In the span of nearly two years, since Russia initiated a full-scale invasion, Ukraine has managed to reclaim a substantial 54 percent of its occupied territory. Yet, the haunting reality persists with Russia’s continued occupation of 18 percent of the nation. The resolute offensive undertaken by Ukraine in 2023 yielded modest territorial gains, yet the battle lines have etched a sombre stability for nearly a year. Both adversaries entrenched, the landscape of the conflict defies easy breakthroughs, exacerbating the already staggering toll of military casualties, reaching an appalling half a million. Against this backdrop of resilience and suffering, the spectre of war looms large as Russia relentlessly bombards Ukrainian cities and imposes a stranglehold on its vital ports.

You can also read: World Tired of Zelensky? Shift From Weaponry to Peace?

In response, Ukraine, with a burgeoning tenacity, amplifies its resistance through intensified drone attacks targeting Russian ships and critical infrastructure. The collateral damage of this protracted conflict is immeasurable. A staggering 22,000 civilian casualties bear witness to the brutality of the fighting and airstrikes. The consequences are profound, with 5.1 million internally displaced and an additional 6.2 million forced to flee Ukraine in search of refuge. The urgent cry for humanitarian aid reverberates, as 17.6 million people find themselves in desperate need.

A DEEP DIVE INTO THE DEVASTATING IMPACT OF THE CONFLICT

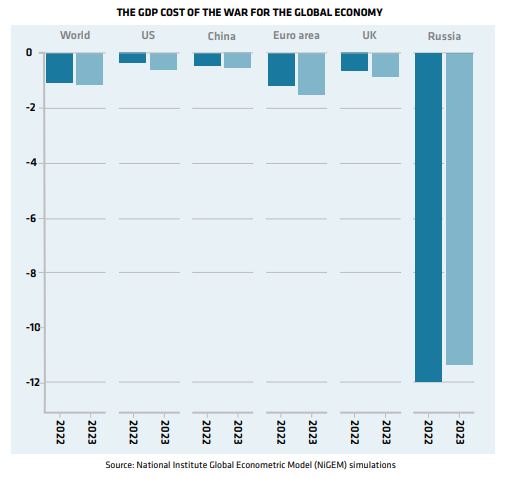

The foreseeability of the war in Ukraine as a global economic catastrophe was apparent from the outset. While the economic impacts pale in comparison to the suffering and loss of life on the battlefields, they present critical challenges that leaders must urgently address to mitigate further suffering, including poverty, food shortages, and a burgeoning cost-of-living crisis. Once considered one of the poorest Soviet republics, Ukraine’s progress, albeit uneven, since gaining independence in 1991 is now unravelling in the wake of this war, compounding its economic woes catastrophically.

The economic output of Ukraine has plummeted to a fraction of its pre-war levels, with the first year of the conflict witnessing a staggering 30-35% loss in GDP. This downturn marked the largest recession in Ukraine’s history, as illustrated in Figure 1. Although a meagre projection suggests a modest 0.5% growth in GDP for 2023, the impact of the conflict continues to reverberate, casting a long shadow over the nation’s economic prospects.

Due to the impact of the war, dangers of poverty loom large, as incomes have nosedived, rendering 24.2% of the Ukrainian population engulfed in its suffocating grip, a stark departure from the 5.5% just a year prior, as lamented by the World Bank. A staggering 7.1 million souls, once on the cusp of progress, find themselves yanked into the harsh embrace of destitution, unravelling 15 years of painstaking advancement (Kilfoyle, 2023, October 24).

THE MACABRE DANCE OF DEATH AND ECONOMIC RUIN

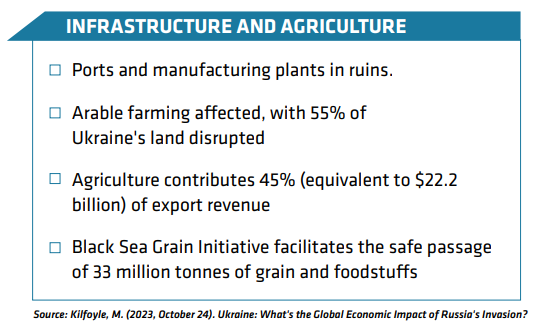

The genesis of Ukraine’s deepening plight is multi-faceted, borne of the relentless onslaught on its infrastructure by Russia. Ports and manufacturing plants lay in ruins, and the once vibrant economic activity, including the backbone of agriculture, now withers in the shadow of conflict. A symphony of job losses resounds, echoing the desolation wrought by the cessation of normalcy. Yet, the toll is not only measured in economic terms; it is etched in the gravestones of household earners.

