Amid a fragile financial system and a long-standing reliance on the US dollar and other foreign currencies, Zimbabwe has initiated the introduction of a new gold-backed currency called “Mosi-oa-Tunya”, marking a significant departure from its tumultuous economic history. This bold step holds promise for stabilizing the nation’s economy and restoring confidence in its financial system. The introduction of gold coins aims to restore confidence in the Zimbabwean dollar and provide a more stable means of transaction and store of value.

The Golden Prospect

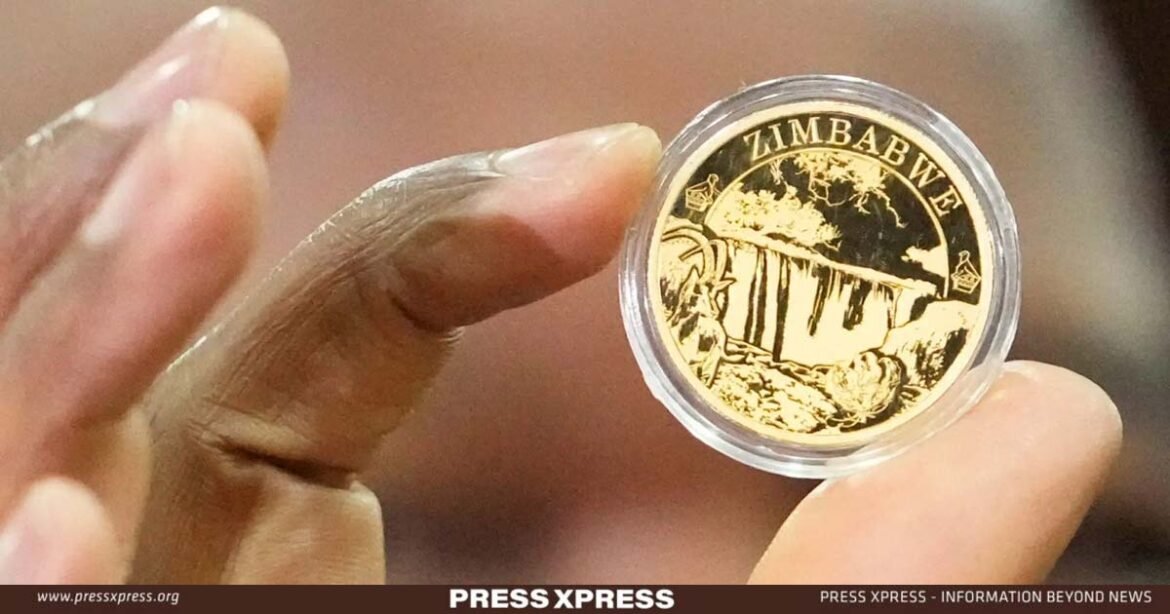

According to the central bank, the gold coins dubbed the “Mosi-oa-Tunya” (local name for Victoria Falls), will be made available for purchase from July 25, 2022. Each coin will contain one troy ounce of 22-carat gold and will be sold at the prevailing international price for gold, plus a 5% minting and distribution fee.

You can also read: Why Wealth Inequality on Every Continent?

The coins will be available for purchase in both local and foreign currencies, making them accessible to a broader range of investors and citizens. Additionally, the coins can be easily traded, both locally and internationally, providing a hedge against inflation and currency volatility.

Background: From Hyperinflation to Stability

Zimbabwe’s decision to introduce a gold-backed currency is not without precedent. In the past, several countries have adopted similar measures to stabilize their economies and combat hyperinflation. Notable examples include the German Rentenmark in the 1920s and the Swiss “Parallel” Franc in the late 1970s.

Zimbabwe’s circumstances are unique, as the country has faced prolonged economic turmoil, characterized by hyperinflation, currency devaluations, and a series of failed attempts to introduce a stable domestic currency. The Zimbabwean dollar was abandoned in 2009 after hyperinflation rendered it virtually worthless, leading the country to adopt a multi-currency system primarily reliant on the US dollar.

