- Bangladesh Bank aims to merge weak banks with stronger ones to enhance the overall stability of the banking sector

- Banks are classified into red, yellow, and green zones based on financial performance

- Experts emphasize that depositors’ interests should be protected during bank mergers

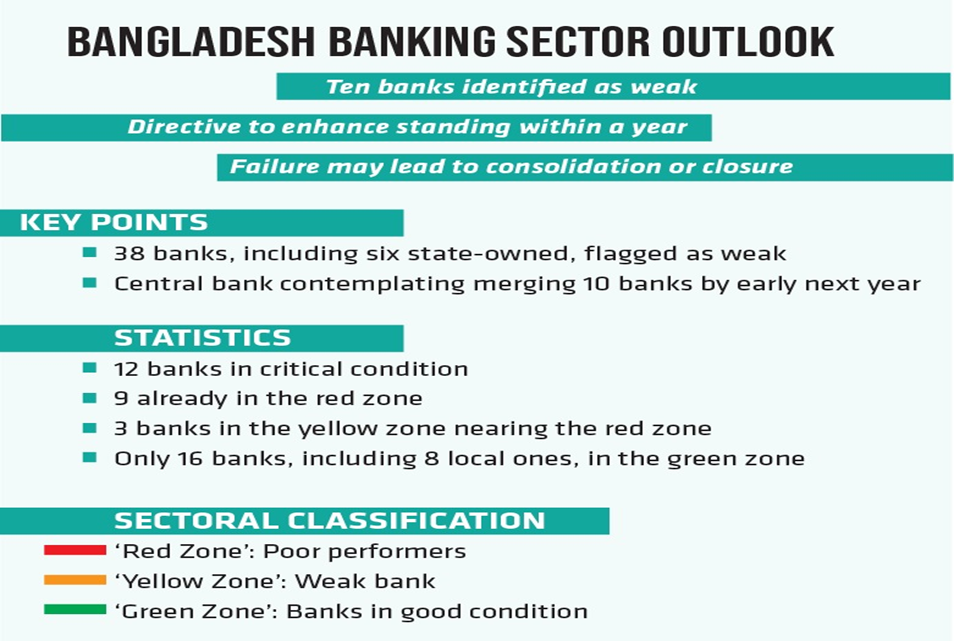

Tougher times are ahead for ten banks identified as weak in the country’s banking sector. Some government departments, including the central bank, have indicated that these ten banks, as identified by the Bangladesh Bank, have been instructed to improve their financial position within a year. Failure to meet this directive may result in their consolidation with stronger banks, and in severe cases, some may even face closure. Alternatively, these banks may be merged with other sound financial institutions, with closure being a possibility in extreme cases.

You can also read: Cabinet OKs Transport Act Draft with Big Punishment Cut

In contrast to struggling institutions, the green zone showcases 16 banks including eight local and eight foreign banks, according to the report, were in good condition. These banks are Prime Bank, Eastern Bank, NCC Bank, Midland Bank, Bank Asia, Shimanto Bank, Jamuna Bank, Shahjalal Islami Bank, Bank Alfalah, Woori Bank, HSBC, Commercial Bank of Ceylon, City Bank NA, Habib Bank, Standard Chartered Bank and State Bank of India.

In a recent development, the Bangladesh Bank has identified 38 banks, including six state-owned banks, as weak performers out of the 54 banks analyzed. This categorization comes at a critical juncture as the central bank considers the merger of 10 banks by early next year (2025).

Sectoral Classification

According to an internal report from Bangladesh Bank, over two-thirds of the banks in the country are now considered weak. These banks are divided into three categories based on their financial health: the ‘Red Zone’ comprises the worst or poor performers, the ‘Yellow Zone’ indicates weakness, while the ‘Green Zone ’signifies banks in good condition.

Of the 54 banks scrutinized, 12 are in critical condition, with nine already shifted to the red zone. Additionally, three banks in the yellow zone are dangerously close to crossing into the red zone. Conversely, only 16 banks, including eight local ones, have managed to secure a place in the green zone.

Analytical Framework and Exclusions

This comprehensive report spans data from 54 banks over six semi-annual periods, from December 2020 to June 2023. The Financial Stability Department meticulously prepared the Bank Health Index and HEAT Map using six different ratios based on CAMELS rating, excluding market risk sensitivity but including the leverage ratio proposed in Basel-3, to estimate Z-scores.

Notably, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, and ICB Islamic Bank were excluded from the analysis due to significant discrepancies in their data points. Similarly, Bengal Commercial Bank, Citizens Bank, Community Bank Bangladesh, and Probashi Kallyan Bank were not considered due to a lack of historical data.

Source: Datawrapper

Implications and Responses

The central bank’s report, unveiling concerning information about weak banks, coincides with a growing momentum surrounding the discussion of merging weak banks with stronger counterparts in the country. However, Bangladesh Bank Spokesperson Md Mezbaul Haque expressed unawareness regarding the report’s specifics, highlighting potential gaps in communication within the institution.

Meanwhile, Bangladesh Bank Governor Abdur Rouf Talukder announced in a recent meeting with bank owners that approximately 10 banks in the country will be merged by January 2025, providing an opportunity for weak banks to coordinate with stronger entities for potential mergers.

Will the problem be solved?

For the resolve of improving the banking sector, Bangladesh Bank is signifying to merge all the weak or bad banks with strong or good banks.

There are presently 61 banks in Bangladesh. Observers have noted that approximately 40 of these banks are performing admirably, yet the condition of the remaining banks is deemed unfavorable.

If a bank within the banking sector is weak, it poses a risk to the entire sector and impacts the broader economy. The central bank believes that merging weak banks with stronger ones can resolve this issue.