The UN Office of the High Commissioner for Human Rights (OHCHR), in a sombre record, tallies 26,717 civilian casualties in August 2023 alone—9,511 lives extinguished, 17,206 forever altered by injury. A macabre dance of death unfolds, as US officials unveil a grim reality. Almost half a million casualties mar the landscape, with a staggering 60% hailing from Russia.

Once, Ukraine and Russia stood as giants on the global stage of agriculture and food production. In the halcyon days before the war, arable farming embraced 55% of Ukraine’s vast land, employing 14% of its populace and contributing a staggering 45%—equivalent to $22.2 billion—of its export revenue (International Trade Administration, ITA, 2022). Yet, the thunder of war disrupted this agricultural symphony, eroding soil, displacing farmers, and casting a pall over the ‘breadbasket.’

A glimmer of hope emerged in July 2022, as Russian and Ukrainian officials inked the Black Sea Grain Initiative, offering a brief respite for exports. While the Russian invasion throttled commercial operations in Ukrainian ports, this accord facilitated the safe passage of grain exports from three ports in the Black Sea. The numbers tell a story of resilience—33 million tonnes of grain and foodstuffs exported by July 2023, a testament to the fleeting but impactful rebound (Kilfoyle, 2023, October 24).

THE BLEAK REALITY OF ‘FOOD-FOR-FUNDS’ IN THE GLOBAL FOOD ORDER

In the tumultuous wake of the conflict, a profound ripple extends far beyond borders, disrupting global stability and plunging the world into a vortex of unprecedented challenges. The heart of this storm lies in the decimation of food security, as Ukraine and Russia, once the behemoths of wheat exports, stand fractured and the world grapples with the consequences. Before the war, the alliance of Ukraine and Russia comprised over a third of global wheat exports, and more than half of the world’s sunflower oil found its origin within their borders.

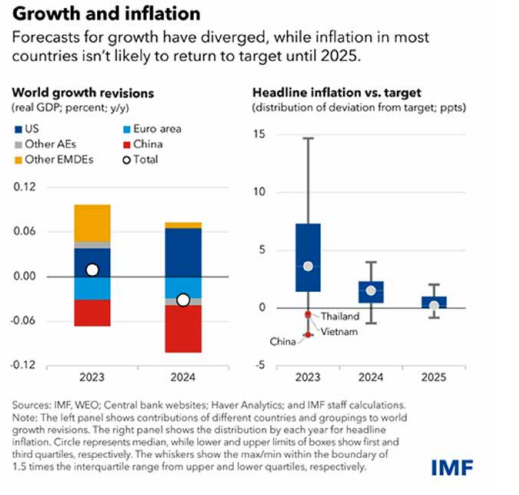

As the conflict unfolded, early predictions materialized, proving correct the grim forecast of exacerbating global food insecurity. The impact echoes most acutely in developing and emerging economies, where dependence on Ukraine and Russia for fuel and grain imports becomes an Achilles’ heel. The Food Security Information Network casts a stark light on the aftermath, attributing the surge in food insecurity to the war, alongside the shadows of the pandemic, other conflicts, and extreme weather. A staggering 258 million people in 58 countries find themselves in the grip of a food crisis or severe acute food insecurity, a record high since the organization’s inception in 2017 (Gourinchas, 2023, October 10).

The now-dormant Black Sea Grain Initiative, a glimmer of hope, played a role in extracting more grain from Ukraine. However, a somber truth emerges from the data – the majority of this sustenance flowed towards wealthier nations, leaving low-income and lower-middle-income countries receiving less than 20% of Ukraine’s grain exports by January 2023. The disturbing concept of ‘food-for-funds’ takes center stage, painting a grim picture of an imbalanced world order.

Equitable food distribution, a cornerstone of the UN’s Sustainable Development Goals, remains elusive. Despite a surge in food exports, the imbalance persists, and food prices continue to soar in many developing nations. In Nigeria, March 2023 witnessed food inflation surpassing 24%, while some European nations cautiously revel in a decline in global food prices.

EAST VS WEST CHASM OF THE ECONOMIC IMPACT

European nations, in a bid to sever ties with Russian energy, find themselves entangled in a complex web. The sabotage of Nord Stream 1 and 2 in September 2021 complicates efforts to replace Russian energy, often resulting in the adoption of more expensive alternatives such as liquified natural gas (LNG) from the United States. The consequences are felt keenly in the UK, where continental Europe’s supply problems feed directly into local prices. Amidst the chaos, a paradoxical silver lining emerges.

