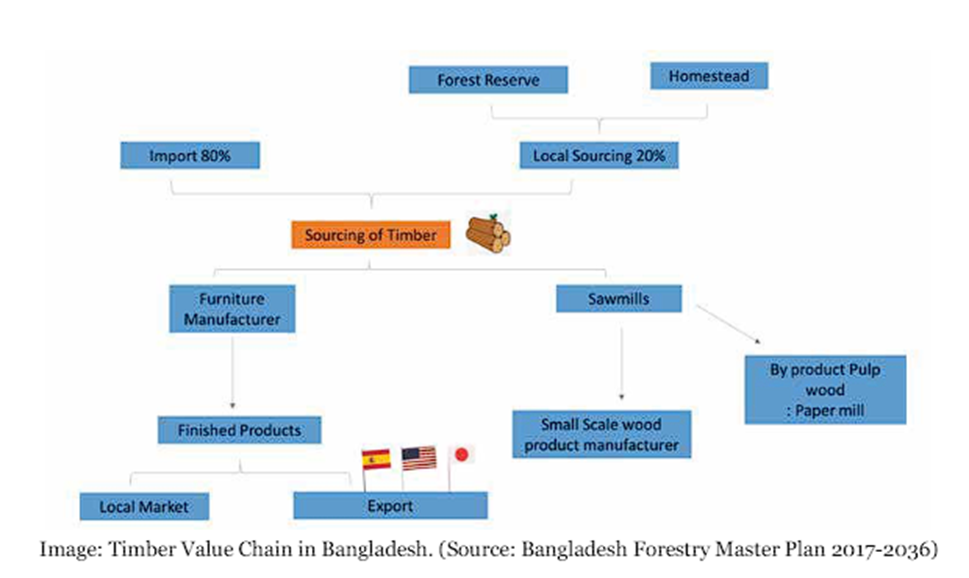

Furniture and allied product exports from Bangladesh started in 1995. The chief raw materials used are wood, laminated board, wrought iron, processed wood, MDF, particleboard, and rattan bamboo. However, most of these materials need to be imported, primarily from Africa (Tic, Gamar, and Hardwood), Myanmar (Barmatic wood), and other countries. The high import duties on these materials, ranging from 10.72% for solid wood to 92.3% for particleboard, significantly increase production costs, making it challenging for manufacturers to provide affordable furniture.

Despite 93% of manufactured furniture being sold in the local market, the industry has significant export potential, with an annual average growth of more than 20%. Currently, Bangladeshi furniture is exported to the US, Canada, Australia, the UK, the Middle East, European countries, and other South Asian nations, including India. The Bangladesh Bank has announced a 15% export subsidy/cash incentive to support the furniture industry’s exports.

The furniture industry’s raw materials are primarily imported from Africa, Canada, the USA, Australia, Myanmar, and other countries, while export destinations include India, the Middle East, the USA, and various other regions.

Conclusion

With the right policy support, stakeholders remain hopeful, to address bottlenecks, Bangladesh’s furniture industry stakeholders remain optimistic about realizing the sector’s potential as a significant foreign exchange earner following in the footsteps of the country’s ready-made garment industry.