In Bangladesh, the push for agricultural insurance, addressing risks from floods, cyclones, droughts, and more, is driven by governmental and stakeholder advocacy. Currently, a local Insurance Company with a Weather Index-based Crop Insurance pilot program, initiated in 2021 with Swiss support, strives to mitigate risks. However, the absence of a comprehensive insurance program leaves farmers exposed to an annual disaster cost of $300 million, as per the World Bank Group’s 2018 study.

You can also read: Sneaky Taxes Propel Poverty Trap!

The ground reality shows that Bangladesh confronts vulnerability to climate-induced threats, particularly small peasants with extreme weather who are getting havoc on their crops and livelihoods in many seasons. But their participated agriculture contributes 11.50 percent to the GDP and directly supports 45% of the population. This indicates that crop insurance emerges as a crucial defense mechanism.

Overview of Agricultural Insurance

Sadharan Bima Corporation (SBC) and Green Delta Insurance Company (GDIC) offer Agricultural Insurance Schemes, allowing farmers to buy crop insurance plans protecting against weather-related risks. Bangladesh has a business rationale for agricultural insurance, addressing farmers’ resilience needs. Launched in 2021, the BRAC’s non-life insurance project covered 966 farmers initially, increasing to 1,093 in the year 2023. The project plans to extend coverage to rice, potatoes, and vegetables too.

GDIC, aiding 600,000 farmers since 2015, provides up to 100% coverage based on risk criteria. Despite successful claim resolutions, there’s no insurance for cyclone-induced crop losses due to insufficient data. GDIC developed a weather-based index spanning 40 years to address this gap. While crop insurance is beneficial, premium costs rise with data analysis, posing affordability challenges for farmers.

SBC’s Proposal: Weather Index Crop Insurance for Agriculture

SBC is the only state-owned non-life insurer and reinsurer in Bangladesh under the Ministry of Finance. The project of SBC about

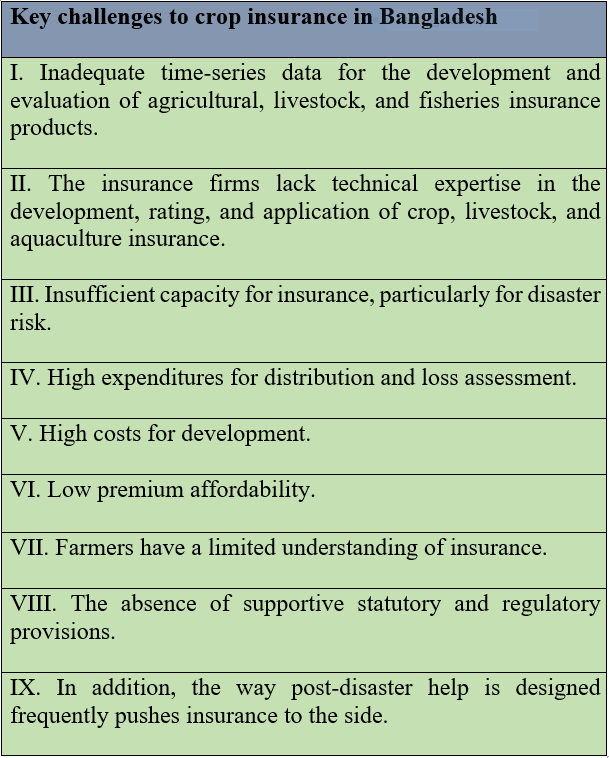

Challenges to Bangladesh’s development of crop insurance

Bangladesh is positioned among the top five countries facing heightened vulnerability to climate change based on being classified as a low-income and exceptionally susceptible nation. A single episode of severe weather can ruin the entire crop of wheat, rice, or cotton, forcing farmers to take loans or abandon their land. The agriculture sector suffers from low profitability due to high risks and poor returns, which worsens the danger of crop loss.

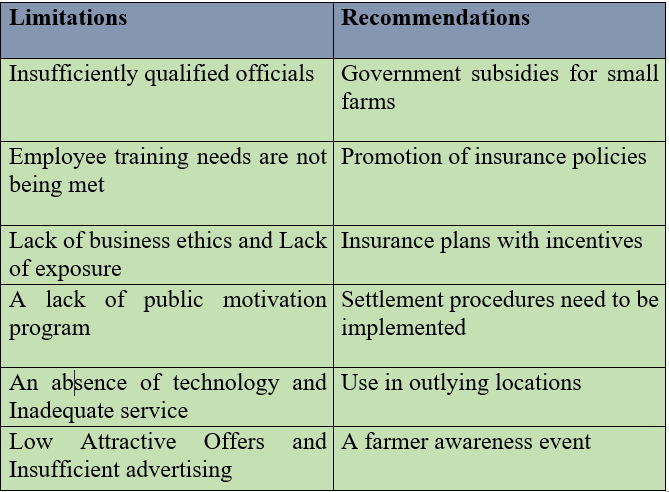

Limitations and recommendations for crop insurance

Bangladesh grapples with challenges in its crop insurance landscape, impeding the effective safeguarding of farmers’ livelihoods. Limited data availability, coupled with unpredictable climatic patterns, poses hurdles in accurately assessing and managing risks. The prevalence of small-scale agriculture amplifies these issues, hindering the widespread adoption of insurance schemes. This necessitates a comprehensive examination of the limitations to revamp the existing system. Recommendations should focus on bolstering data infrastructure, enhancing outreach and education to farmers, and tailoring insurance solutions to the specific needs of diverse agricultural practices. Addressing these constraints is paramount for establishing a resilient and equitable crop insurance framework in Bangladesh.

Furthermore, beyond the suggestions for expanding crop insurance coverage, emphasizing support for small and marginal farmers and establishing a mechanism for grievance resolution can be regarded as a crucial measure.

Crop Insurance in Global Context

In 2021, the Crop Insurance Market reached a valuation of USD 36.7 Billion, with projections indicating a growth to USD 61.30 Billion by 2030 at a Compound Annual Growth Rate (CAGR) of 5.90%. Agricultural insurance has traditionally served as a crucial risk management tool for farmers in both developing and industrialized economies. However, the paths to sustainability vary across countries.

Crop insurance in Bangladesh serves as a crucial safeguard against the unpredictable challenges faced by farmers. By mitigating financial risks associated with crop failure, it promotes agricultural sustainability and empowers farmers to withstand adverse conditions. Implementing and expanding such insurance schemes is pivotal for fostering resilience and ensuring food security.