Key Features of the Gold Currency

The introduction of the gold currency comes with several key features designed to enhance its credibility and functionality:

- Convertibility: The new currency is expected to be freely convertible into gold at a predetermined rate, allowing individuals and businesses to exchange paper money for tangible assets, thus safeguarding against inflationary pressures.

- Transparency: Zimbabwean authorities have pledged to maintain transparency in managing the nation’s gold reserves and monetary policy, ensuring accountability and trust in the financial system.

- Stability: By anchoring the currency to gold, Zimbabwe aims to achieve greater stability in its monetary environment, reducing volatility and enhancing predictability for economic stakeholders.

- Legal Framework: The government has enacted legislation to support the gold-backed currency, establishing clear legal parameters for its issuance, circulation, and regulation.

Economic Implications

By pegging the new currency to gold, Zimbabwe aims to instill confidence among its citizens and investors while mitigating the risks associated with fiat currencies with expectations that it will have far-reaching implications for Zimbabwe’s economy. Here are some potential effects:

- Inflation Hedge by tying the value of the currency to a tangible and globally recognized asset like gold, the new coins could provide a hedge against inflation. This could help restore confidence in the Zimbabwean dollar and encourage its wider adoption, both domestically and internationally.

- Foreign Investment Attraction The gold-backed currency may attract foreign investors seeking stable investment opportunities and a means to preserve their wealth. This could potentially lead to increased foreign direct investment (FDI) in Zimbabwe, stimulating economic growth and development.

- Domestic Savings and Investment The availability of a stable and reliable currency could encourage Zimbabweans to save and invest more within the country, rather than seeking alternative investment options abroad or in foreign currencies.

- International Trade Facilitation If the gold-backed currency gains widespread acceptance, it could facilitate international trade for Zimbabwe by providing a stable medium of exchange and reducing reliance on foreign currencies.

Challenges and Concerns

The introduction of a gold-backed currency holds the potential for several significant impacts on Zimbabwe’s economy and society:

- Restoring Confidence: A gold-backed currency may bolster confidence among both domestic and international investors, signaling a commitment to financial stability and prudent economic management.

- Inflation Control: Tying the currency to gold could help control inflationary pressures by limiting the government’s ability to print money indiscriminately, thereby preserving the purchasing power of the currency over time.

- Attracting Investment: The adoption of a gold standard may attract foreign investment, as it offers a tangible and secure asset base for financial transactions and wealth preservation.

- Currency Stability: With a stable and reliable currency, businesses can make more accurate financial projections, foster long-term investment, and stimulate economic growth.

However, the transition to a gold-backed currency is not without challenges:

- Gold Price Volatility: The value of gold fluctuates in response to various factors, including global economic conditions, geopolitical tensions, and market sentiment. These fluctuations could impact the stability of the new currency and pose challenges for policymakers.

- Reserve Management: Effective management of gold reserves is essential to maintain the credibility of the currency. Zimbabwe must adopt prudent policies to ensure the integrity and security of its gold holdings.

- Economic Diversification: While gold may provide a stable anchor for the currency, Zimbabwe must also focus on diversifying its economy and enhancing productivity across sectors to sustain long-term growth and resilience.

- Public Education: Implementing a new monetary system requires public education and awareness to ensure widespread understanding and acceptance. Citizens need to comprehend the benefits and implications of the gold-backed currency to participate effectively in the economic transition.

Zimbabwe’s decision to introduce a gold-backed currency aims to control the inflation rate, increase investment, and facilitate international trade, the success of this initiative will depend on several factors.

Effective implementation, credible governance, and sustained political and economic stability will be crucial in determining whether the gold-backed currency can achieve its intended goals. Additionally, close monitoring and adaptation to market conditions and feedback from stakeholders will be necessary to ensure the currency’s long-term viability and acceptance.