Key Highlights:

- On Wednesday, May 22, Sunak stunned Britain by calling for a general election on July 4

- Sunak strategically timed his announcement amidst two positive developments: a dip in inflation and a decline in legal migration

- Recently, there has been a flurry of policy announcements, including increasing defense spending to 2.5% of GDP

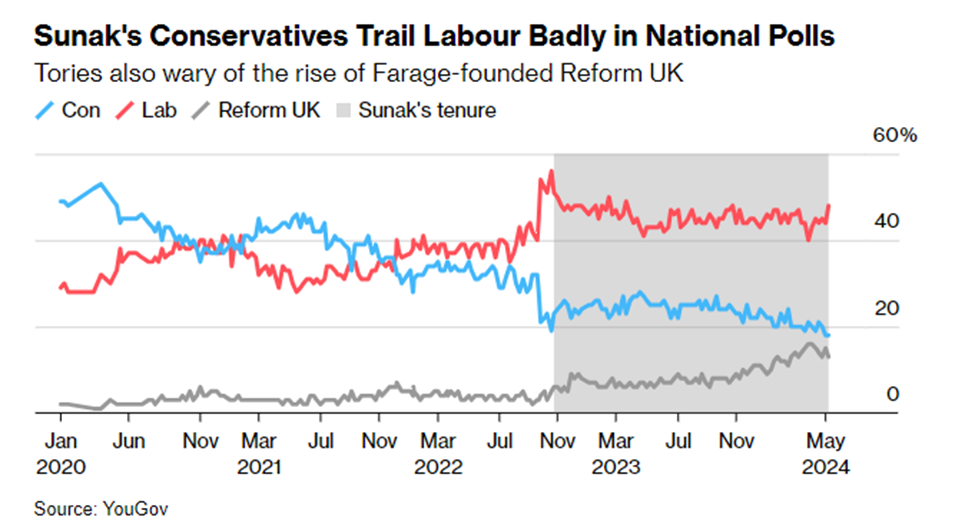

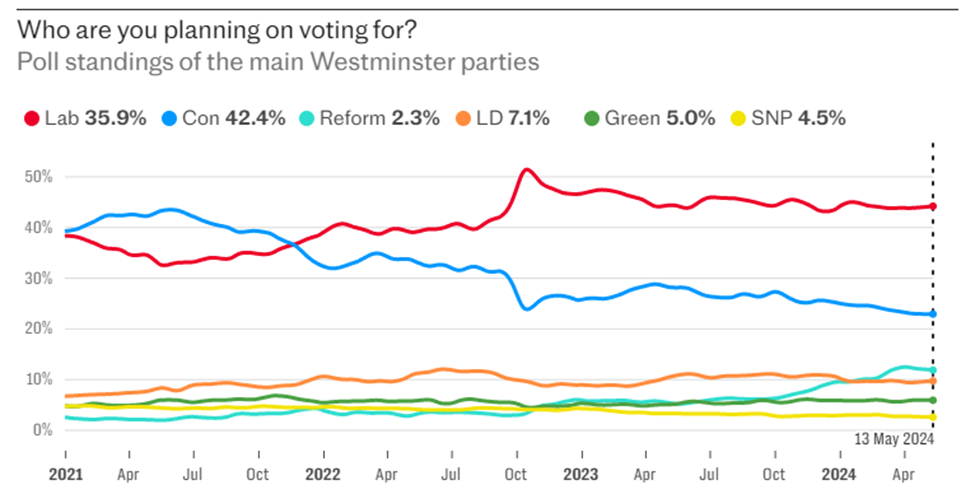

For someone who claims to be “not a betting person,” Rishi Sunak has just made a bold gamble. On Wednesday, May 22, Sunak stunned Britain by calling for a general election on July 4, despite his Conservative Party lagging behind the opposition Labor Party by over 20 points in most polls.

Most political analysts in Westminster had anticipated that Sunak would delay the election until October or November to allow more time for his party to recover. At first glance, this decision to potentially cut short his tenure might seem baffling. The polls still look grim, but the reasoning from No. 10 Downing Street is that all factors considered, July is the least unfavorable option.

You can also read: Labor Leader Keir Starmer Pledges to Rebuild Britain as Election Nears!

Some concerns waiting until the autumn could bring more challenges. With an increasing number of people facing higher monthly payments as their cheap fixed-term mortgages expire, and with the small boats crisis showing no signs of improvement, the bad news could outweigh any potential gains if Sunak postpones the election.

Election Timing to Dodge Trump Drama and US Election!

Conservative MPs reacted to the news with a mix of dismay, colorful language, and resigned acceptance.

