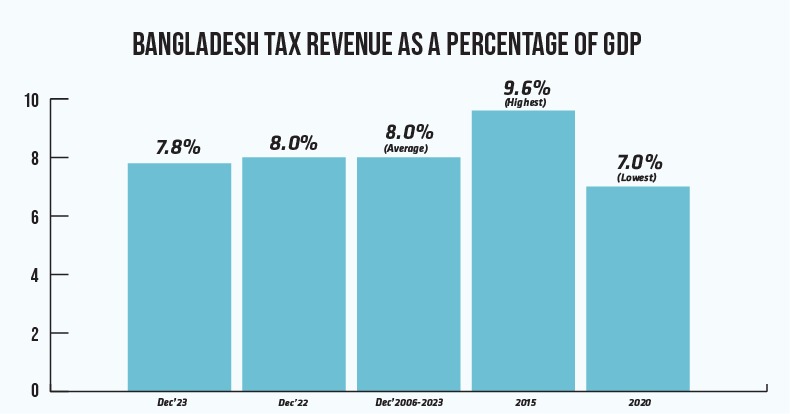

Bangladesh is at a pivotal juncture, balancing on the edge of fiscal challenges while glimpsing the promising prospects of economic advancement. Currently, the country’s tax revenue represents 7.6% of GDP, which presents an opportunity for growth compared to global standards. Yet, there’s room for improvement to ensure sustainable development. Additionally, the debt-to-revenue ratio, standing at 380%, calls for careful management to prevent crossing the threshold of 400%, a benchmark associated with Highly Indebted Poor Countries.

You can also read: Insights from Bangladesh Banking Sector’s Earnings Growth Trends

The vision of Bangladesh to achieve developed status by 2041 remains steadfast, albeit with obstacles to overcome. With projected revenue losses of Tk50 trillion by 2041, it is a call to action for comprehensive reforms to ensure sustained economic growth.

Bangladesh’s Quest for a 60% Surge in Tax Base

In the corridors of PRI’s discourse, the urgency for immediate reform resounds, underscoring the necessity of a seismic shift in Bangladesh’s revenue strategy. The dream of prosperity risks fading into mere reverie amidst dwindling tax income, soaring debt, and a looming fiscal deficit.

Bangladesh teeters on the edge of irreversible decline, yet redemption beckons through resolute action—a call to break free from fiscal inertia and embrace reform’s crucible. Amidst the tempest, a glimmer of hope emerges, offering a chance to redefine our destiny and tread a path toward prosperity.

In the labyrinth of fiscal reform, hope flickers like a solitary candle in the darkness. However, in the short term, a beacon of opportunity emerges—a potential infusion of Tk6000 crore over three to four years, achieved through the gradual removal of tax exemptions. This immediate action, while a mere prelude to the sweeping reforms to come, signals a crucial first step toward fiscal resilience.

But the true crescendo lies in the symphony of medium-term reforms, where the seeds of transformation take root. The establishment of a dedicated tax policy division within the Ministry of Finance heralds a new era of strategic fiscal management.

VAT reform, automation of tax administration, and the introduction of wealth taxes form the bedrock upon which our economic future will be built.

In the urgency of now, a Tk50 trillion revenue loss looms large, casting a shadow over our aspirations. Yet, within reach, lies the key to avert disaster—a transformative reform unlocking a 60% surge in our tax base, breathing life into our dreams.

Fiscal Reform’s Turbulence and Promise

As Bangladesh strides towards fiscal redemption, its impact transcends revenue alone. A more empowered government will propel the nation towards development and graduation from the least developed status. Augmented revenue promises thriving public services and flourishing infrastructure, ushering in prosperity for all.

Yet, challenges abound. To sustain this momentum, recalibration of economic strategy is imperative, reducing reliance on trade taxes and fostering an export-friendly environment.

Amidst reform’s turbulence, lies the promise of prosperity. Economic modeling by PRI-CDRM unveils a future of exponential growth fueled by increased tax revenue—a rising tide that lifts all. From the privileged to the marginalized, the benefits will be universal—a testament to the transformative might of fiscal reform.

Immediate Actions Needed to Boost Tax Collection:

- Gradual removal of tax exemptions ;

- Establishment of a dedicated tax policy division within the Ministry of Finance;

- VAT reform, and automation of tax administration;

- Introduction of wealth taxes;

- Adopting a single exchange rate regime.

Indeed, the heart of the matter lies not in facile comparisons with nations like Somalia or Congo, but in a nuanced understanding of revenue sources. Dr. Zaidi Sattar, Chairman of PRI, casts a discerning gaze upon our export landscape, unveiling the policy biases that stifle the growth of non-RMG exports. In this revelation lies the key to unlocking our economic potential—a shift away from tariff-ridden protectionism towards a more equitable and dynamic trade environment.

