Amidst economic turbulence and foreign currency volatility, a majority of publicly traded banks navigated 2023 with resilience, witnessing growth in earnings. Bolstered by increased interest income and astute business strategies, 23 banks, including seven smashing records, showcased remarkable performance.

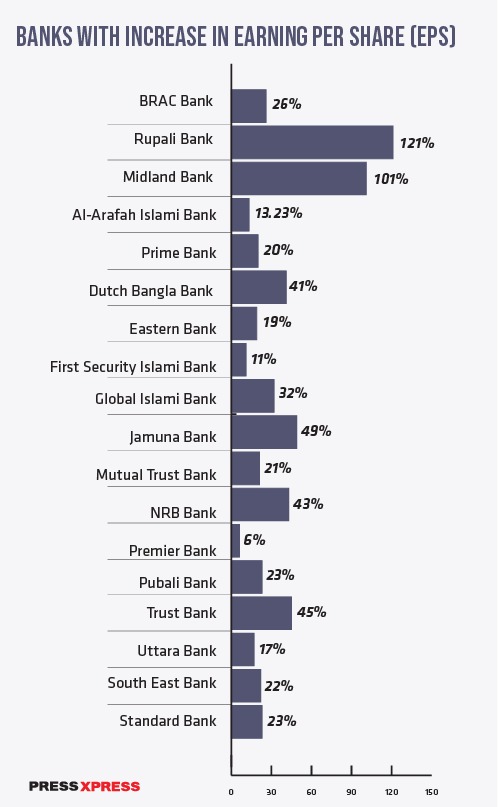

Earnings per share (EPS) surged between 0.64% to a staggering 121% compared to the previous year, exemplifying their financial prowess and strategic acumen.

You can also read: April Sees Modest Remittance Uptick, Yet Falls Short of Expectations!

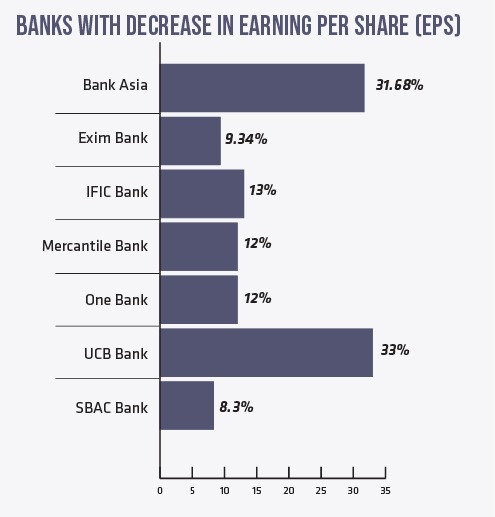

While 18 banks demonstrated robust double-digit EPS growth, eight experienced a decline. ICB Islami Bank and National Bank, in particular, mirrored their previous year’s losses. Dhaka Bank and Shahjalal Islami Bank remained stagnant, maintaining their EPS figures from 2022.

Record Profits and Augmented Dividends Define Bangladesh’s Banking Landscape

Among the 36 listed banks, 35 have disclosed their financial results and dividends for 2023, but comprehensive annual reports are still pending. Notably, several banks, in light of their profit surge, have opted to enhance dividends for their shareholders, either through cash, stock, or both. Approximately 16 banks chose to bolster their capital base with stock dividends, while others offered cash dividends exclusively. Surprisingly, three banks opted out of distributing dividends altogether.

EPS Growth for 2023:

- 23 banks reviewed, 7 achieved record profits.

- EPS growth ranged from 0.64% to 121%.

- 18 banks demonstrated double-digit EPS growth compared to 2022.

- The remaining banks experienced growth below 10%.

In this financial panorama, BRAC Bank emerges as a standout, reporting an impressive 26% surge in EPS to Tk4.73 in 2023, marking its highest-ever profit of Tk825 crore for the year. Amidst the ebb and flow of financial markets, the narrative of resilience and success shines through, defining a remarkable year for Bangladesh banking sector’s.

In response to soaring profits, the private sector lender announced augmented dividends compared to the previous year. While disbursing a total dividend of 15%—7.5% in cash and 7.5% in stock—in 2022, the bank declared a bountiful total dividend of 20%—10% in cash and 10% in stock—for 2023.

In a contrasting narrative, Rupali Bank, the solitary publicly-listed state-owned commercial bank, recorded a staggering 121% growth in EPS for 2023, yet opted against distributing dividends to its shareholders, mirroring the previous year’s stance as indicated in its financials published on the Dhaka Stock Exchange (DSE).

Consequently, the Dhaka Stock Exchange (DSE) is poised to relegate Rupali Bank from its current B category to the Z category effective May 5th, in compliance with a directive issued by the Bangladesh Securities and Exchange Commission (BSEC) on February 15th. Thursday saw Rupali Bank’s shares plummet by 15% to Tk23.1 each.

Diverse EPS Performance Shapes the Narrative

Meanwhile, Midland Bank recorded a remarkable 101% surge in earnings per share (EPS) to Tk1.77, electing to extend a 5% cash dividend to its shareholders, consistent with the previous year’s dividend payout. Al-Arafah Islami Bank also posted a commendable 13.23% growth in EPS to Tk2.14, attributing the upswing to reduced provisions against investments compared to the previous year.”

