In the bustling garment industry, Bangladesh stands as the second-largest garment exporter in the world after China. Bangladesh has been in the picture as the local garment exporters use almost 71 percent cotton fiber and 29.2 percent non-cotton fiber in making garments. With a focus on sustainable practices, Bangladesh’s textile sector has embraced eco-friendly materials and processes, ensuring a harmonious balance between tradition and modernity.

Bangladesh’s initiatives to increase non-cotton fiber in garment making have been a positive contribution to the global garment industry. In a recent study conducted by Wazir Advisors Pvt Ltd, India titled “Beyond Cotton: A Strategic Blueprint for Fiber Diversification in Bangladesh’s Apparel Industry” on behalf of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the utilization of non-cotton fibers in garment manufacturing in Bangladesh has risen from 25 percent to 29 percent over the past three years. Exporters are opting for diversification to secure improved prices and to enhance their global presence.

Bangladesh’s Cotton and Non-Cotton Garments

Cotton, a time-honored tradition, weaves its legacy through diligent growth practices, respecting the earth’s bounty. Sprouting without chemical intervention, its cultivation embraces soil rotation, hand-weeding, and minimal pesticides, championing sustainability.

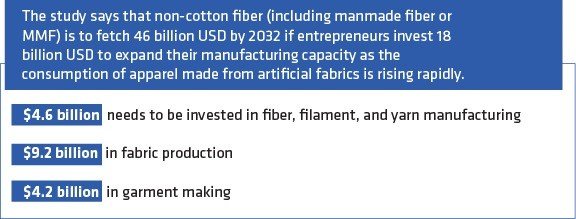

However, the global textile landscape shifted towards non-cotton fibers, dominating 75% of the industry. Polyester reigns supreme, with China’s diminishing influence creating opportunities for other players. In contrast, Bangladesh, a major cotton exporter, diversifies into non-cotton fabrics, eyeing a $46 billion annual yield by 2032. As India and China adapt to changing dynamics, Bangladesh’s share in non-cotton garments rises, promising economic growth and job creation (The fresh investments are expected to generate 1.76 million new jobs). Amidst this textile dance, both cotton and non-cotton garments contribute to a rich tapestry of global fashion, where looms hum and needles stitch tales of textile ingenuity.

Bangladesh’s share in the non-cotton garment segment increased from 1% to 5% in 2022, while China’s share dropped from 56% to 36%. Notably, outerwear is a major export for both countries, with Bangladesh reaching nearly $16 billion and China at $115 billion last year.

Garments made from materials other than cotton encompass a variety of items such as waistcoats, T-shirts, wind jackets, brassieres, non-woven garments, trousers, synthetic garments, shirts, overcoats, tracksuits, full or knee-length hosiery and socks, rubberized garments for women, non-knitted synthetic clothes, and more.

“The investment will also improve the capacity through the installation of additional 4.7 million spindles, 14000 new knit machines, 31,000 new looms, and 05 million sewing machines”

– Varun Vaid

Business Director of Wazir Advisors Pvt Ltd

BGMEA about Non-Cotton Garments

BGMEA President Faruque Hassan revealed that Bangladesh’s garment production has seen a shift in the past few years. Exporters are opting for manmade fibers over cotton for better prices and market expansion. Hassan emphasized Bangladesh’s potential in non-cotton fibers, citing global demand growth.

The BGMEA aims to raise its global apparel market share to 12% from 7.87% by focusing on artificial fibers. Hassan highlighted the impact of climate change, stating consumer preferences for non-cotton items. While cotton exports dominate, the rising trend in non-cotton exports suggests buyers’ interest in diverse apparel from Bangladesh.

The annual import of non-cotton fibers in Bangladesh amounts to $1.2 billion, and local investments in this sector could benefit garment exporters and create more opportunities. Faruque Hassan also expressed their aspiration to achieve a $100 billion export target by 2030.

Key Challenges of Non-Cotton Export of Bangladesh

Bangladesh confronts key challenges in non-cotton garment exports. While diversifying from traditional cotton, environmental concerns persist as non-cotton fibers, such as polyester, dominate.

The need for sustainable practices clashes with the economic potential, demanding a delicate balance. Navigating global market dynamics and competition, especially in the face of China’s evolving role, adds complexity.

To secure success, Bangladesh must address environmental impacts, ensure competitiveness, and adapt strategies in the dynamic landscape of non-cotton garment exports.

Recommendations for the Future Growth

To address the challenges faced in non-cotton exports in Bangladesh, several strategic recommendations emerge from an analysis of the existing data. Diversifying product offerings based on market demand trends can strengthen export volumes. Harnessing digital platforms for marketing and adopting transparent supply chain practices will enhance competitiveness. Investing in research and development for product quality improvement is paramount. Additionally, streamlining bureaucratic processes and offering financial incentives can expedite export procedures. Collaborative efforts between government bodies and private enterprises are essential for the effective implementation of these recommendations. By embracing these measures, Bangladesh can overcome non-cotton export challenges and foster sustainable economic growth.

The recommendations for overcoming the export challenges-

- implementing a fiber security strategy to ensure raw material availability

- granting duty-free access to all man-made fiber raw materials

- establishing a dedicated low-cost investment fund for the sector

- investing in skill development and technology adoption initiatives

- streamlining customs procedures

- simplify duty drawback processes

- increasing research and development activities to enhance competitiveness

In the past five years, global non-cotton fiber production has risen, contrasting with a decline in cotton fiber production. Among manmade fibers, polyester filament yarn holds the largest share at 39%, followed by polyester staple fiber at 15%. The non-cotton garment sector in Bangladesh exhibits promising potential, with data indicating a substantial rise in production and export figures. The diversification beyond traditional cotton textiles reflects the industry’s adaptability and market responsiveness. As consumer preferences evolve, this data-driven trend positions Bangladesh as a competitive player in the global textile field, poised to capitalize on the growing demand for non-cotton garments.