Key Highlights:

- The Policy Research Institute (PRI) stressed the importance of reducing tax expenditure to boost Bangladesh’s revenue.

- Additionally, PRI proposed that raising the tax-GDP ratio by 2 percentage points through PIT could generate an additional Tk65,000 crore in revenue.

- A 2 percentage point rise in overall tax revenue would result in a 0.2 percentage point increase in real GDP growth if invested in public services.

The government, recognizing the urgent need to enhance tax revenues, outlined its intentions in the 8th five-year plan, aiming to raise tax revenue to 12.3% of GDP by 2025. The Finance Ministry recently emphasized Bangladesh’s diminishing access to concessional borrowing, estimating a $4.5 billion requirement in the next fiscal year to service debt. Thus, promptly increasing the tax-to-GDP ratio is essential for reducing dependence on high-cost borrowing in the future.

You can also read: Bangladesh’s Mega Road Network, A Beacon of South Asia’s Trade

The Policy Research Institute (PRI), unveiled a report titled “Economic Impacts of Fiscal Policy Change: Effects of increased tax revenues in Bangladesh on GDP Growth, Consumption, Household Income, and Inequality,” and stressed the importance of reducing tax expenditure to boost Bangladesh’s revenue, indicating that this strategic move could significantly bolster the country’s financial reserves by Tk30,000-Tk40,000 crore. Tax expenditures, including various provisions within the tax code like special credits and deductions, can affect federal revenue.

PRI conducted a press briefing recently, titled “Connecting Fiscal Policy Changes to Economic Outcome: Evidence from a Quantitative Exercise,” also suggested that increasing revenue through taxation, particularly via direct taxation such as Personal Income Tax (PIT), would have tangible positive effects on economic growth. This extra revenue could also support government spending on infrastructure and essential services like social protection and agriculture.

Additionally, PRI proposed that raising the tax-GDP ratio by 2 percentage points through PIT could generate an additional Tk65,000 crore in revenue.

Bangladesh currently faces low tax revenue levels compared to its GDP, standing at 7.6%, which poses risks to short-term economic stability and medium-term development goals, especially as the country aims to achieve developed nation status by 2041. Compared to similar nations like Vietnam, Bangladesh’s tax revenues as a percentage of GDP are only half, stressing the need for urgent fiscal reforms.

Enhancing Tax Revenue in Bangladesh

- Tax Expenditure Reduction: Tk30,000 – Tk40,000 crore boost in revenue

- Increase Tax-GDP Ratio by 2%: Additional Tk65,000 crore revenue

- Current Tax Revenue/GDP: 7.6%

- Goal: Achieve developed nation status by 2041

The PRI’s Insights

A 2 percentage point rise in overall tax revenue would result in a 0.2 percentage point increase in real GDP growth if invested in public services. Increased overall tax revenues, aimed at funding expanded spending, would also aid in alleviating poverty and inequality, with the poorest 40% of households experiencing the most significant benefits.

Focusing the increase in tax revenue on Personal Income Tax (PIT) would provide the greatest economic boost, with a 2 percentage point rise leading to a 0.5 percentage point increase in real GDP growth above current levels. This increase in PIT would benefit all sectors, including industry, agriculture, and services.

However, increases in Value Added Tax (VAT) revenues could have adverse effects on economic growth, household income, and consumption due to inflationary pressures. The report also noted that emphasizing direct taxes, like PIT, would align Bangladesh with other emerging economies.

Maximizing Tax Revenue for Economic Growth

- Real GDP Growth: +0.2 percentage points

- Poverty Alleviation: Significant benefits for poorest 40% households

- Focus on Personal Income Tax (PIT):

- PIT Increase: +2 percentage points

- Real GDP Growth Boost: +0.5 percentage points

- Government’s Fiscal Plans:

- Tax Revenue Target: 12.3% of GDP by 2025

- Addressing Debt Servicing Needs: Estimated $4.5 billion requirement in next fiscal year

