With Russia facing sanctions and the power of the US dollar’s hegemony still almost unopposed; nations are increasingly wary of the dollar’s monopoly and are looking for alternatives. To this end, BRICS countries are actively working towards an alternate, united currency akin to the EURO. While the path ahead is still long, the very consideration merits a look at the possibility of a BRICS currency.

BRICS—an acronym for Brazil, Russia, India, China, and South Africa—represents an intergovernmental organization that has evolved from a loose economic categorization to a formal geopolitical alliance.

You Can Also Read: BRICS BOOM: MILLIONAIRE SURGE FORECASTED IN NEXT DECADE!

Originating from Goldman Sachs economist Jim O’Neill’s 2001; what started as an economist’s prediction about emerging economic powerhouses has transformed into something much more. The BRICS countries have banded together, creating an intergovernmental organization that goes beyond just economics.

These five nations are forging a geopolitical alliance with some ambitious goals. For one, they want to drive economic growth not just within their borders but globally. They’re also pushing for greater integration among themselves on matters of politics and policy. But perhaps most ambitious is their aim to shake up the existing world order dominated by Western institutions like the IMF and World Bank. The BRICS nations envision a more multipolar world where power and influence is more evenly distributed.

While it began as an acronym identifying promising emerging markets back in 2001, the BRICS has evolved into a formidable coalition. These countries believe their economies will be major forces shaping the global landscape by the middle of this century. And they intend to leverage their collective heft to counterbalance Western dominance and push their own agenda on the world stage.

Economic and Population Value of BRICS Countries

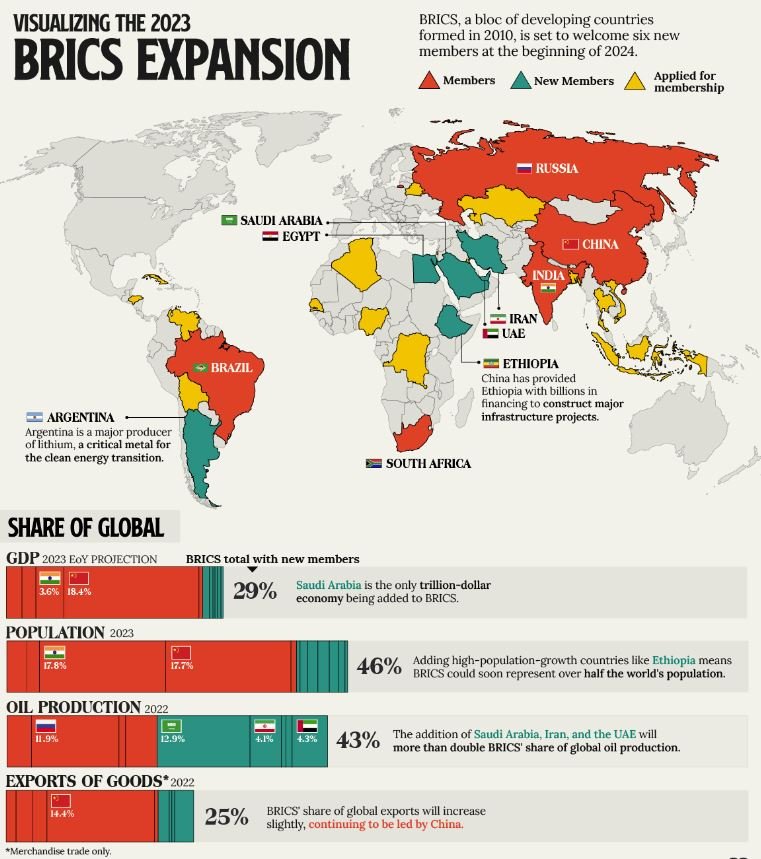

The BRICS bloc, with the recent inclusion of Egypt, Ethiopia, Iran, and the United Arab Emirates, covers about 30% of the world’s land surface and 45% of its population. These nations collectively represent a significant portion of global GDP and purchasing power parity, indicating a massive economic and demographic footprint. As of 2018, the initial five BRICS countries had a combined nominal GDP of US$28 trillion and a GDP (PPP) of around US$57 trillion, holding approximately US$4.5 trillion in foreign reserves.