When it comes to bank mergers, the name of ‘PCA’ comes up again and again.

For example, in the context of merger of weak banks, the term ‘PCA’ is frequently mentioned.

For instance, concerning the merger of struggling banks, Majbaul Haque, the Executive Director and Spokesperson of the Central Bank, stated, “If any bank fails to fully implement the PCA, then options like merger will be under the purview of the Central Bank.”

Now, the question arises: what is PCA, and why is it so significant?

On February 5, 2023, Bangladesh Bank issued a circular titled ‘Prompt Corrective Action (PCA) Framework’. This framework was established as part of efforts to address the crisis of weak banks.

It also stipulates that if banks are unable to implement the PCA and address their weaknesses, the central bank may take actions such as consolidation.

What will happen to the depositors?

Experts in the banking sector emphasize that the merger of distressed and stable banks should not harm depositors or customers. They argue that when a sound bank acquires a struggling one, thorough consideration is given to all factors. Zahid Hossain, former chief economist of the World Bank Dhaka office, said that a merger entails the combination of balance sheets, implying that the acquiring bank must also assume responsibility for depositors. He emphasized the importance of the acquiring bank being financially strong and well-governed to ensure a smooth transition for customers.

.“A merger entails the amalgamation of their (the troubled bank’s) balance sheet with yours (the stable bank’s). Consequently, the stable bank assumes the responsibility for depositors. Refusal to honor these obligations is not an option.”

However, he cautioned that careful evaluation of the strength and assets of the weak bank is essential before assuming responsibility. Specifically, he highlighted the importance of assessing whether the weak bank’s assets are sufficient to cover its deposit liabilities

Which banks fall in what category

Bangladesh’s banking sector undergoes a detailed examination as institutions are classified into red, yellow, and green zones based on their financial performance. Here’s an overview of which banks fall into each category:

Red Zone:

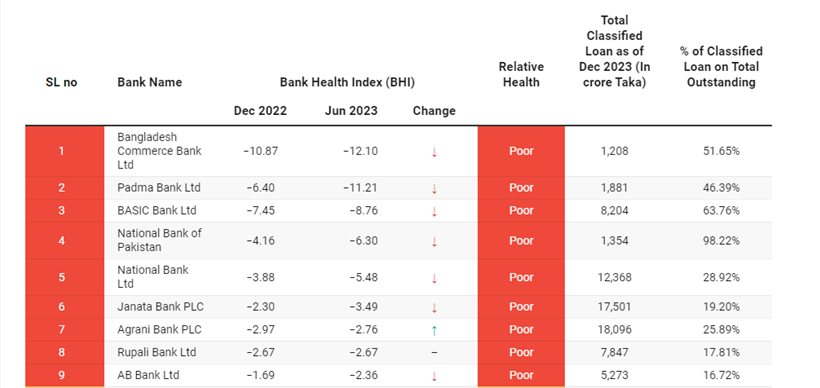

Among the six state-owned commercial banks, four—BASIC Bank, Janata Bank, Agrani Bank, and Rupali Bank—are identified as struggling entities. Similarly, four private commercial banks—Padma Bank, Bangladesh Commerce Bank, National Bank, and AB Bank—along with one foreign bank, National Bank of Pakistan, find themselves in the red zone.

Yellow Zone:

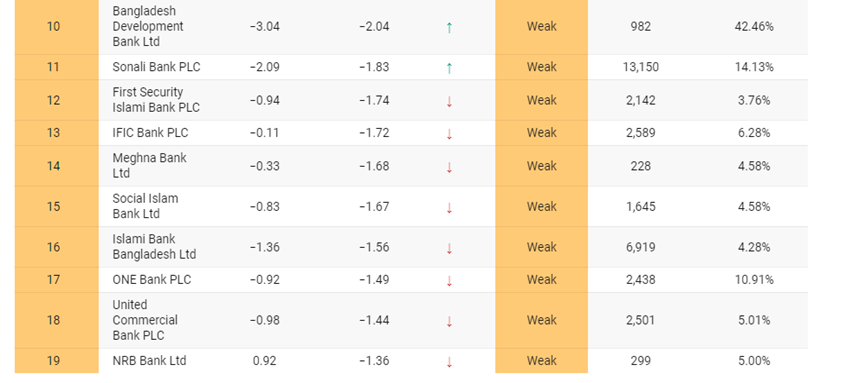

The yellow zone accommodates banks teetering on the edge of the red zone. This category includes three commercial banks—Bangladesh Development Bank, Sonali Bank, and First Security Islami Bank—that are in precarious positions.

Furthermore, the yellow zone hosts three state-owned commercial banks, 19 conventional private commercial banks, and eight Shariah-based Islamic banks. Notable names among them include IFIC Bank, Meghna Bank, Islami Bank Bangladesh, and Dutch-Bangla Bank, among others.

Supervisory Attention and Stress Testing:

The central bank underscores the need for supervisory attention, particularly for banks in the red and yellow zones, due to their deteriorating health compared to industry averages. Special focus is directed toward banks in the red zone, recognizing their heightened vulnerabilities. Stress test results further highlight the precarious position of banks in the yellow zone, necessitating proactive measures to ensure stability.

Non-Performing Loans (NPLs) Overview:

Bangladesh Bank data reveals a concerning trend regarding non-performing loans (NPLs). As of December 2023, the total NPLs amount to Tk145 lakh crore. Notably, the 12 banks in the red zone account for Tk90 lakh crore of this total, constituting a significant portion of 62%.

In conclusion, the classification of banks into red, yellow, and green zones sheds light on the diverse challenges and strengths within Bangladesh’s banking sector. Addressing vulnerabilities and promoting stability remain crucial for sustainable growth and resilience in the sector.