On March 8, 2024, the globe commemorates International Women’s Day, spotlighting the notable advancements achieved by women in Bangladesh. Despite grappling with entrenched social and cultural constraints, Bangladeshi women are overcoming barriers and charting courses toward financial autonomy. Enduring societal norms have long impeded women’s empowerment and economic autonomy. Despite numerous initiatives by both non-government organizations and governments, gender disparity endures, underscoring the enduring struggle for women’s rights.

Women involved in Financial Activities towards Financial Independence

In Bangladesh, despite comprising half of the population, women’s participation in the labor force stood at only 36.4 percent in 2020, contrasting sharply with the 84.0 percent rate for men. According to data from Bangladesh Bank, the number of MFS (Mobile Financial Services) accounts reached 220 million by the conclusion of November 2023. Among these, women accounted for 92.3 million accounts, representing 42 percent of the total.

You Can Also Read: Bangladesh Embraces Fashion Evolution with Non-Cotton Garments

Traditionally confined to domestic roles, Bangladeshi women have increasingly embraced various financial endeavors, breaking barriers and reshaping societal norms. Microfinance initiatives taken by many governments and non-government foundations and agencies have played a pivotal role in fostering women’s financial inclusion. These programs empower women by providing them with access to credit and financial services, allowing them to establish and expand small businesses. As entrepreneurs, women are venturing into diverse sectors, from agriculture to retail, contributing significantly to local and national economic growth.

Furthermore, the digital revolution has opened new avenues for women to engage in financial activities. Mobile banking and e-commerce platforms enable women in remote areas to conduct transactions, manage savings, and participate in online marketplaces. This technological leap has not only facilitated financial inclusion but has also enhanced financial literacy among women.

The shift towards financial independence is not only an economic transformation but also a societal one. As women continue to break stereotypes and actively engage in financial activities, they pave the way for a more inclusive and prosperous Bangladesh, fostering sustainable development and gender equality.

Women play pivotal roles across various sectors, striving for financial independence and equality. These are some key areas where their impact is significant.

Steps Taken by the Government of Bangladesh

The government of Bangladesh has made significant strides in enhancing women’s economic opportunities and financial inclusion. Despite a reduction in the female unemployment rate to 6.7% in 2017 from 7.3% in 2013, gender inequality persists. Efforts include diversifying job opportunities, with women constituting 80% of the 4 million workers in the ready-made garment sector. Initiatives like the re-fixing of minimum wages for 43 industrial sectors have narrowed the gender wage gap, particularly in the public sector.

Financial inclusion measures, such as microfinance organizations, have supported over 49 million individuals, predominantly women. The National Industry Policy and Bangladesh Bank’s fixed interest rate of 9.0% for women entrepreneurs aims to facilitate access to institutional finance. Women-led enterprises receiving finance experienced a 165% growth from FY17 to FY18.

Furthermore, the government has fostered women’s participation in politics, with 50 parliamentary seats reserved exclusively for women and a notable increase in female MPs. The country’s ranking of 50th in the Global Gender Gap Index 2020 reflects Bangladesh’s successful efforts in promoting women’s empowerment compared to its South Asian counterparts.

Legal and regulatory improvements include the formation of sexual harassment prevention committees and, the enactment of laws like the Child Marriage Restraint Act 2017, and the Dowry Prohibition Act 2018. However, challenges persist, especially in curbing child marriage.

The government’s commitment to Gender-Responsive Budgeting (GRB) is evident through its incorporation in the formal budgeting process. The share of expenditure on women’s development as a proportion of the total budget increased to 29.65% in FY 2019.

Even Bangladesh had been positioned as the top country in terms of the most gender-equal country in South Asia 10 times in a row according to the Global Gender Gap Report by the World Economic Forum (WEF).

Looking ahead, Bangladesh aims to address various aspects of women’s empowerment, including healthcare, education, employment opportunities, business development, and participation in decision-making processes. The focus is on eliminating discriminatory provisions and increasing labor force participation, recognizing the need for continued progress toward gender equality.

Other Organizations engaged in Women Empowerment

Along with the government, different organizations globally are increasingly focusing on integrating women into workplaces and the economy. NGOs play a vital role in this effort, particularly through microfinance projects that empower rural women with financial services in Bangladesh too.

