Saudi Arabia’s launch of a $40 billion investment fund aimed at artificial intelligence emphasizes a deliberate shift towards economic diversification and asserting global technological dominance

The Kingdom of Saudi Arabia is embarking on a momentous endeavor, poised to launch an investment fund valued at approximately $40 billion, with a dedicated focus on the burgeoning realm of artificial intelligence (AI). This strategic move is intricately woven into Saudi Arabia’s overarching vision to assert itself as a global powerhouse in innovation and technology. As highlighted by The New York Times (March 19, 2024), the Kingdom’s decision underscores a broader agenda aimed at spearheading advancements in crucial sectors.

You can also read: Geopolitical Rifts Loom Over Brazil’s G20 Agenda

Recent deliberations involving the Saudi Public Investment Fund have illuminated potential collaborations with esteemed entities such as Andreessen Horowitz, a prominent Silicon Valley venture capital firm, signaling the Kingdom’s intent to forge formidable partnerships in its quest for technological supremacy.

Saudi Arabia’s foray into AI investment mirrors a global trend, with nations and corporations worldwide increasingly recognizing the pivotal role of modern technology in shaping the future. This ambitious initiative not only aligns with Saudi Vision 2030’s objective of economic diversification but also underscores the Kingdom’s unwavering commitment to fostering innovation and propelling progress on the global stage.

Saudi’s Economic Diversification and Global Expansion

The initiative aligns with a larger strategy wherein Saudi Arabia endeavors to diversify its economy and leverage emerging sectors to stimulate economic growth and ensure long-term financial resilience. The escalating recognition, both nationally and globally, of artificial intelligence as a pivotal investment domain underscores the significance of this move.

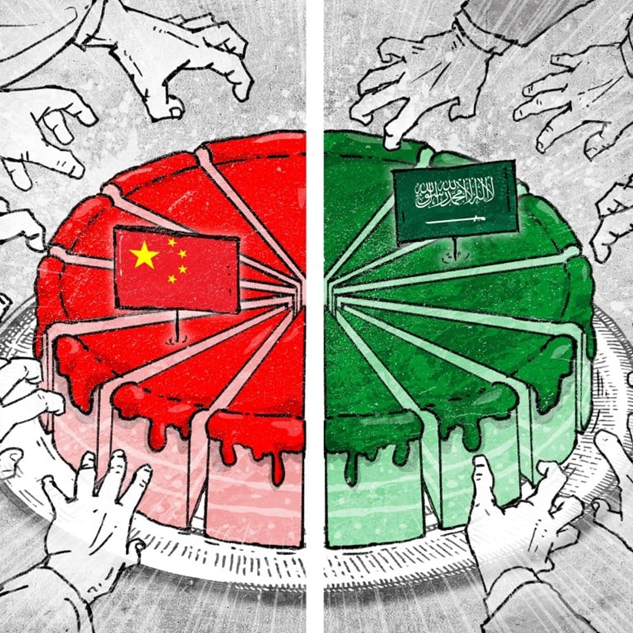

The establishment of the new technology fund coincides with a period of intense global competition among countries and corporations vying to lead advancements in this cutting-edge field, underscoring the sector’s critical role in propelling progress and development across various economic and social spheres. Saudi Arabia’s venture into artificial intelligence investment reflects a global trend, as numerous nations and corporations vie for prominence in this advanced domain.

Projections indicate that the new fund will play a pivotal role in steering economic growth within the Kingdom and realizing the ambitious strategic objectives outlined in Saudi Vision 2030, which aims to transition the Saudi economy into a knowledge-based one reliant on innovation and technology.

The establishment of the technology fund dedicated to artificial intelligence investment marks a substantial strategic stride undertaken by Saudi Arabia toward realizing its developmental aspirations.

Immutable’s $100 Million Fund for Blockchain Gaming

Immutable has introduced the “Inevitable Games Fund” (IGF), a $100 million fund designed to foster blockchain gaming. The fund has secured its initial $30 million from Alpha Wave Ventures, Web3 gaming guild Merit Circle, and other significant figures in the crypto and gaming industries.

