Key Points:

- Modest finances, extravagant tastes

- Seek convenience and ethical consumption

- Crave seamless transactions and genuine connections

- Value authenticity in a digital world

The enigmatic nature of youth continues to baffle generations, as today’s young individuals present a unique blend of characteristics. With their juxtaposed traits of modest finances and extravagant tastes, they seek both convenience and ethical consumption, craving seamless transactions and genuine connections. Amidst their immersion in a digital world, authenticity remains a prized virtue.

You can also read: Scholz Presses China on Debt Relief for Developing Nations

In terms of sheer numbers, the youth wield significant influence. The European Union houses nearly 125 million individuals aged 10 to 34, while America boasts another 110 million Gen Zs and millennials, constituting a third of its population. Their collective spending power reached a staggering $2.7 trillion in 2021, solidifying their impact on the economic landscape.

What are the Generation Z (Gen Z)?

Generation Z, often abbreviated as Gen Z, encompasses individuals born between 1997 and 2012. Positioned between Millennials and Generation Alpha, this cohort represents the newest wave of societal evolution. Its oldest members are transitioning into their late twenties, navigating milestones such as completing education, entering the workforce, and establishing families, while its youngest members are as young as 12 years old.

Generations defined by name, birth year, and ages in 2024

Understanding the psyche of young consumers requires delving into the economic contexts that have shaped them. From enduring the aftermath of the 2007-09 financial crisis to navigating the disruptions of the COVID-19 pandemic, today’s youth have faced considerable challenges. A study revealed that a quarter of Gen Zs doubt their ability to retire, with less than half envisioning homeownership in their future.

Youth Influence

• EU: 125M aged 10-34

• USA: 110M Gen Z & Millennials

• Collective spending power: $2.7 trillion in 2021

Despite this uncertainty, impulsive spending emerges as a coping mechanism. Disproportionately affected by the pandemic, young Americans are experiencing a rebound, with millennials increasing spending by 17% by March 2022. However, their long-term financial outlook remains bleak, as they accumulate less wealth than previous generations at the same stage of life.

Shopping Habits of the Young

The shopping habits of young consumers reflect the influence of easy payment options and the “attention economy.” McKinsey’s survey revealed that 45% of European youth plan splurges in the next three months, contrasting sharply with 83% of older Boomers who reject such profligacy. Forrester’s findings indicate that ‘buy now, pay later’ app users are typically around 20 years old. In the digital age, online shopping is preferred by youngsters, fueled by social media’s allure and smartphone dependence. They demand convenience, with Gen Z showing the highest preference for speedy delivery and mobile payments. This demographic, dubbed ‘always-on purchasers’, opts for quick fixes and subscription services, propelling the success of online rental and streaming platforms like Netflix.

Shopping Habits

- Preference for online shopping

- Demand for quick fixes and subscription services

- Highest preference for speedy delivery and mobile payments

Impulsive Spending and Coping Mechanisms

Despite this uncertainty, impulsive spending emerges as a coping mechanism. Disproportionately affected by the pandemic, young Americans are experiencing a rebound, with millennials increasing spending by 17% by March 2022. However, their long-term financial outlook remains bleak, as they accumulate less wealth than previous generations at the same stage of life.

