As the world watches developments unfold, Bangladesh must remain resilient and proactive in safeguarding its economic stability

As we navigate through April 19, the dynamics of conflict between Israel and Iran have taken a significant turn. The exchange of retaliatory measures between the two nations culminated in a pivotal event on April 1, 2024, with Israel’s airstrike on the Iranian embassy in Damascus, which swiftly met with Iran’s response on April 14, 2024. These actions underscore a series of escalating confrontations, amplifying tensions across the Middle East.

You can also read: Bangladesh Booms Stability and Progress Under Sheikh Hasina, Says Atlantic Report

Amidst a backdrop of global challenges, including the lingering aftermath of the pandemic and the ongoing Russia-Ukraine conflict, the intensification of hostilities between Israel and Iran adds a troubling new dimension.

While signs of economic recovery surface in Bangladesh, with promising indicators in export earnings and inward remittances, the specter of conflict threatens to disrupt progress. The emerging threat posed by the escalating tensions in the Middle East underscores the fragility of ongoing recovery efforts and the need for heightened vigilance on the global stage.

Israel and Iran Engage in Hostilities

In the midst of escalating tensions, the Middle East has been rocked by a series of unprecedented attacks between Israel and Iran, signaling a significant escalation in their enduring conflict. The first of these attacks took place on April 1, 2024, when Israel conducted an airstrike on the Iranian embassy in Damascus, resulting in the tragic loss of 16 lives, including 7 Islamic Revolutionary Guard Corps soldiers and 2 civilians.

The response was swift. On April 14, 2024, Iran retaliated with a barrage of over 120 ballistic missiles, 170 drones, and more than 30 cruise missiles.

Fast forward to April 19, Israel retaliated with a missile attack against Iran. Air defenses targeted a major air base in Isfahan, situated some 340 km south of Tehran. This base has long housed Iran’s fleet of American-made F-14 Tomcats, purchased before the 1979 Islamic Revolution, along with other nuclear sites.

Tension Mounts in Middle East

The current state of the Iran-Israel conflict is tense, with both nations engaging in a series of tit-for-tat attacks. The most recent development occurred when Iran responded to an Israeli airstrike on its consulate in Damascus with a direct attack, deploying a vast array of drones, cruise missiles, and ballistic missiles against Israel and its allies

The ongoing Israel-Gaza conflict, now in its sixth month, has escalated beyond the borders, with tensions reaching a critical point.

Israel has waged one of the most devastating wars of the century in the Gaza Strip, resulting in the deaths of tens of thousands and pushing at least half of the population into conditions akin to famine. Israel has resisted international pressure to allow increased humanitarian aid into the enclave.

However, the United States and its allies are urging caution, keen to avoid another damaging war in the Middle East, especially during an election year when President Biden’s popularity is already under fire due to his support for Israel.

Despite the desire to avoid an all-out war, miscalculations can and do happen, as history has shown.

However, it might not be possible many a time to avoid conflict or its consequences. Therefore, the government should focus on ensuring the continuity of essential services and critical infrastructure in emergency situations. To ease the economic downturn, the relevant authorities’ policy responses must be prompt and pragmatic to address the situation effectively.

Economic Implications of the Conflict

Businesses and economists have expressed concerns that If the conflict continues to escalate, it could have various repercussions on Bangladesh’s economy. One such consequence could be the destabilization of the energy market, leading to fluctuations in energy prices, similar to the aftermath of the Russia-Ukraine conflict in 2022. This could result in increased financial burdens on Bangladesh’s oil and liquefied natural gas (LNG) import bills due to inevitable price hikes.

The Red Sea shipping route, already affected by Yemen’s Houthi attacks, could face additional disruptions, potentially having significant impacts on global supply chains. If there are further complications at the Strait of Hormuz, through which one-fifth of the world’s daily oil production flows, it could lead to increased freight costs and longer shipping times.

Economic Experts Weigh in on Conflict’s Potential Impacts

Azam J Chowdhury, chairman of East Coast Group, expressed concerns about the impact of the Iran-Israel conflict on Bangladesh’s economy. He stated that the price of oil has already risen by $1 per barrel, and if the conflict persists, it is likely to further increase. The state-owned Bangladesh Petroleum Corporation (BPC) has generated approximately Tk4,000 crore in profits since implementing the automated monthly pricing formula. However, these profits might not be sustained if prices further increase, putting additional pressure on the balance of payments (BOP)..

“The oil price has risen by $1 per barrel and may continue to climb if the Iran-Israel conflict persists,”

– Azam J Chowdhury

Unstable Energy Market and Increased Import Bills

Dr Masrur Reaz, CEO of the private think-tank Policy Exchange of Bangladesh, highlighted the potential impact of an unstable energy market on Bangladesh’s economy. He warned that price escalations could lead to increased import bills. If the government fails to import energy at higher prices, there may be an increase in load shedding and economic losses.

“In the short term, expatriate Bangladeshis may not lose their current jobs, but new recruitment will likely be halted,”

– Dr Masrur Reaz.