Already, the fund has invested in seven blockchain games on either the ImmutableX or Polygon platforms, such as Pixelmon and Guild of Guardians. Immutable’s founder, Robbie Ferguson, anticipates that a successful blockchain game could catalyze mainstream adoption or motivate major gaming companies to embrace blockchain technology.

The Future of AI and Blockchain

The forthcoming advancements in artificial intelligence and blockchain gaming signify the swift progress occurring within these domains. With both nations such as Saudi Arabia and corporations increasing their investments in these pioneering technologies, the outlook for AI and blockchain appears optimistic.

Emphasizing AI safety standards within the Saudi fund is imperative for the conscientious advancement of artificial intelligence endeavors. Saudi Arabia’s intention to become a prominent investor in the venture capital realm through its upcoming tech fund is poised to have a significant impact on the industry. As more venture capital entities recognize the potential of AI and blockchain, heightened investment and innovation within these sectors are to be expected.

Chinese Companies Boost Saudi AI

Chinese companies, including Huawei, Alibaba, China Mobile, and Shangtang Technology, are actively participating in advancing the Saudi AI sector. Their expansion in Saudi Arabia has contributed significantly to enhancing the country’s AI infrastructure. For instance, in September 2023, the Huawei Cloud Riyadh node was inaugurated, offering comprehensive cloud services such as infrastructure, databases, big data, and AI services to cater to various industries.

Saudi’s Establishment of SDAIA: Key Milestone

In 2019, the Saudi Data and Artificial Intelligence Authority (SDAIA) was established by Saudi Arabia, tasked with charting the industry’s strategic course and ensuring its effective execution through data management. The primary goals include harnessing the potential of data and AI to fulfill the objectives outlined in Saudi Arabia’s “Vision 2030” and positioning the nation as a global frontrunner in these fields. Subsequently, in 2020, Saudi Arabia unveiled its National Strategy for Data and Artificial Intelligence (NSDAI), reaffirming the imperative of maximizing the benefits derived from data and AI.

Furthermore, initiatives such as the National Industrial Development and Logistics Plan (NIDLP) and the Data Center Strategic Plan (DCSP) have played pivotal roles in fostering the growth of the data and AI sector.

Neighborhood Rivalry

Saudi Arabia’s primary competitor in the region is the United Arab Emirates, where in 2017, Omar Sultan Al Olama became the first AI minister globally. Al Olama disclosed that over 1,000 AI-focused enterprises are currently operational in the UAE. The country has strategically enticed these companies to broaden their footprint within its borders by offering lenient regulations, substantial tax incentives, “golden visas” to attract AI talent and other enticing benefits.

Furthermore, the Emirates has actively sought to attract leading AI firms from Europe to relocate their headquarters to the Gulf nation. Recent reports from the Financial Times indicate that officials from Canada and the UAE have engaged with burgeoning AI companies such as Aleph Alpha from Germany and Synthesia and Stability AI from the UK, in attempts to persuade them to consider relocation.

On another front, the European Union recently enacted the AI Act, regarded as one of the most stringent regulatory frameworks globally concerning AI. The act prohibits systems that pose “unacceptable risks,” including those utilizing biometric data to reveal sensitive personal information like sexual orientation. Moreover, it delineates specific regulations for general-purpose AI models like ChatGPT.

Contrastingly, the UK operates under a comparatively more relaxed AI framework, wherein existing industry regulators formulate rules governing the technology rather than crafting bespoke legislation. With a tech market exceeding $1 trillion, London is viewed by many startups as an ideal locale for securing funding.

In conclusion, Saudi Arabia’s launch of a $40 billion investment fund targeting artificial intelligence signifies a strategic move towards economic diversification and global technological leadership. Aligned with Vision 2030, this initiative reflects Saudi Arabia’s commitment to innovation. Partnering with prominent firms and leveraging Chinese expertise emphasizes the nation’s determination to shape the future of AI. The establishment of SDAIA marks a crucial milestone in Saudi’s journey toward AI excellence, fostering an environment ripe for growth and innovation.