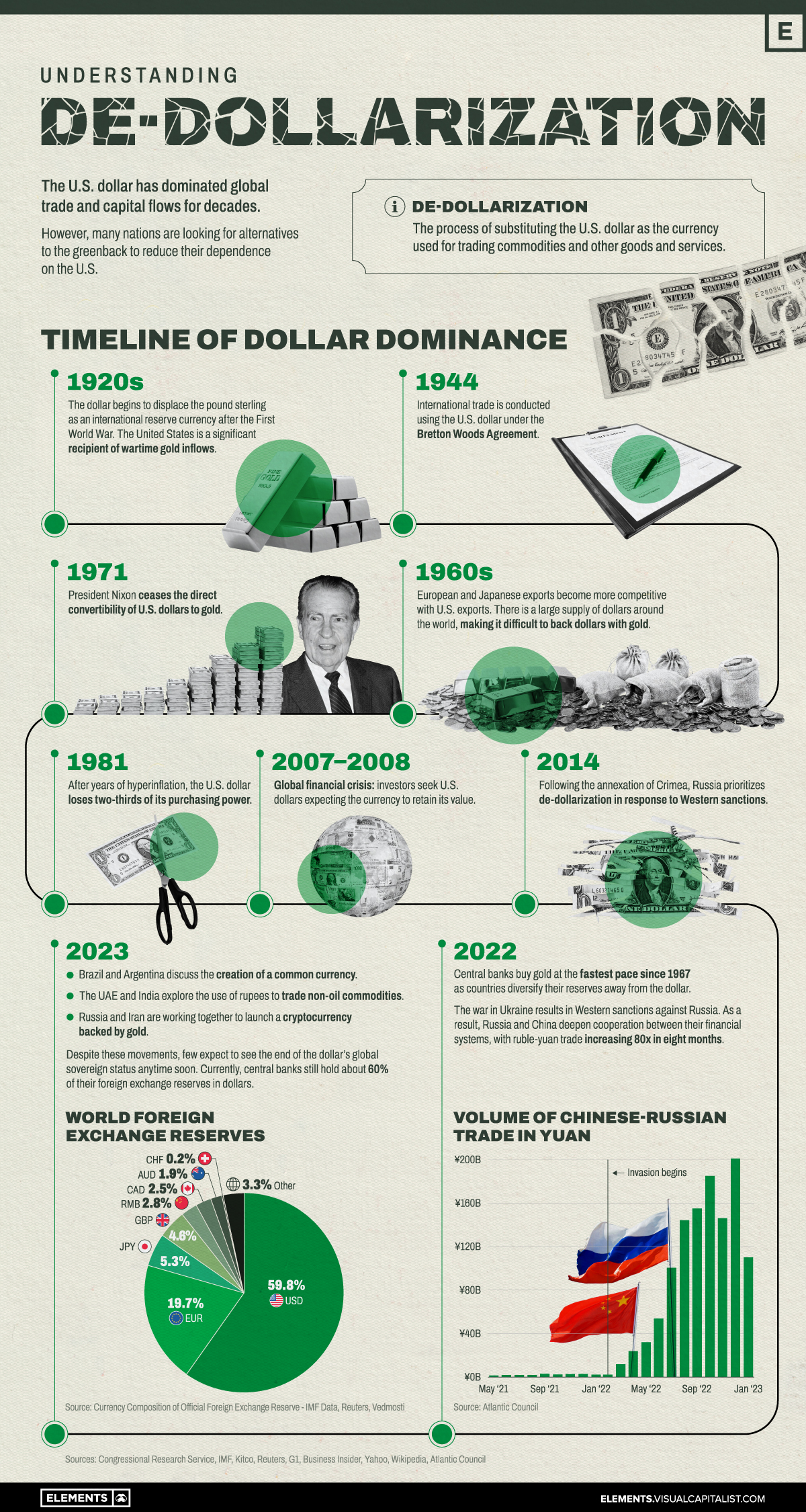

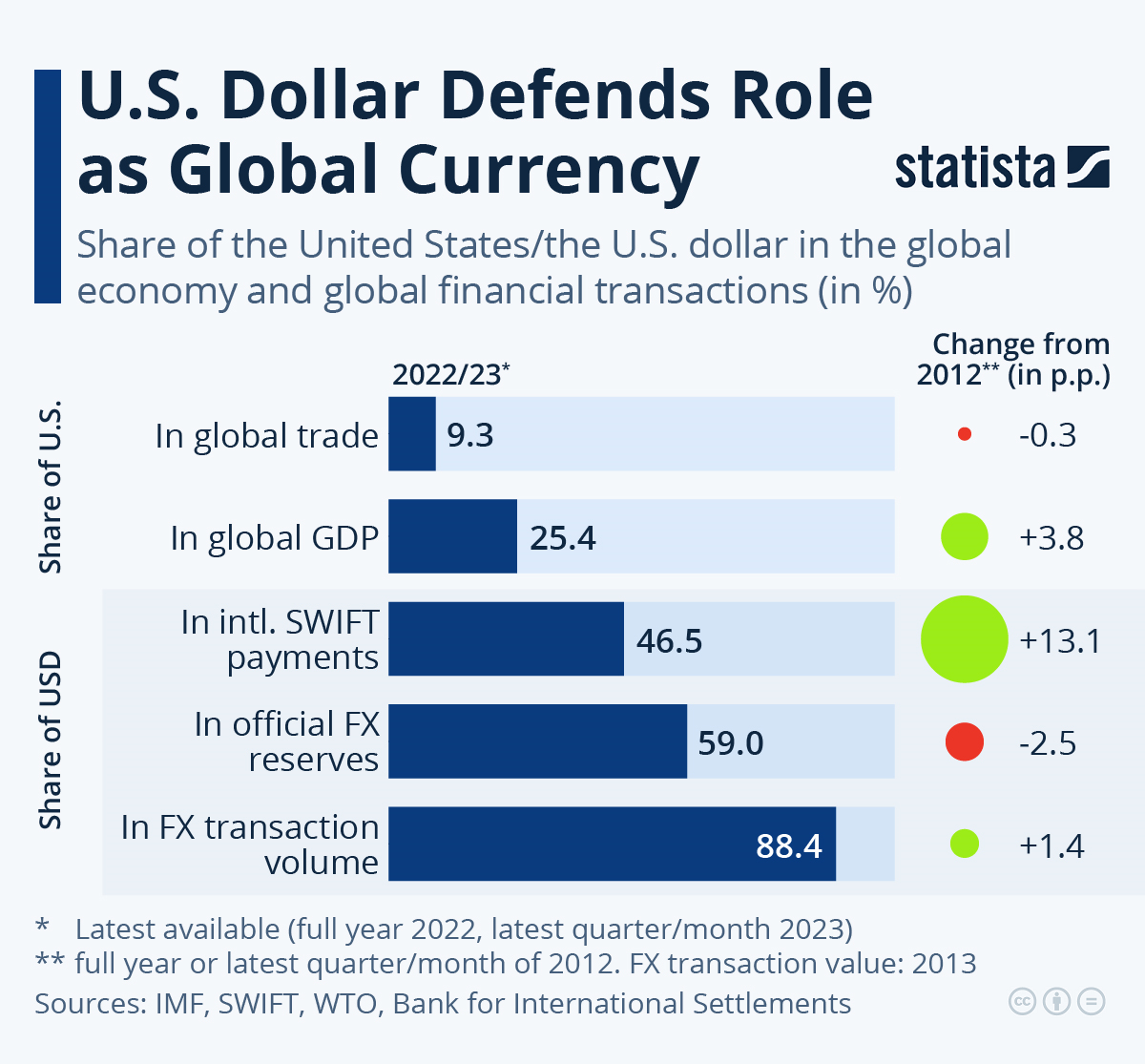

Why Nations are Looking to Reduce Dollar Dependence

The U.S. dollar’s dominance in global trade and finance has been a long-standing gripe for many countries, including the BRICS nations. Relying heavily on the dollar leaves their economies at the mercy of exchange rate fluctuations and policy decisions made by the U.S. Federal Reserve, over which they have no control. Recent events like U.S. interest rate hikes and the sanctions slapped on Russia have really driven this point home, sparking calls for “de-dollarization” as a way to enhance their economic sovereignty and insulate themselves from such volatility.

