Key Points:

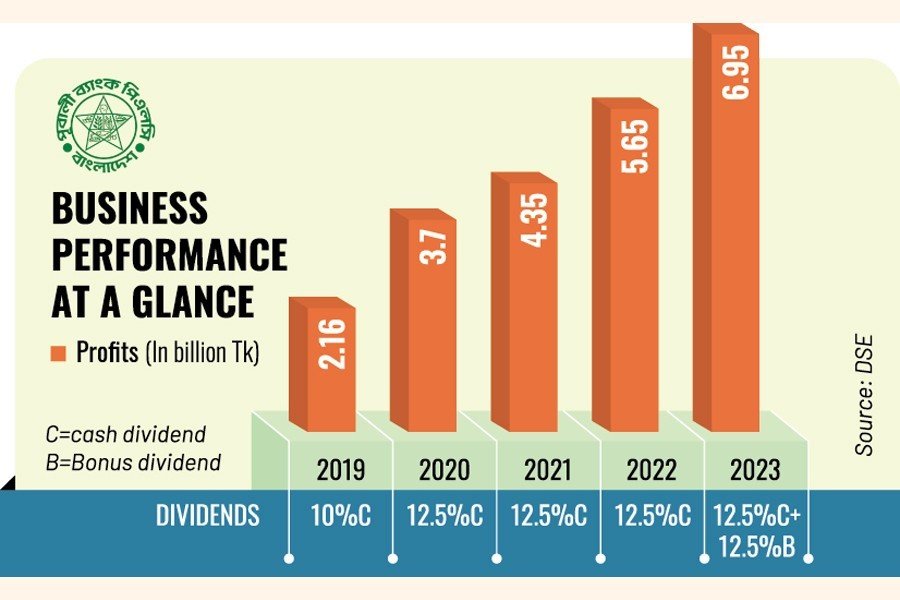

- The bank made Tk 695.12 crore, a 30% rise year-on-year

- Consolidated earnings per share stood at Tk 6.76 for 2023

- In 2022, the bank provided a 12.5 per cent cash dividend

Bangladesh’s banking industry is navigating through a complex situation, marked by both hurdles and triumphs. While certain banks grapple with mounting debt burdens, facing impediments in sustaining their operations and seeking refuge through mergers with more robust counterparts, there are others like Pubali Bank that continue to exhibit resilience and fortitude.

Pubali Bank PLC achieved an unprecedented profit of Tk 6.95 billion in 2023, marking the highest level since its stock market listing. This remarkable feat was driven by a surge in interest income coupled with significant earnings from government securities.

You Can Also Read: STRATEGIC MERGERS TO RESHAPE THE BANKING SECTOR IN BANGLADESH

The bank has prioritized the continued implementation of its growth strategy, with a particular emphasis on improving the deposit mix, reducing the cost of funds, diversifying its loan portfolio, and strengthening its overall risk management processes.

The bank’s profit surge was primarily fueled by two key factors: an increase in interest income and proceeds from treasury bonds. The lifting of the interest rate cap by the central bank played a pivotal role in boosting the bank’s interest income.

These initiatives have enabled the bank to enhance its business performance, bolster profits, and ultimately create value for shareholders, according to officials.

Achievement in 2023

The lender’s consolidated profit also witnessed a substantial 23 per cent increase compared to the previous year’s Tk 5.65 billion. Consequently, its consolidated earnings per share stood at Tk 6.76 for 2023, up from Tk 5.49 in the preceding year, according to a recently published price-sensitive statement.

Buoyed by this impressive profitability, the bank’s board declared a 25 per cent dividend (12.5 per cent cash and 12.5 percent stock dividend) for 2023, the highest dividend since 2010 when a 35 percent stock dividend was paid. In 2022, the bank had provided a 12.5 per cent cash dividend.