Bangladesh’s Revenue Landscape

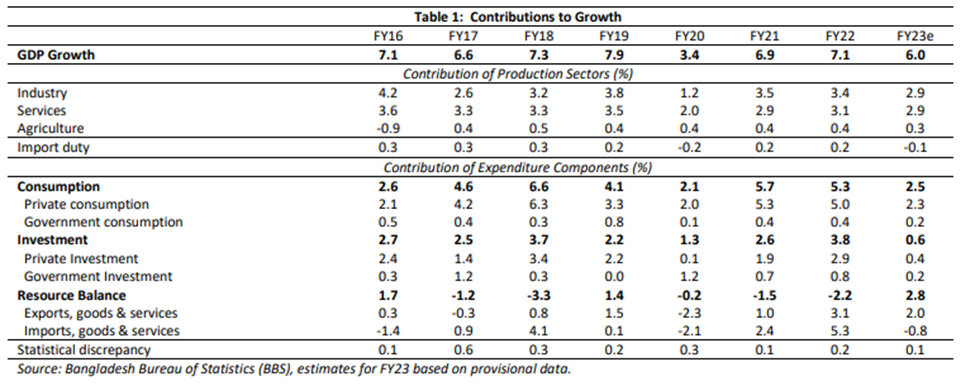

Bangladesh’s tax revenue as a percentage of GDP remains among the lowest globally. Private consumption and investment growth slowed due to high inflation and rising uncertainty. The trade deficit narrowed thanks to import compression and resilient export growth. Inflation accelerated due to increased energy prices and currency depreciation.

However, recent economic growth in Bangladesh has significantly reduced poverty. Between 2016 and 2022, poverty and extreme poverty rates declined annually by 1.3 and 0.6 percentage points to reach 30.0% and 5.0%, respectively. Poor households now have similar levels of physical capital as non-poor households did in 2010, particularly in access to electricity, water, sanitation, and improved housing.

Although, inequality remained largely unchanged, with the Gini coefficient increasing marginally to 33.4. Urban consumption growth favors better-off households over poorer ones, exacerbating urban inequality. Promoting equitable access to education and land ownership can address this persistent inequality.

On the supply side, the industrial and services sectors experienced slowdowns. Industrial production index declined from 11.9% in FY22 to 5.1% in FY23 due to import restrictions, rising raw material costs, and energy disruptions. Private sector construction slowed due to high raw material prices, while agricultural growth saw a modest decline from 3.2% in FY22 to 3.1% in FY23, despite robust public food stock supporting food security.

What should be the Road Ahead?

To harness the potential of tax reform, policymakers must prioritize the following:

Strategic Reductions:

The upcoming budget should focus on targeted reductions in tax expenditure. By eliminating unnecessary exemptions and streamlining the tax code, Bangladesh can unlock substantial resources.

Expanding TIN registrations:

To enhance revenue from Personal Income Tax (PIT), the strategy involves broadening the tax base by boosting Taxpayer Identification Number (TIN) registrations nationwide, with a focused campaign aimed at rural areas and non-urban regions. Additionally, there’s an emphasis on enhancing compliance among current TIN holders through mandatory submission of tax returns and employing various enforcement measures. Moreover, the establishment of a centralized automated tax administration database is proposed to mitigate corruption and streamline tax processes.

VAT reforms:

The call for VAT reforms was spurred by the need to boost revenue without causing inflationary repercussions. Achieving this entails rectifying existing inefficiencies within the system, primarily by broadening the VAT base through a reinstatement of the VAT Act of 2012. Additionally, enhancing compliance and curbing evasion can be accomplished by deploying more Electronic Fiscal Devices (EFDs).

In conclusion, Bangladesh needs to enhance tax revenues, stimulate economic growth, and promote equitable development. By advocating for strategic reductions in tax expenditure, emphasizing investment in growth-driving sectors, and prioritizing equitable distribution of resources, the government should navigate the challenges and opportunities ahead.

As Bangladesh aims to achieve its development goals and mitigate economic vulnerabilities, proactive measures based on evidence-based insights like those presented by PRI will be instrumental in steering the country towards a more prosperous and inclusive future.