Disruptions in Shipping Routes and Additional Costs

Dr Reaz also pointed out that the Red Sea route, already experiencing disruptions with ships rerouting via Africa, would further increase shipping time and costs if trade through the Strait of Hormuz is disrupted. This situation could potentially create a crisis for ships due to the additional time required to navigate through the African region.

Impact on Expatriate Bangladeshis and Remittances

While neither Iran nor Israel directly hosts Bangladesh’s migrant workers, the repercussions of the conflict will be felt in other Middle Eastern countries, notably Saudi Arabia and the UAE, where hundreds of thousands of Bangladeshis are employed. In the short term, expatriate Bangladeshis may not lose their current jobs, but new recruitment will likely be halted. As a result, the inflow of remittances will decrease, putting pressure on the balance of payments. If the conflict persists for a year or more, Bangladeshis may indeed begin to lose their jobs.

Overall, the insights provided by these experts emphasize the importance of monitoring geopolitical developments and their economic repercussions to navigate potential challenges effectively.

Oil price after Iran’s missile attack on Israel

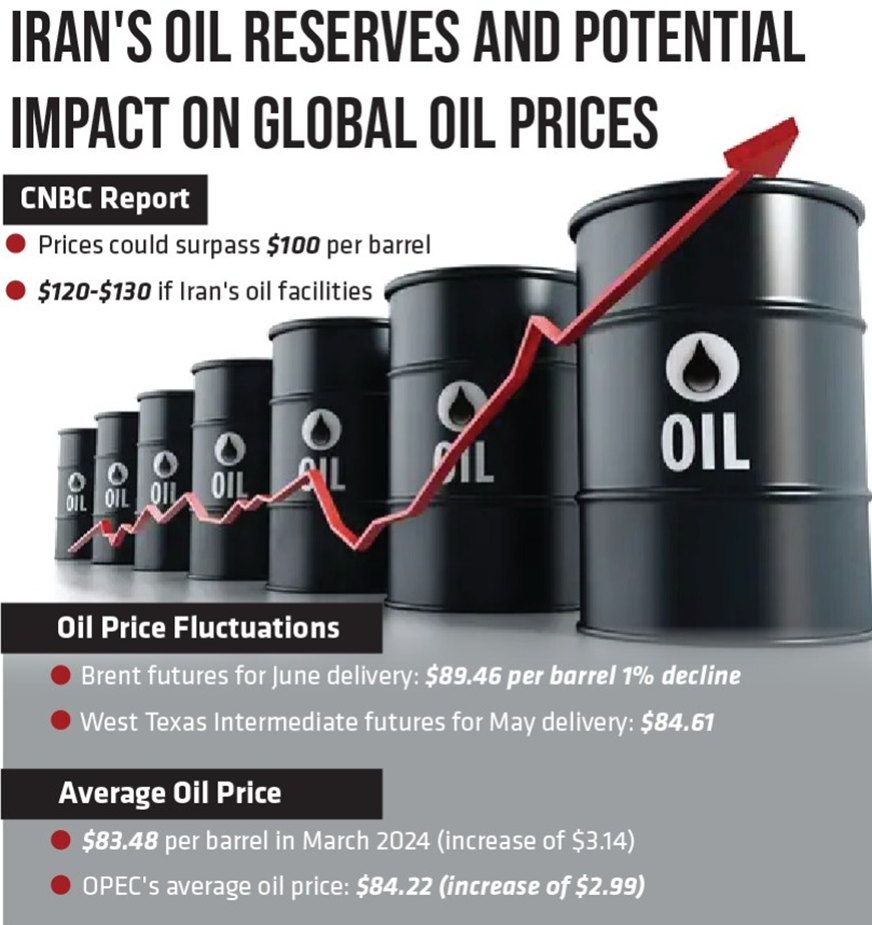

Iran, a key OPEC member with vast oil reserves, faces scrutiny as CNBC warns of potential disruptions to its oil supply. The closure of the crucial Strait of Hormuz could exacerbate oil price hikes, with CNBC reporting forecasts of prices exceeding $100 per barrel. Andy Lipow from Lipow Oil Associates suggests prices could skyrocket to $120-$130 if Iran’s oil facilities are targeted or if the strait shuts down.

However, Reuters notes a 1% decrease in oil prices, indicating reduced market concerns following Iran’s attack on Israel. Brent futures for June delivery fell to $89.46 per barrel, while West Texas Intermediate futures for May delivery dropped to $84.61.

Earlier, on April 12th, oil prices surged in anticipation of Iran’s retaliatory attack, reaching their highest levels since October. Additionally, Iran’s heavy crude oil price rose to $83.48 per barrel in March 2024, while OPEC’s average oil price climbed to $84.22, marking significant increases.

In conclusion, the Iran-Israel conflict threatens Bangladesh’s economic recovery by affecting energy markets, supply chains, and the livelihoods of Bangladeshi workers in the Middle East. Economists and experts urge policymakers and stakeholders to monitor the situation to mitigate potential negative consequences closely.