The rise in fossil fuel costs, a consequence of the conflict, becomes a catalyst for the acceleration of cleaner energy supplies, including renewables. The unintended but encouraging side effect is a decline in economic growth, limiting fossil fuel consumption in the face of the looming climate crisis. In the aftermath of conflict, the scars left on the global economic landscape are stark and unforgiving, reaching far beyond geopolitical borders to echo in the corridors of international trade. The evidence etched in the fluctuations of the stock market paints a grim tale, revealing the profound impact on businesses tethered to Russia through trade or ownership. A meticulous study from the London School of Economics unveils a sombre truth – firms deeply entwined with Russia, whether through commerce or ownership, witnessed a substantial nosedive in share prices post-invasion.

On average, the tendrils of trade with Russia caused a 1.53% plunge in the value of each country’s aggregate stock market index. The pre-war landscape, where firms bore an average dependence of 0.25% on Russia, now translates into economic tremors felt across the globe (Gourinchas, 2023, October 10). Yet, the fallout is not uniformly distributed. Some nations find themselves tethered more tightly to the economic repercussions of the conflict.

European countries, in particular, bear the brunt of the losses, with East European nations grappling with trade linkages, while their West European counterparts face the storm through ownership connections. In stark contrast, countries with less intimate ties to Russia, notably the United States and China, weather the storm with greater resilience, hinting at a geopolitical divide in the burden of long-term financial consequences. The echoes of economic impact resonate most acutely across the European landscape, a testament to the interconnectedness of global markets and the profound influence of regional dynamics.

BRENT OIL’S SOARING ASCENT AND GEOPOLITICAL REPERCUSSIONS

As we unravel the layers of the economic impact, it becomes apparent that the urgency of the situation transcends the immediate suffering and death witnessed in the warzone. The toll on Ukraine and Russia is staggering, with repercussions extending beyond shattered economies to plunge food insecurity and poverty to perilous depths. The war, like a relentless tempest, drives the economic crisis to profound depths, and the longer its duration, the more insidious its impact becomes.

The expulsion of Russian banks from SWIFT, a financial artery, casts shadows over Russia’s export capabilities, injecting an element of uncertainty into its economic future. Central Asia, intricately woven into the economic fabric of post-Soviet states and a primary destination for millions of migrant workers from the Commonwealth of Independent States (CIS), bears the brunt of the sanctions, laying bare the interconnectedness of global economies.

The sanctions extend their reach to the very heart of Russia’s economic resilience – the Central Bank. Asset freezes, a strategic move, aim to curtail its ability to offset the impact of sanctions, amplifying the economic pressure on the nation. The magnitude of the sanctions is underscored by the staggering $630 billion in foreign exchange reserves held by the Russian Central Bank, now held in financial limbo. President of the European Council, Charles Michel emphasizes the importance not just of freezing assets but also enabling their confiscation, a pivotal step towards harnessing resources for the reconstruction of Ukraine.

In the early days of 2022, Russia stood as a formidable force, producing 11.3 million barrels per day (Mb/d) of crude oil and condensate, securing its place as the world’s third-largest oil producer. Yet, it wielded an even mightier influence as the largest exporter of oil products globally and the second-largest exporter of crude, trailing only Saudi Arabia. As the invasion unfolded, the oil market quivered, responding with an unprecedented surge.

Within a mere fortnight, global oil prices catapulted by a staggering USD$8 per barrel, propelling Brent oil prices beyond the symbolic $100 per barrel threshold, a territory unexplored since 2014. The seismic shifts weren’t confined to market dynamics; BP, a behemoth in the oil and gas realm, made a historic announcement. In a move echoing the geopolitical tremors, BP declared its divestment from a 19.75% stake in Rosneft, the largest foreign investor in Russia, potentially incurring a colossal cost of up to $25 billion (Council on Foreign Relations, n.d.).

DECLINING DEMAND, WARM WEATHER, AND THE REVERSAL OF FORTUNES

The shockwaves rippled across continents, reaching the shores of Norway, home to the world’s largest sovereign wealth fund. The Government Pension Fund of Norway, with assets in Russian company shares and government bonds totaling 25 billion Norwegian kroner ($2.83 billion), swiftly froze investments and initiated a process of divestment. Meanwhile, Canada, echoing the chorus of dissent, imposed a ban on Russian crude oil imports, underscoring the global denouncement of Russia’s actions.