Initiatives like microloans enable women to start small businesses, save money, and achieve financial independence. Both local and multinational companies are actively recruiting female employees, contributing significantly to women’s empowerment. Major NGOs like BRAC and ASA have extended financial services to rural women, aiming to support survivors of gender-based abuse and educate women about their financial rights.

Banks and financial institutions have also introduced specialized loan products for women entrepreneurs, supported by Bangladesh Bank, with a focus on closing the gender gap and increasing women’s access to financial services. Specific programs like IDLC Finance Limited’s Purnota offer comprehensive support, including loans, training, networking events, and market linkages, contributing to the economic empowerment of women in Bangladesh.

Despite progress, challenges remain, and public support for women-led businesses is crucial for achieving true gender equality. International Women’s Day serves as a reminder that while strides have been made, there’s still a journey ahead for Bangladesh to achieve gender equality and parity.

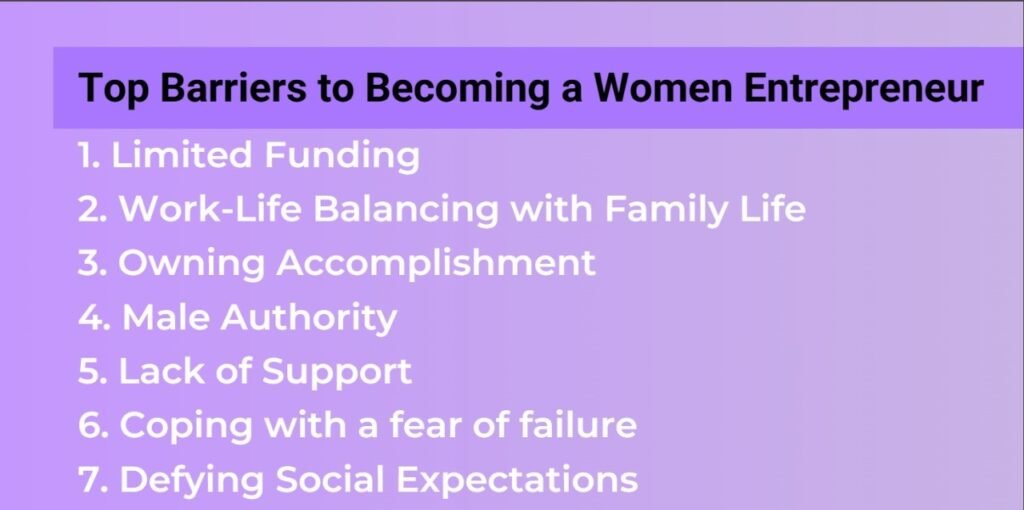

Barriers to the Financial Independence of Women

The Time Use Survey 2021 by the Bangladesh Bureau of Statistics reveals a stark gender disparity in domestic and caregiving tasks. Women dedicate eight times more time than men to these activities, with men spending around 1.6 hours daily, while women allocate an average of 11.7 hours, nearly half of their day. Sadly, these essential caregiving tasks are undervalued, leaving women unpaid for their significant contributions.

Historical inequalities persist, with women experiencing limited opportunities, lower pay, and fewer chances for career growth. Urban areas show progress in women’s empowerment, but rural regions lag due to challenges like limited education, financial services, and opportunities. It is crucial to prioritize rural women’s needs for equal opportunities and financial independence, addressing issues of discrimination, violence, and restricted access to education and employment.

Recommendations

Promoting financial independence for women is crucial for achieving gender equality. Several barriers often impede women’s financial autonomy. Here are some recommendations to address these barriers:

- Equal Pay and Employment Opportunities

- Financial Education

- Access to Banking and Credit

- Entrepreneurial Support

- Parental Leave and Work-Life Balance

- Retirement Planning

- Addressing Gender Stereotypes

- Legal Reforms

- Networking and Professional Development

- Government Policies and Corporate Initiatives

- Community Support

Achieving financial independence for Bangladeshi women is imperative for encouraging economic growth and societal equity. By empowering women with education, skills, and access to financial resources, we can break the cycle of poverty, enhance family well-being, and contribute to overall national development. Recognizing the pivotal role women play in economic progress, it is paramount to implement policies that promote equal opportunities and dismantle barriers. Through collaborative efforts from government, NGOs, and the private sector, we can catalyze a transformative change, ensuring that Bangladeshi women have the means to control their financial destinies, thus paving the way for a more prosperous and inclusive society.