The push for a BRICS currency and reduced dependence on the dollar is a strategic response aimed at mitigating the impacts of Western sanctions and lessening their reliance on the U.S. currency. This approach was catalyzed by the harsh sanctions imposed on Russia lately, which saw nearly half its foreign currency reserves frozen and its exclusion from the SWIFT international payment system. It was a wake-up call highlighting the vulnerabilities that come with putting all your eggs in the dollar’s basket.

A BRICS currency could provide an alternative to the almighty dollar, reducing its dominance over global financial transactions. This would help shield trade and money flows from the impacts of sanctions by routing them outside dollar-centric systems. It would likely involve developing multilateral clearance mechanisms independent of SWIFT to avoid economic punishment through that channel.

But institutional workarounds are just one part of the de-dollarization strategy. Market-based measures are also on the agenda, like creating new multilateral financial institutions for non-dollar financing, promoting the use of local currencies for cross-border business, and diversifying the mix of global reserve currencies to include other national tenders as well as potential supranational or digital currencies.

By advancing these ‘go-it-alone’ strategies, the BRICS contingent hopes to build new institutional and market-based mechanisms that aren’t dollar-dependent. The goal is to severely undercut the dollar’s status as the world’s vehicle currency, thereby allowing members to better defend themselves against currency fluctuations and the threat of sanctions. Moreover, by rallying other nations to the de-dollarization cause and scaling up these alternative systems, the BRICS could attract more players – including non-Western states and organizations. That would create a sizable sphere operating outside the U.S. dollar’s orbit.

What Would a Possible BRICS Currency Look Like?

Creating a BRICS currency is about much more than just economics – it’s a highly political project that would require extensive cooperation among the member nations. We’re talking things like a joint banking union, coordinated fiscal policies, and bringing their macro-economic indicators into alignment. No small feats.

Experts have floated different possibilities for what form this currency could take. Some have proposed using a basket of the different BRICS currencies. Others suggest pegging it to gold or even using cryptocurrencies. But most see those as longer-term solutions down the road, not something that can be implemented right away.

Because let’s face it, the BRICS have some significant hurdles to clear first. There are trade imbalances within the bloc that would need ironing out. And establishing a truly common central banking system to govern this new currency? That’s a massively complicated undertaking all its own.

Beyond the economic factors, you also have to consider the diverse political landscapes across the BRICS countries. With their divergent governing styles and national interests, it’s no easy task getting all five on the same page for something as monumental as a unified currency.

While the potential formation of a BRICS currency carries major geopolitical implications as a counterweight to Western dominance, it’s an incredibly complex and ambitious goal. Significant obstacles – both economic and political – remain before this could ever become a reality. Cooperation on an unprecedented scale would be required

Conclusion

The notion of a BRICS currency as an alternative to the US dollar has gained attention, but experts doubt its feasibility due to substantial challenges. The vast economic disparities among BRICS nations, coupled with China’s dominance, complicate efforts to establish a unified currency. The primary aim appears to be reducing, rather than eliminating, the dollar’s global hegemony, offering more financial options.

Yet, achieving even this modest goal faces significant hurdles, requiring deep financial cooperation across diverse economies. While the rhetoric reflects a desire for economic sovereignty, actual implementation is daunting.

The viability of any BRICS currency depends on overcoming these challenges. Currently, the discussion itself signals a shift away from dollar dependence among major economies, although immediate change is unlikely. This discourse underscores a growing discontent with dollar dominance and hints at potential future developments in global finance.