The financial saga continued with a somber symphony on the London Stock Exchange, where Gazprom, Rosneft, and Lukoil, bearing the weight of sanctions, witnessed staggering losses in stock value. These losses, reaching up to 99.6%, painted a grim picture of the economic toll on Russian energy giants. The benchmark Russian Crude Oil Urals, trading at an $18 discount to Brent, faced challenges finding buyers, as oil traders recoiled from potential sanctions. (Giles, Wheatley, & Romei, 2022, February 25)

drama reached into the heart of global geopolitics. As the United States declared a ban on Russian oil imports, President Joe Biden asserted a formidable stance, proclaiming a potent blow against Putin’s war machine. Germany, however, stood on the precipice of an energy crisis, with its Minister for Economic Affairs cautioning about the potential ramifications of dwindling gas supplies. Despite European nations reducing purchases, China, India, and other developing nations stepped in, contributing to a staggering $24 billion income for Russia in the first three months post-invasion.

Russia’s oil dominance in China reached historic proportions, with Russia becoming China’s largest supplier of oil. As the curtains fell in 2022, the economic fallout became undeniable. The imposition of price caps on crude and processed oil, coupled with the broader impact of sanctions, led to a precipitous fall in Russia’s oil revenues. The first quarter of 2023 saw an income of just $19.61 billion, a stark contrast to the $42 billion per quarter in 2022. The narrative, once dominated by surging profits for oil and gas giants, witnessed a reversal as global prices declined due to factors like declining demand and unseasonably warm weather.

THE GLOBAL RIPPLE EFFECT OF THE RUSSIA-UKRAINE WAR ON BANGLADESH

Since the first shots rang out in February 2022, the war in Ukraine has reverberated through the Bangladesh economy, manifesting primarily as disruptions in the supply chain. The immediate and palpable impact was felt in the energy sector, where international markets saw a surge in prices. Global oil prices, in particular, climbed to unprecedented heights, surpassing $120 a barrel due to concerns about a global supply shortfall from Russia—marking a stark contrast to the pre-war level of $70 a barrel. Although prices retreated to pre-war levels by the close of 2022, the subsequent summer months witnessed a resurgence, with prices heading back towards the $100 threshold.

Brent crude, a key oil price benchmark, recently reached a 10-month pinnacle of nearly $94 a barrel, a notable ascent from its low point of $72 a barrel in June. This trajectory suggests the most significant quarterly increase since Russia’s invasion of Ukraine, signifying a climax in the volatility of global oil prices. The impact on liquefied natural gas (LNG) prices was even more direct and profound for the Bangladesh economy.

The war catapulted gas prices to historic highs, with spot prices in August 2022 soaring over 640% compared to the previous year. Subsequently, prices receded, returning to the average levels observed between 2019 and 2021. By June 2023, they had plummeted by 92% from the peak in 2022. Despite the ongoing conflict, Bangladesh, compelled to suspend spot market purchases during the surge, managed to resume LNG supplies from the spot market. (UNB, 2023, September 23) In the absence of spot market LNG, Bangladesh turned to coal, traditionally a cost-effective fuel. However, even this energy source witnessed a price surge during the war.

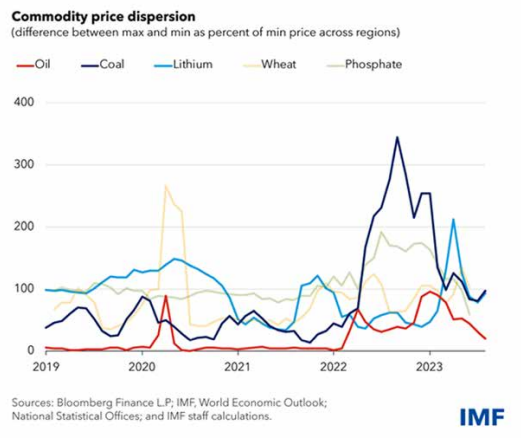

The coal supply from the Russia/Ukraine region, a significant player in the world market, halted due to the ongoing conflict. This cessation had a cascading effect, leading to global shortages and disruptions in various industries, particularly steel. Steel production, heavily reliant on coal, faced challenges as Russia and Ukraine, major exporters of steel and alloying elements, invoked Force Majeure due to the war, resulting in disruptions in steel availability worldwide.

