The ongoing decline in the capital markets of the nation comes as little shock to those keeping a close eye on the market. The imbalance between poor-performing and strong-performing stocks has persisted for over a decade, posing a persistent challenge. However, there is a ray of hope on the horizon following a recent public statement by the Honorable Prime Minister, who advocated for the listing of state-owned Enterprises (SoEs) on the stock market.

You can also read: PM Hasina Urges Italian Investment in Bangladesh for Mutual Growth

In a moment of strategic clarity, during a high-stakes Executive Committee of the National Economic Council (ECNEC) meeting, Prime Minister directed the Finance Division to spearhead the process of bringing SoEs into the capital market. Planning Minister Major General (retd) Abdus Salam and Planning Secretary Satyajit Karmaker, in a post-meeting press briefing, echoed the premier’s intent to fortify these entities financially.

SoE Listing Quest: Past Echoes, Present Realities, Future Hopes

This transformative journey finds its genesis in the approval of a visionary project, aimed at rejuvenating the operations of Chhatak Cement Company. A shift from traditional wet processing to modern dry-process manufacturing symbolizes a broader mission to invigorate state-owned enterprises.

Entrusted with the task, the Finance Division meticulously evaluates which SoEs are ripe for public listing. Once identified, a comprehensive proposal awaits the prime minister’s nod, signaling a pivotal step toward revitalization. Satyajit Karmaker extols the virtues of public listing, envisioning a future where SoEs rival their private counterparts in competitiveness.

Abdus Salam echoes the urgency, lamenting the lag behind private enterprises despite an early start. He champions a culture of competitiveness, urging SoEs to embrace financial responsibility and pursue excellence with unwavering determination.

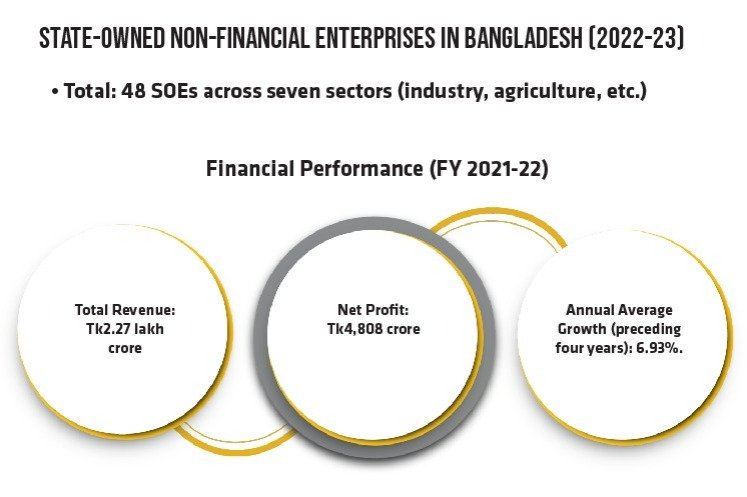

The Bangladesh Economic Review 2022–23 delineates a landscape dominated by 48 state-owned non-financial enterprises spanning seven pivotal sectors, ranging from industry to agriculture, each represented by a myriad of corporations, boards, and authorities. Despite their vast presence, the fiscal year 2021-22 unveiled a sobering reality: while these entities collectively amassed a staggering revenue of Tk2.27 lakh crore, their net profit barely scraped Tk4,808 crore, reflecting a meager annual average growth of 6.93% over the preceding four years.

In a stagnant environment, echoes of past directives persist. Despite previous successes like oil and gas listings in the early 2000s and calls for action from figures like Finance Minister AMA Muhit and AHM Mustafa Kamal, progress on State-Owned Enterprise (SoE) listing remains uncertain.

A Turning Point for Bangladesh’s SoEs

Capital market pundits dissect the conundrum with surgical precision, identifying a fatal flaw embedded within the very fabric of these enterprises: a lack of competitiveness born from an archaic mindset and entrenched workplace culture. The tale of 22 SoEs listed on the Dhaka Stock Exchange serves as a poignant microcosm, where the privileged few, buoyed by monopolistic advantages, bask in prosperity while the majority languish in the shadows of inefficiency.

In the tumultuous arena of commerce, contrasts abound: oil distributors flourish while sugar mills languish, and stalwarts like Eastern Cables falter against private sector dominance.