The net operating cash flow per share, a measure of the bank’s ability to generate cash from its operations, stood at a negative Tk 2.88 in 2023, an improvement from the negative Tk 3 per share recorded in the previous year.

The net asset value, which represents the excess of total assets over total liabilities, reached Tk 46.33 per share in 2023, up from Tk 41.96 in 2022. As of April 18, the bank’s price-earnings (PE) ratio stood at 5.12, significantly lower than the market average. Currently, the overall market’s PE is around 12.

Factors Contributing to the Profit Surge

Higher Interest Income

The bank’s remarkable profit growth can be primarily attributed to the escalation in interest income. This significant rise was a direct consequence of the central bank’s decision to abolish the interest rate cap. This move instigated a positive ripple effect across the entire banking sector, leading to a substantial increase in interest income.

The Bangladesh Bank, in a strategic shift, decided to abandon the previously imposed 9 percent interest rate limit on loans and instead, adopted a market-based rate. This was a significant change in the banking sector, as banks had been adhering to the interest rate cap since April 2020, following the directives of the central bank.

This transition to a market-based rate allowed banks to adjust their interest rates based on market conditions, leading to increased competitiveness and efficiency in the banking sector. It also provided banks with greater flexibility in managing their assets and liabilities, thereby enhancing their profitability.

Moreover, this policy change also had implications for the borrowers. While it potentially meant higher borrowing costs, it also improved the availability of credit, especially for higher-risk borrowers who were previously underserved.

The lifting of the interest rate cap played a pivotal role in boosting the bank’s profits by driving up interest income, demonstrating the profound impact of monetary policy decisions on the banking sector’s performance.

Treasury Bond Proceeds

A further substantial factor bolstering the bank’s profit was the increase in proceeds from treasury bonds. The yield rate of these bonds has been on an upward line for a number of months, guaranteeing a more robust income stream from this investment.

Treasury bonds, being government-backed securities, offer a relatively safe investment option for banks. The rising yield rates indicate a strengthening economy and higher interest rates, which translate into increased returns for the bondholders.

Over the past few months, the yield curve has steepened, suggesting that long-term interest rates are rising faster than short-term rates. This is generally a positive sign for banks as they typically borrow short-term and lend long-term, and thus, can benefit from a wider spread between the two.

Moreover, the rise in treasury bond yields also reflects the market’s expectations of future inflation and economic growth. Higher yields can attract more investors, leading to an increase in demand for these bonds, which in turn can drive up their prices.

Dividend Declaration

The bank also made a cash dividend of 12.5 per cent and a stock dividend of an equal percentage for the year 2023. This marked the highest dividend declaration in over a decade, underscoring the bank’s strong financial performance.

For context, the bank had previously announced a substantial 35 per cent stock dividend back in 2010. More recently, in 2022, the bank provided a cash dividend of 12.5 per cent, demonstrating a consistent commitment to rewarding its shareholders.

The decision to recommend the stock dividend was strategically aimed at bolstering the bank’s capital base. This is a crucial move for supporting future business expansion and enhancing certain regulatory ratios, which are key indicators of the bank’s financial health and stability.

Furthermore, it was clarified that the recommended dividend was sourced from the bank’s accumulated profit. This not only reflects the bank’s robust profitability but also its prudent financial management. By reinvesting a portion of its profits back into the business, the bank is well-positioned to sustain its growth line and deliver value to its shareholders

Pubali Bank’s unprecedented profit achievement in 2023 stands as a resounding affirmation of its solid financial standing and Bangladesh Bank’s strategic moves. The removal of the interest rate ceiling, coupled with the upward trajectory of treasury bond yields, presented an opportune landscape for the bank to capitalize on these favorable circumstances adeptly. The bank’s resolution to declare a substantial dividend underscores its unwavering dedication to providing rewarding returns to its shareholders. As one of Bangladesh’s preeminent private commercial banks, Pubali Bank’s remarkable performance has set an elevated benchmark for the nation’s banking industry.