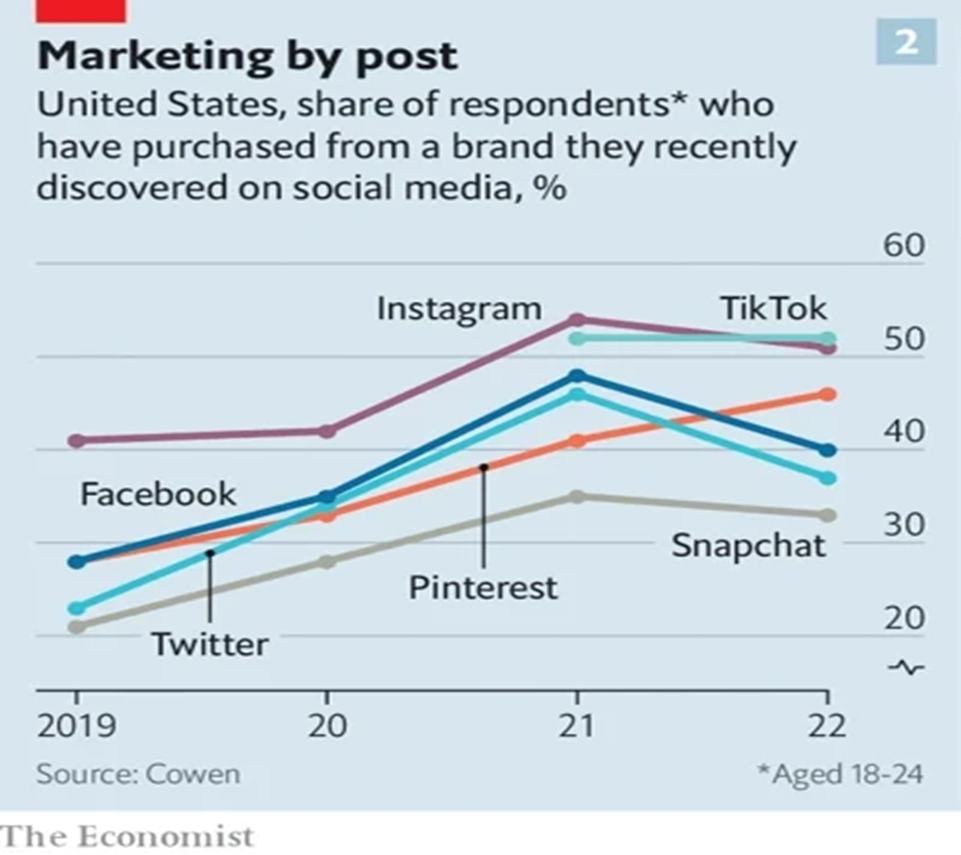

Influence of Social Media on Shopping Behavior

The internet has also changed how the young discover brands. Print, billboard, or TV advertising has given way to social media. Instagram and TikTok are where the young look for inspiration, particularly for goods where looks matter such as fashion, beauty, and sportswear. TikTok’s user-generated videos can propel even tiny brands to speedy viral fame. Such apps are increasingly adding features that allow users to shop without ever leaving the platform.

Why is youth financial inclusion important in Bangladesh?

Bangladesh faces the imminent conclusion of its demographic dividend. To make the most of this window of opportunity, it’s imperative to empower the youth demographic now.

Empowering youth through access to financial institutions and services is crucial. It enables them to acquire new skills, pursue higher education, or initiate entrepreneurial ventures – all of which can significantly contribute to the country’s economic growth.

Research conducted since the early 2010s consistently highlights the positive impact of financial inclusion on youth. When young people have access to financial services, they are more likely to build wealth and ascend the economic ladder. Moreover, financial inclusion enhances their financial security for the future.

Recognizing the importance of this issue, the Youth Policy Forum (YPF) and BRAC are collaborating on a project titled ‘Fin-Fit Future for Youth’. This initiative aims to explore strategies for enhancing youth financial inclusion in Bangladesh. A recent webinar organized under this project discussed existing policies for youth financial inclusion, identified implementation challenges, and proposed interventions to address them.

A significant portion of Bangladesh’s population, one-fourth to be precise, falls within the 15-29 age group, totaling 45.9 million individuals (4 crore and 59 lakh), as per the recent census report published by the Bangladesh Bureau of Statistics (BBS).

However, concerns arise regarding the effective utilization of this sizable youth demographic. The BBS’s previous labor force survey in 2016 revealed a higher unemployment rate among university graduates. The report indicated a 10 per cent unemployment rate among university graduates and an 8.7 per cent unemployment ratio within the 15-29 age group.

The latest census report, published on Wednesday, reveals that Bangladesh’s current population stands at 165,158,616 (16 crore 51 lakh 58 thousand 616). Ten percent of this population belongs to the 15-19 age group, 9 per cent to the 20-24 group, and 8.71 per cent to the 25-29 group. Typically, individuals within the 15-29 age bracket are categorized as part of the youth population.

Additionally, 9.28 per cent of the population falls within the 60-100 age group.

According to the census report, 27.82 per cent of the country’s population comprises youth. This substantial youth population holds the potential to shape Bangladesh’s future landscape.

Changing Preferences and Values

How the young shop is clearly in flux. What they buy, too, is changing. What older generations consider discretionary, such as wellness and luxury, have become essentials. Self-care is all the rage. On the hunt for clothing that will set them apart, the young are turning to posh brands at an ever more tender age.

More broadly, young consumers profess to be more values-driven than previous generations. Research shows that this attitude is even more common among teenagers and 20-somethings than among slightly older counterparts. Some of these values are centered around identity (race, gender, and so on). Others stem from things the young care about, such as climate change.

Conclusion

Youngsters’ appetite for instant gratification is also fuelling some distinctly ungreen consumer habits. The young have virtually invented quick commerce, observes Isabelle Allen of KPMG. And that convenience is affordable because it fails to price in all its externalities. Shein, a Chinese clothes retailer that is the fastest in fast fashion, tops surveys as a Gen Z favorite in the West, despite being criticized for waste; its fashionable garments are cheap enough to throw on once and then throw away. Like everyone else, the young are, then, contradictory—because, like everyone else, they are only human.