Amidst the diverse performance of banks, Bank Asia reported a significant 31.68% decrease in EPS to Tk1.79, attributing it to the maintenance of higher provisions compared to the previous year. Similarly, Exim Bank noted a 9.34% decline in EPS for 2023 to Tk2.33, citing an increase in provisions for investments as the primary cause.

In contrast, Prime Bank’s EPS surged by 20% to Tk4.24, propelled by an upswing in net interest and investment income, as disclosed on the stock exchanges. City Bank witnessed a remarkable 33.59% growth in EPS to Tk5.21, announcing a generous 25% dividend—15% in cash and 10% in stock—for its shareholders. Dutch Bangla Bank also marked a substantial 41% growth in EPS to Tk10.72, promising a hefty 35% dividend—17.5% in cash and 17.5% in stock, a significant leap from its 2022 dividends.

Eastern Bank, First Security Islami Bank, Global Islami Bank, Jamuna Bank, Mutual Trust Bank, NRB Bank, Premier Bank, Pubali Bank, Trust Bank, Uttara Bank, South East Bank, and Standard Bank showcased commendable EPS growth figures ranging from 6% to 49%.

However, IFIC Bank, Mercantile Bank, One Bank, UCB Bank, and SBAC Bank experienced declines in EPS ranging from 8.3% to 33%, reflecting diverse trajectories within the Bangladesh banking sector. Amidst this dynamic landscape, each bank’s performance defines a unique narrative, echoing the challenges and triumphs of Bangladesh’s financial landscape.

Dutch-Bangla, Pubali, City, and Eastern Banks Surge with Profits and Dividend Bonanza

Dutch-Bangla Bank emerged as a standout performer, boasting a remarkable 42% surge in profits to Tk801 crore in 2023, its highest ever. The bank proposed a generous 17.50% cash dividend and 17.50% stock dividend for its shareholders.

Pubali Bank followed suit with substantial profit growth of 23% to Tk695 crore, respectively. Pubali Bank recommended a 12.50% cash dividend and 12.50% stock dividends for the year.

City Bank and Eastern Bank showcased impressive profit hikes of 33% to Tk638 crore and 20% to Tk612 crore, respectively. City Bank proposed a 15% cash dividend and 10% stock dividends, whereas Eastern Bank declared a 12.50% cash dividend and 12.50% stock dividends for the year.

Shahjalal Islami Bank and Uttara Bank also experienced notable profit increments, reaching Tk358 crore and Tk317 crore, respectively. Shahjalal Islami Bank recommended a 14% cash dividend, while Uttara Bank proposed a 17.50% cash dividend and 12.50% stock dividends.

Since 2022, Bangladesh has grappled with mounting macroeconomic pressures, as highlighted in Eastern Bank’s 2023 annual report. The relentless surge in inflation, coupled with rapid foreign exchange depletion and strained liquidity, paints a bleak picture. Private sector credit growth dwindles to 10.13% in December 2023 from 12.89% the previous year, denting confidence and triggering FDI downgrades.

Amidst this turmoil, the Bangladesh banking sector’s faces governance lapses, liquidity crunch, and soaring defaults. However, Mutual Trust Bank shines with a commendable 21% profit growth, offering a modest yet significant 10% cash dividend to loyal shareholders, symbolizing enduring strength.

Despite valiant efforts, Mercantile Bank grapples with a bitter 12% profit decline. Yet, a commitment to weather the storm together echoes through a declared 10% cash dividend.

The Key to Bangladesh Banking Sector’s Triumph in 2023

In the economic narrative of Bangladesh, 2023 emerges as a pivotal chapter marked by triumph over adversity. Amidst persistent inflation, the banking sector witnessed one institution soaring beyond expectations. With resounding clarity, a senior official revealed that in 2023, the bank breached the formidable milestone of Tk600 crore profit. This achievement, he emphasized, was not mere luck but a testament to meticulous Asset and Liability Management (ALM), fortified by prudent risk management and a tapestry of cost rationalization measures meticulously woven together.

The intricate dance of Asset and Liability Management (ALM) formed the bedrock of success. Fueled by high-quality loan growth and a swift rise in loan returns compared to deposit costs, the bank navigated 2023 with finesse under the SMART rate mechanism.

This victory wasn’t solitary. Policy reforms, notably Bangladesh Bank‘s recalibration of lending rates, catalyzed progress. The new lending rate formula, effective from July 1, 2023, eased deposit costs, fostering financial resilience amid uncertainty.

Yet, shadows lingered amidst triumphs. Default loans surged, fueled by political uncertainties and a dollar shortage. By December’s end, default loans ballooned by Tk25,000 crore, totaling Tk1.45 lakh crore, urging swift action.

In response, Bangladesh Bank unveiled a roadmap, aiming to reduce default loans to 8% by June 2026, echoing IMF sentiments and showcasing Bangladesh’s resolve for economic resilience.