Key Highlights:

- Traditional coins and banknotes have been the backbone of transactions

- Rise of digital payments is evident with the shift toward contactless payments

- Despite digital advancements, physical currency remains ingrained in culture and everyday transactions

- Significant portion of the population, especially in rural areas, lacks access to digital financial services

In the symphony of the economy, the familiar clink of coins and the reassuring rustle of banknotes have long played their part as the backbone of transactions. However, as the world pivots towards the digital era, the melody is shifting to the crisp dings of successful contactless payment notifications.

You Can Also Read: Dynamic Digital Bank’s Smart Motion to Economic Growth

The question that arises is whether this ascent of digital currency foretells the demise of physical money. While the complete extinction of cash may seem improbable, its destiny, even in Bangladesh, is undeniably intertwined with the burgeoning digital realm.

Rise of Digital Payments in Bangladesh

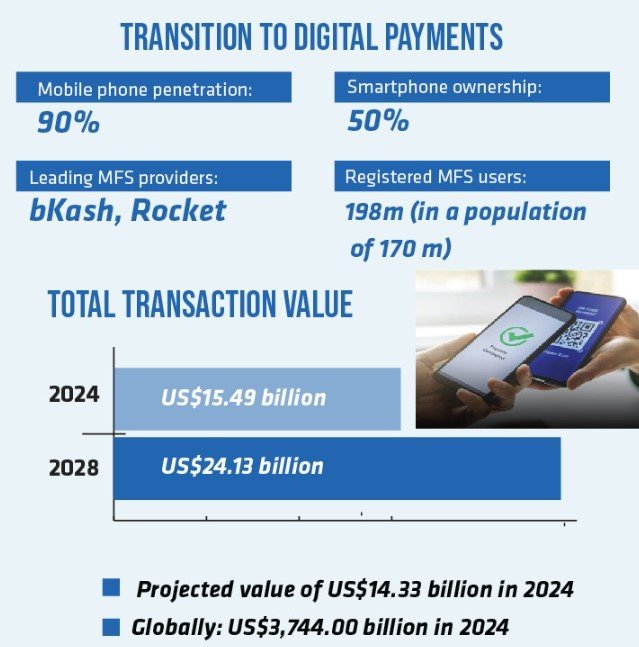

A notable surge in digital payment adoption has been witnessed, propelled by various factors. Firstly, with mobile phone penetration soaring to approximately 90% in Bangladesh, of which nearly half own smartphones, these handheld devices have become ubiquitous tools for digital transactions. Leveraging this technological advancement, Mobile Financial Services (MFS) such as bKash and Rocket have spearheaded a financial revolution, particularly empowering millions in rural areas with access to previously elusive financial services. The undeniable convenience and security of digital transactions have fueled a steady rise in their utilization.

Presently, approximately 198 million users are registered across 13 MFS providers in Bangladesh, a figure that surpasses the country’s population due to individuals maintaining multiple accounts. bKash, for instance, has augmented its platform with features like biometric ‘Face ID’ and ‘Fingerprint’ login options, along with innovative functionalities like ‘Group Send Money’ and ‘Savings Marketplace,’ enhancing both safety and attractiveness.

In tandem, Bangladesh Bank initiated the ‘Cashless Bangladesh Smart Bangladesh’ campaign in 2023, aimed at integrating small-scale merchants into an accessible payment ecosystem. The introduction of charge-free transactions via the ‘Bangla QR’ code for micro-merchants has been a pivotal step in propelling the cashless Bangladesh agenda forward.

Participation from ten banks, three mobile financial services, and three international payment gateways underscores the collaborative effort towards this initiative.

Secondly, concerns regarding hygiene amidst the global pandemic have expedited the shift towards contactless payments, further bolstering the momentum towards digital alternatives. Additionally, the seamless efficiency of digital platforms, particularly for online transactions and bill payments, has cemented their popularity.

However, a complete transition from physical to digital currency in Bangladesh remains a distant prospect.

Bangladesh’s Digital Payments Market

In Bangladesh, the digital payments landscape is experiencing a significant surge, with the total transaction value projected to reach US$15.49 billion in 2024. This growth trend is expected to continue, with an annual growth rate (CAGR 2024-2028) of 11.72%, resulting in a projected total amount of US$24.13 billion by 2028. Notably, the largest segment within this market is Digital Commerce, with a projected total transaction value of US$14.33 billion in 2024. Despite these impressive figures, when compared globally, Bangladesh’s digital payments market is still evolving. For instance, the highest cumulated transaction value is reached in China, with an estimated US$3,744.00 billion in 2024, showcasing the vast potential for further growth and development in the digital payments sector in Bangladesh.

Global Landscape and the Future of Money

Globally, physical currency still holds considerable weight, with approximately $40 trillion worth of physical money in circulation worldwide. Challenges concerning digital literacy and trust in online transactions persist, particularly among older generations. Therefore, both physical and digital forms of currency are likely to coexist for the foreseeable future.

The Role of Central Bank Digital Currencies

The Bangladesh Bank is actively exploring the potential of Central Bank Digital Currencies (CBDCs) to reshape the financial landscape. CBDCs aim to combine the benefits of digital transactions with the stability and security associated with traditional central bank-issued currencies. However, challenges such as equitable access, financial stability risks, and regulatory considerations must be addressed.

Navigating the Future of Money

The rise of digital payments in Bangladesh signifies a significant shift in the financial landscape, but it does not necessarily spell the end of physical money. Both forms are likely to coexist, catering to different needs and preferences. Striking the right balance between embracing innovation and ensuring financial inclusion for all will be crucial in navigating the evolving landscape of money, not only in Bangladesh but also globally. As new technologies emerge and consumer preferences evolve, the key lies in creating a dynamic ecosystem that fosters financial inclusion and facilitates seamless transactions, irrespective of the chosen method – cash or digital. In the symphony of the economy, the familiar clink of coins and the reassuring rustle of banknotes have long played their part as the backbone of transactions. However, as the world pivots towards the digital era, the melody is shifting to the crisp dings of successful contactless payment notifications.

The question that arises is whether this ascent of digital currency foretells the demise of physical money. While the complete extinction of cash may seem improbable, its destiny, even in Bangladesh, is undeniably intertwined with the burgeoning digital realm.

In conclusion, the rise of digital payment in Bangladesh, while significant, does not spell the end of physical money. Both forms are poised to coexist, catering to diverse preferences and needs. The key lies in striking a harmonious balance between embracing innovation and ensuring universal access, thereby navigating the evolving landscape of currency with foresight and adaptability.