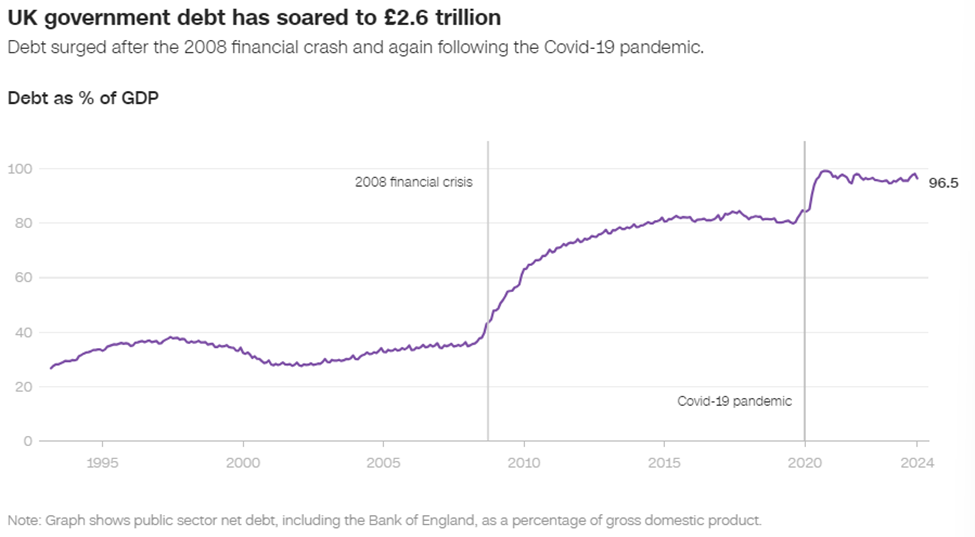

A cornerstone of a November election campaign would have been further tax cuts. Yet, Sunak and Chancellor Jeremy Hunt face an empty fiscal reservoir. Government sources attribute Wednesday’s decision partly to a warning from the International Monetary Fund of a potential £30 billion shortfall in public finances.

Publicly, the government rebuffed the IMF’s contention that there’s no room for a third national insurance cut. Instead, the Treasury is urged to explore unpopular options like reducing public spending or revisiting the triple lock on state pensions.

Opting for a summer election offers additional benefits. It sidesteps a clash with the US election in November and the potential chaos any offhand remark from Donald Trump could inject into both campaigns.

Did Major Expenditures Trigger Summer Election?

One of the key drivers of the decision, according to those familiar with the strategy, is a series of significant spending commitments. These include an increase in defense spending, a £10 billion compensation package for victims of the infected blood scandal, and funds for victims of the Post Office scandal. These expenditures mean there will be no money left for tax cuts in the autumn budget.

As one Tory insider noted: “They have been clearing the decks with big spending plans, which means there won’t be any money left for an autumn statement. And if you haven’t got any money to give away before the election, what are you waiting for?”

In a bid to appeal to the Tory base, a promised crackdown on benefit payments and a dilution of net zero commitments were announced. The stakes were further raised with a speech by Sunak last Monday, May 20 accusing Labor of being a threat to UK security, followed by Jeremy Hunt’s warning that Sir Keir Starmer would increase taxes.

Recently, there has been a flurry of policy announcements, including increasing defense spending to 2.5% of GDP. Sunak has centered his reputation on his relentless focus on reducing inflation. On Wednesday, it was announced that inflation had dropped to a 3-year low of 2.3%, just above the Bank of England’s target rate of 2%.

Voters Want New Deal Over New Government

As a concerned voter who perceives a pressing need for substantial governmental reform in the UK, mere changes in leadership won’t suffice; what’s required is a comprehensive “new deal” to reverse the country’s decline, stemming from ineffective governance, fiscal challenges, and the complexities of Brexit.

The latest Chandler Good Government Index report underscores this urgency, revealing a drop in the UK’s global ranking from 10th to 11th place, with its international trade performance plummeting to 28th, largely attributed to the altered trading dynamics with the EU. A significant 56% of UK businesses are grappling with the intricacies of post-Brexit trade regulations, hindering their operations.

The repercussions are palpable across various sectors. Notably, the NHS faces heightened challenges sourcing medicines amidst escalating costs and logistical hurdles, exacerbated by years of underinvestment and staffing shortages resulting from prolonged austerity measures under successive Conservative administrations.

Adding to the strain, the recent imposition of import tariffs on essential goods like fish, sausages, and cheese imposes additional bureaucratic burdens, with costs soaring up to £145 ($184) per shipment.

Recent surveys, such as one conducted by Deltapoll and the Tony Blair Institute, underscore public sentiment, with 52% advocating for government reinvestment in enhancing public service quality and efficiency, while a mere 11% support further tax reductions. Such findings suggest that prioritizing long-term stability and societal well-being should supersede short-term fiscal gains.

With the Conservative Party trailing behind and the specter of fiscal challenges looming large, Sunak’s decision seems both audacious and calculated. But amidst the clamor of campaign rhetoric and strategic maneuvering, one question hangs in the air: Will this gamble pay off for Sunak and his party, or will it lead to a political showdown of unforeseen consequences?