Yet, amidst this tumult, a beacon shines bright. In December 2021, the BSEC beckoned 17 state-owned entities to the stock market fray, followed by a curated list of 29 firms, rallying governance to action.

- Identified fatal flaw: Lack of competitiveness due to entrenched workplace culture.

- Contrasts in performance: Some flourish due to monopolistic advantages, while others languish in inefficiency.

Sectoral Contrasts:

- Flourishing sectors: Oil distributors.

- Struggling sectors: Sugar mills.

- Competition challenges: Eastern Cables vs. private sector dominance.

These entities stand as guardians of Bangladesh’s economic destiny, from Bakhrabad Gas to Biman Bangladesh Airlines. And in this transformative journey, ICB Capital Management emerges as a guiding force, illuminating the path toward responsible stewardship and a brighter future.

In the tapestry of governance, a deeper truth emerges—a sacred bond between accountability and prosperity. Experts, with unwavering resolve, urge the government to honor minority shareholders’ rights, laying the foundation for modern, efficient state-owned enterprises. For within the crucible of transparency lies the promise of abundance—a harvest of capital, trust, and boundless potential.

The tale of Titas Gas, amidst turbulent waters, is a testament to the allure of public listing. Once a beacon of promise, regulatory shadows dimmed its light. Yet, a government’s renewed commitment reignites hope, restoring profitability and investor trust.

Bangladesh’s Struggle with Underperforming Stocks

In the tempestuous realm of the nation’s stock exchanges, a somber reality grips the hearts of vigilant observers. For years, underperforming stocks have shrouded the landscape in gloom, leaving investors disheartened. Despite earnest efforts by exchange authorities, a pervasive bearish sentiment pervades, haunted by recurrent losses.

Yet, amidst this bleakness, a glimmer of hope emerges—a resolute call from the esteemed prime minister. Her recent proclamation reverberates through financial corridors, signaling a new era for state-owned enterprises (SoEs) as she champions their listing on the exchanges.

While praise is warranted for this bold initiative, a sense of skepticism lingers, colored by memories of past unfulfilled promises. Five years prior, a similar call faltered in the face of adversity. But now, as the market malaise defies conventional solutions, there arises a newfound resolve to overcome past hesitations and forge a path toward progress.

In the annals of governance, a pivotal decision unfolds as the ECNEC reaffirms its commitment to scrutinize SoE listings. Yet, the crux lies not in mere divestment but in the judicious allocation of publicly traded stocks. While titans like Titas Gas and DESCO have seen partial divestment, lingering concerns shadow their governance and operational efficacy.

Allegations of financial misconduct loom large, emblematic of a systemic challenge transcending individual missteps. As echoes of past directives fade, the call for decisive action grows louder.

Amidst the labyrinth of bureaucracy, a troubling trend emerges—retaining control post-divestment. Privatized SoEs, tethered to administrative oversight, stifle entrepreneurial spirit, hindering profitability.

Insights from Bangladesh’s Market Landscape

In the shadows of governance, ordinary shareholders languish, their voices drowned in the din of boardroom discourse. Annual general meetings, once bastions of democracy, now echo with hollow promises as management reigns supreme and accountability fades into obscurity.

Yet, amidst this darkness, a beacon of clarity emerges—a resounding call from the prime minister to divest. It is a call to arms, a clarion call to wrest control from complacency and steer toward profitability and accountability.

But beware—mere divestment is not the answer. Its execution will unveil the sincerity of governance. It is a test of resolve, a crucible through which true intentions are revealed. Beyond privatized SoEs lies a broader imperative—to usher in prosperity, to invite blue-chip companies into the sanctum of the stock exchanges.

In the government’s vision, state-owned enterprises (SoEs) embrace the ethos of good corporate governance, promising not just financial success but also attracting foreign investments. As state control recedes, the treasury finds relief from reinvestment burdens. Embracing transparency, SoEs step into the spotlight of public scrutiny.

The saga of TITAS Gas stands as a poignant lesson—a tale of profitability swayed by sudden policy shifts, underscoring the delicate balance between regulation and investor trust. In the halls of the Dhaka Stock Exchange, listed state-run companies may appear subdued, yet their growth potential is undeniable, evidenced by their diverse market shares.

Listing a company is not a mere formality; it’s a transformative journey, offering access to capital, strengthening structures, and enhancing reputation. But with this privilege comes responsibility—to meet trading requirements, lest the threat of delisting looms, casting uncertainty over the company’s path forward.