THE INTERSECTION OF COAL PRICES, POWER GENERATION, AND ECONOMIC RESILIENCE

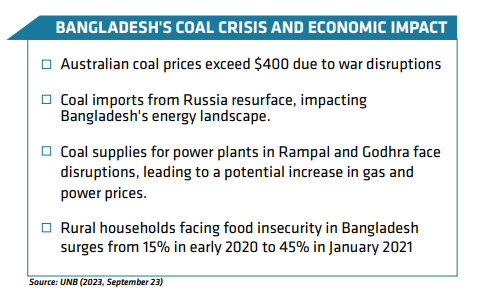

The war, a catalyst for unforeseen disruptions, propels the cost of Australian coal to unprecedented heights, soaring beyond $400. Simultaneously, coal imports from Russia, once halted under the weight of sanctions, now resurface, reclaiming their pre-war levels. The intricate web of global sanctions and trade dynamics unfolds, reshaping the energy landscape for Bangladesh. Yet, the narrative takes a darker turn as coal supplies for power plants in Rampal and Godhra face disruptions, entangled in the web of unpaid bills.

The repercussions are swift and profound, forcing the Bangladesh government to make a difficult choice – raising both gas and power prices. The implications ripple through the fabric of the nation, where a significant portion of power generation relies on imported fuels. A study by the International Food Price Research Institute paints a stark picture – the proportion of rural households facing food insecurity surges from 15% in early 2020 to a staggering 45% in January 2021 (Star Business Report, 2023, October 17). A fragile recovery from the pandemic-induced fallout now teeters on the brink. The economic symphony takes a more ominous turn as the shadows of scarcity touch Bangladesh’s energy landscape.

The Rampal 1320 MW Power Plant, a cornerstone of the nation’s energy infrastructure, grapples with the impact of coal shortages, a testament to the intricate interdependence in the global supply chain. The economic entanglements extend to projects of monumental scale, such as the Rooppur Nuclear Power Plant (RNPP), a venture involving a staggering USD 12.65 billion. Another recent study titled “Impact of the Russia-Ukraine War Price Shocks on Bangladesh Economy,” conducted by the Bangladesh Institute of Development Studies (BIDS), sheds light on the dire consequences faced by rural households, particularly the vulnerable groups heavily reliant on agriculture, as a result of the war.

In a startling revelation, the study unveils that the price shock induced by the war has thrust approximately 3 million individuals into poverty, as detailed in another paper. This consequential paper unveils the harsh reality that an estimated 24.40 lakh people in rural areas have been driven into poverty, attributing it to warinduced price shocks affecting petroleum, fertilizers, and food. The ramifications extend to urban areas as well, with an additional 5.53 lakh people falling into the clutches of poverty. The collective toll reaches 29.93 lakh, highlighting the widespread impact on the nation’s socio-economic fabric. (BIDS, 2023).

The economic aftermath is seismic, particularly for Ukraine, once a struggling Soviet republic. This economic downturn is intricately entwined with the relentless assault on Ukraine’s infrastructure, reducing ports, manufacturing plants, and the agricultural backbone to ruins. We also tried to show how the disruption echoes in the global food order as Ukraine and Russia, erstwhile major players in wheat and sunflower oil exports, grapple with the consequences.

The Black Sea Grain Initiative, a fleeting respite for exports, underscores resilience, yet the majority of sustenance flows toward wealthier nations, laying bare the imbalanced world order. The reverberations extend beyond the warzone, shaping the global energy landscape. European nations, seeking to sever ties with Russian energy, confront challenges in adopting more expensive alternatives. However, the rise in fossil fuel costs becomes an unexpected catalyst for the acceleration of cleaner energy supplies—a silver lining amid economic turmoil. The article also showed the expulsion of Russian banks from SWIFT and sanctions on the Central Bank amplified economic uncertainties for Russia, impacting export capabilities and financial reserves.

The global oil market experiencing seismic shifts, with a surge in prices and major oil companies divesting from Russian investments. A geopolitical schism emerges, with European nations bearing greater losses than the more resilient United States and China. In this article, using supporting statistics, we tried to show that economic ripples extend to Bangladesh, where disruptions in the supply chain lead to soaring oil and LNG prices. The war-induced surge in commodity prices plunges millions into poverty, especially affecting rural households heavily reliant on agriculture.

The intricate interdependence in the global supply chain disrupts Bangladesh’s energy infrastructure, causing economic challenges and power shortages. Amidst this economic turmoil, the resilience of businesses in Bangladesh, especially small and medium enterprises, shines through. Despite rising costs and weak demand, the private sector displays a positive outlook—a testament to adaptability and fortitude in navigating turbulent economic landscapes. The Ukraine-Russia war leaves an indelible imprint on the global financial landscape, evoking profound economic, humanitarian, and geopolitical consequences. The intricate web of interconnectedness among nations demands urgent collaborative efforts to address the multifaceted challenges posed by this devastating conflict—a clarion call for unity and resilience in the face of unprecedented global shifts.