By expanding access to pension benefits and enhancing scheme accessibility, the government is taking proactive steps towards improving financial well-being and bridging benefit gaps across different sectors.

The government has taken a significant step towards enhancing retirement security for employees by introducing a universal pension scheme. According to a gazette notification from the Financial Institutions Division of the Finance Ministry, the new decision will encompass employees of all self-governed, autonomous, state-run, and statutory entities.

You Can Also Read: UNIVERSAL PENSION SCHEME: THE FIRST STEP TOWARDS A WELFARE STATE

This initiative mandates the inclusion of all employees hired after 1 July this year in the newly established ‘Prottoy’ scheme, as announced by the Finance Division’s regulations wing on 14 March.

One of the sorrowful realitiesof our society is that many people live in miserable old age. Many of them never have their own children by their side. Some elderly people don’t have money saved, which puts them in a difficult situation as they get older. This can lead to them feeling helpless in their own homes or having to move to Old Age Homes for support and care.

To get rid of such a miserable life, one need social or the state support. But the story of pension benefits is only scheduled for the government employees. In this very situation, Prime Minister of Bangladesh Sheikh Hasina has come forward with a generous heart to end this miserable life of all the people of this country.

The government’s significant stride

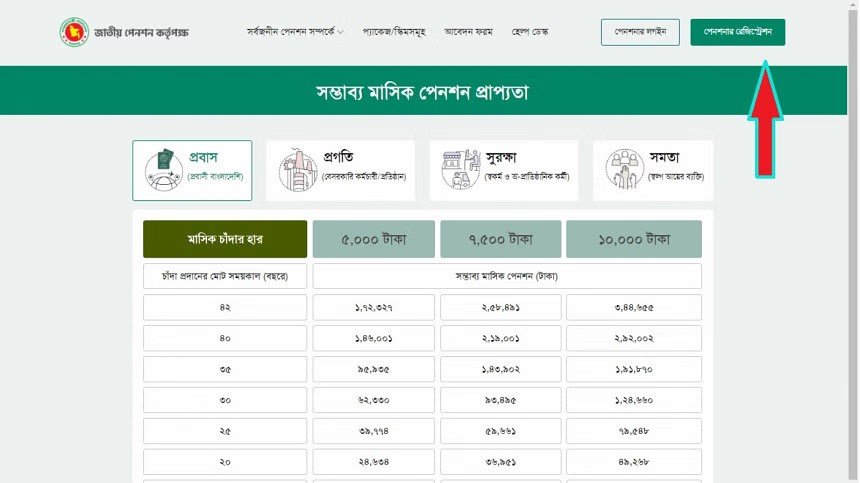

Existing employees within these institutions can also opt to join the scheme, provided they have completed a minimum of 10 years of service. Contributions to the scheme will involve a deduction of up to 10% of an employee’s basic salary or a maximum of Tk5,000, with the organization matching this amount in the employee’s account. Employees have the flexibility to increase their contribution voluntarily.

Upon meeting the requirement of contributing continuously for at least 10 years, employees will be eligible for a monthly pension. Those who contribute for a shorter period will receive a one-time refund with profit. For instance, an employee contributing Tk10,000 per month for 42 years could receive a pension of Tk3,44,655 monthly, while a 10-year contributor could receive Tk15,302 per month.

This marks the first instance of mandatory participation in the public pension system for institutions. Previously, entities without pension provisions relied on the Contributory Provident Fund (CPF), where employees contribute 10% of their basic salary and the company contributes 8.33%. This fund provides retirement benefits and an annual gratuity equivalent to two months of basic salary, primarily funded by the government budget.

What Experts Say

Experts like Fahmida Khatun and Mahbub Ahmed have praised this decision, emphasizing the need to extend similar benefits to government job appointees. They highlight the dual benefits of reducing government pension expenditure and expanding the pension fund. Ahmed also suggests involving civil society in pension authority boards and establishing district-level pension offices to improve scheme accessibility, ensuring a more inclusive and effective pension system for all employees.

Who will be included

As a result of this decision, various entities including public universities, cadet colleges, corporations, governmental bodies like Bida and Beza, government banks, education boards, state-owned enterprises, and different institutes such as rice research institutions, have all been brought under the umbrella of the universal pension system. Additionally, regulatory bodies like the telecommunications regulatory commission, councils of various kinds, and ports of diverse types have also been included in this initiative.

Universal Pension Scheme now

The government initiated four universal pension schemes –

- Progoti

- Surokkha

- Somota and

- Probash – on 17 August 2023, to enrol 10 crore people in the pension system.

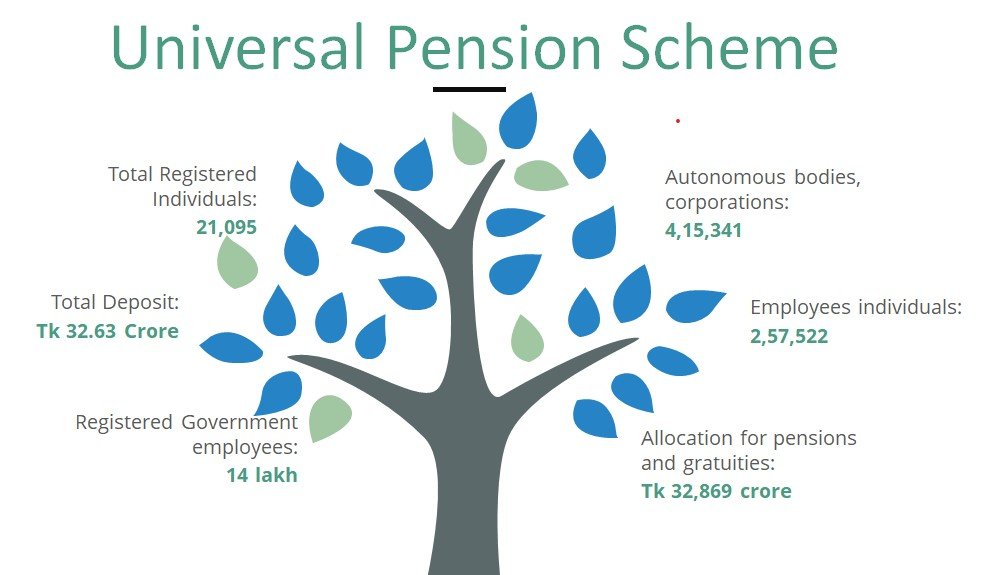

As of March 2, 2024, a total of 21,095 individuals have registered for the scheme, collectively depositing Tk32.63 crore. Despite this, finance officials have expressed discontent with the level of public engagement and are actively seeking ways to enhance the scheme’s attractiveness.

The Statistics of Government Employees-2022 reveal a total of 19 lakh positions within various ministries, divisions, and autonomous bodies, with approximately 14 lakh employees currently in service.

Notably, autonomous bodies and corporations account for 4,15,341 positions, employing 2,57,522 individuals. In the current fiscal year, there is an allocation of Tk32,869 crore designated for government employee pensions and gratuities.

Why is a Universal Pension Scheme needed?

It is indeed saddening to acknowledge the challenges faced by many individuals in our society as they enter old age, often without the support of their own children. This situation is frequently a result of inadequate savings, leaving them in a precarious position. In response to this, Prime Minister Sheikh Hasina of Bangladesh has demonstrated remarkable generosity and compassion in her efforts to alleviate the suffering of all citizens in her country, particularly those enduring hardships in their later years.