Key Highlights:

- 55 international companies were invited

- Bidders to have six months to submit their tenders

- Competitive oil prices based on market values

Petrobangla, Bangladesh’s esteemed oil, gas, and mineral corporation, has recently announced the launch of an offshore bidding tender, beckoning international oil and gas companies to partake in exploration ventures within the country’s maritime expanse in the Bay of Bengal.

You Can Also Read: UAE Embraces Bangladeshi Talent: Gateway to Opportunity Open!

Entitled “Oil and Natural Gas Exploration Under Bangladesh Offshore Bidding Round 2024,” the tender was officially unveiled through publication in local newspapers and on the websites of pertinent government entities, including Bangladeshi diplomatic missions abroad. Interested parties are granted a generous timeframe of six months, with the deadline for bid submissions set for September 9, 2024.

The tender presents an array of opportunities. According to the tender that has been issued, there are a total of 24 offshore blocks available for bidding, comprising nine shallow blocks and 15 deep-sea blocks. Companies, either singly or in collaboration with others, are encouraged to bid for one or more blocks, ensuring a competitive and dynamic bidding process.

Contractual Framework: Attractive Incentives for Investors

Petrobangla’s proposed contract offers a slew of incentives designed to attract international investors. Under the Bangladesh Offshore Model Production Sharing Contract 2023, successful bidders will enjoy benefits such as full profit repatriation, uncapped gas prices linked to international markers, and competitive oil prices based on prevailing market values. Importantly, there are no signature bonuses or royalties, and equipment imports for petroleum operations incur no duty. Additionally, Petrobangla assumes the corporate income tax liability of contractors, further enhancing the attractiveness of investment in Bangladesh’s offshore sector.

Key Features of the Contract

The contractual framework also includes provisions for:

- Bank guarantees for the performance of exploration programs.

- Provision for assignment of interest and share transfer.

- 100 percent cost recovery with a yearly cap of 75 percent.

- Minimum work obligations and biddable work program commitments.

- Petroleum profit sharing based on the R-factor, with upper and lower limits.

- Option to sell natural gas shares in the domestic market to third parties, subject to Petrobangla’s right of first refusal.

Qualification Criteria and Access to Geological Data

To ensure the participation of experienced and capable entities, the tender outlines stringent qualification criteria. Bidders must demonstrate offshore daily production of at least 15,000 barrels of oil or 150 million standard cubic feet of gas, along with prior global experience in oil and gas exploration and production.

Furthermore, Petrobangla provides comprehensive informational packages to assist interested parties in evaluating the geological prospects of the blocks on offer. These packages, available for purchase, contain essential data such as seismic sections, gravity and magnetic surveys, and geological maps, enabling informed decision-making during the bidding process.

Companies keen on participating in the bidding process and acquiring promotional and data packages are directed to contact the Director of Production Sharing Contract at Petrobangla. Detailed contact information is provided in the bidding tender, facilitating seamless communication between Petrobangla and prospective investors.

Challenges and Opportunities

While the initiative holds immense potential for Bangladesh’s energy security and economic prosperity, concerns have been raised regarding potential over-reliance on IOCs and future gas pricing dynamics. Critics caution against the risk of financial burden and loss of sovereignty over-extracted resources.

Despite challenges, experts foresee opportunities for Bangladesh to leverage offshore exploration to build domestic capacity and negotiate better terms in the future. The engagement of IOCs, albeit belated, opens doors for acquiring valuable data and identifying new growth opportunities.

The Implications of the Latest Discovery for Bangladesh’s Energy Future

The discovery of an energy reservoir in the Bay of Bengal by the United States has sparked interest in Bangladesh’s untapped natural gas reserves. As one of the largest deltas in the world, Bangladesh has the potential to fully exploit its gas discoveries.

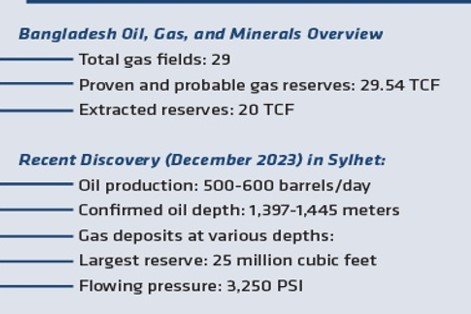

Bangladesh currently generates electricity using a mix of native natural gas, domestic and imported coal, imported oil, imported LNG, biomass, hydropower, and solar power. According to a report by the Institute for Energy Economics and Financial Analysis (IEEFA), natural gas accounts for 49% of the nation’s electricity, while furnace oil and coal contribute 32% and 11%, respectively. The Bangladesh Oil, Gas, and Minerals Corporation (Petrobangla) reports that the nation boasts 29 gas fields, including the Ilisha gas field in Bhola. Out of the proven and probable gas reserves totaling approximately 29.54 trillion cubic feet (TCF), 20 TCF has already been extracted.

In December 2023, a new oil and gas reserve was discovered in Sylhet, capable of producing 500-600 barrels of crude oil per day. Oil was confirmed at a depth of 1,397-1,445 meters, with gas deposits found at various depths, including a significant reserve yielding 25 million cubic feet of gas flow at a pressure of 3,250 pounds per square inch (PSI).

Officials from the state-run Oil, Gas, and Mineral Corporation (Petrobangla) estimate the value of these reserves at around 850 billion taka (over 7 billion U.S. dollars), potentially providing energy for more than 15 years.

Currently, Bangladesh produces approximately 2,300 million cubic feet of gas per day from 21 gas fields, while around 700 million cubic feet of gas per day is imported to meet market demand.