As the luminaries of finance and policy convene, a vision emerges—a vision of a Bangladesh unshackled from the constraints of fiscal inertia, where higher tax revenues fuel the engines of progress. From the hallowed halls of government to the bustling markets of commerce, the call for reform resounds—a clarion call for a brighter, more prosperous future.

Tax System Efficiency Crucial for Sustainable Government Revenue

PRI research has revealed that export competitiveness is not the critical problem. In fact, apart from RMG products which are highly competitive, nearly 500 non-RMG products are also highly or moderately competitive in markets where 30-40 other suppliers compete.

The logical conclusion is that non-RMG exporters are discouraged from exporting as prices and profits are higher in the domestic market. Thus, export diversification suffers as our tariff policy has become a binding constraint to this national priority goal. This anomaly can only be removed by rationalizing the tariff and protection structure, which is the stated goal of the National Tariff Policy 2023.”

Also speaking on the occasion, Dhaka Chamber of Commerce and Industry President Ashraf Ahmed emphasized making tax collection easier through automation and reducing direct contact between taxpayers and tax officials. He also advocated for giving small industries more time to grow before being taxed.

According to experts, Tax System Efficiency is Key for Sustainable Government Revenue. Moreover, experts stress that a well-implemented tax system, balancing direct and indirect taxes, is crucial for sustainable government revenue and fiscal health.

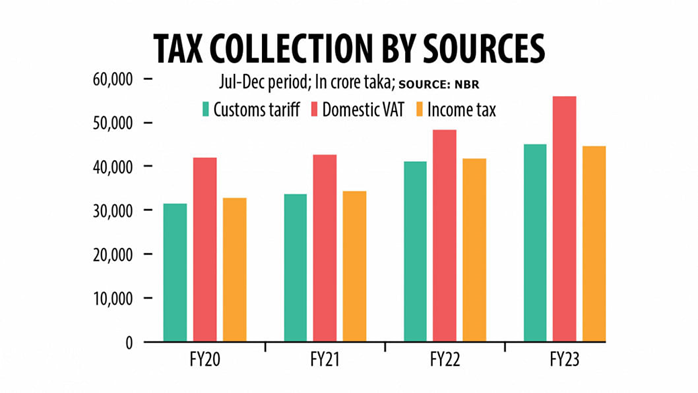

However, in Bangladesh, the distribution of direct taxes within the overall revenue is globally disproportionate. Indirect taxes, predominantly relied upon for revenue generation, impose a heavy burden on the population, contributing to 65-67% of the Tk 3.25 trillion revenue collected in FY23.

A Tale of Contrasting Revenue Sources

In Bangladesh, statistics say that nearly two-fifths to half of tax revenue comes from taxes on goods and services, and another tenth comes from taxes on international trade. In contrast, only around a quarter of tax revenue comes from taxes on income, profits, and wealth.

This stark contrast is unlike other countries in the region or at similar stages of development, where taxes on income, profits, and wealth are higher relative to GDP. India’s FY22 saw indirect tax contributions at 53% (including goods and services tax), and Vietnam’s at 40%.

Dr. Ahsan H Mansur of PRI criticizes Bangladesh’s tax policies for failing to address inequality, noting that low-income individuals bear a disproportionate tax burden while the wealthy contribute little. Moreover, Bangladesh’s tax structure, with only five slabs instead of 12, lacks verticality, exacerbating issues like corporate tax abuse where $1.4 billion is diverted yearly, resulting in a $387 million tax loss, surpassing the regional average.

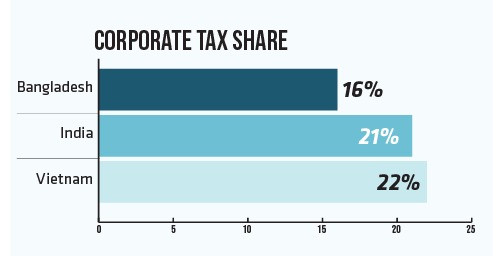

According to a report by the Tax Justice Network (TJN), Bangladesh’s corporate tax share stands at a mere 16%, contrasting sharply with India’s 21% and Vietnam’s 22% in 2016. India’s fiscal year FY23 witnessed impressive revenue growth from direct taxes, exceeding budgeted estimates by a substantial margin, far outstripping Bangladesh’s figures.

Some say that Bangladesh’s tax-GDP ratio may be understated due to government practices of inflating GDP data and inadequately adjusting for inflation. “In reality, the ratio is much higher. In the last year and a half, the value of Taka has fallen by 31%, but the numerical value of GDP has not changed much,” an expert asserted.