Key Highlights:

In a recent study by the Research and Policy Integration for Development (RAPID), a troubling correlation emerged. A higher burden of indirect taxes, including Value Added Tax (VAT) and import duties, significantly links to higher poverty rates and worsened income inequality.

This revelation sheds light on a pressing issue faced by many nations, where two-thirds of governmental revenue is sourced from such indirect levies. These taxes, affecting both the economically disadvantaged and the affluent, exert considerable financial strain, perpetuating stagnant poverty rates and widening wealth disparities.

You can also read: Tax Paying: Now A Vital Responsibility for Private Institutions in Bangladesh

RAPID’s findings show the big impact of indirect taxes. They reveal that each 1 percentage point increase in this burden causes a 0.42% uptick in poverty. This is a stark reminder of the link between fiscal policy and socioeconomic outcomes.

How Higher Indirect Tax Linked to Higher Poverty?

The link between higher indirect taxes and increased poverty levels is unmistakable, as highlighted by the study’s findings. According to the research, for every 1 percentage point increase in the indirect tax burden, poverty rises by 0.42 percentage point. This relationship is also shown by cross-country analysis. It reveals a 0.1 percentage point rise in income inequality for each one percentage point surge in indirect taxes.

The study, titled ‘Assessing the Impact of Indirect Taxation on Poverty and Inequality: A Pseudo-Panel Data Analysis on Bangladesh and Global Insights from Cross-Country Panel Regressions’, elucidated these connections.

Despite a notable decrease in poverty over the past decade, dropping from 50 percent in 2000 to 24 percent in 2016, income inequality persists. Dr. Md Deen Islam, the research director at RAPID, highlighted this disparity, noting that poor households experience a 2.0 to 7.0 percent increase in the indirect tax burden, exacerbating the challenges they face.

Bangladesh Perspectives

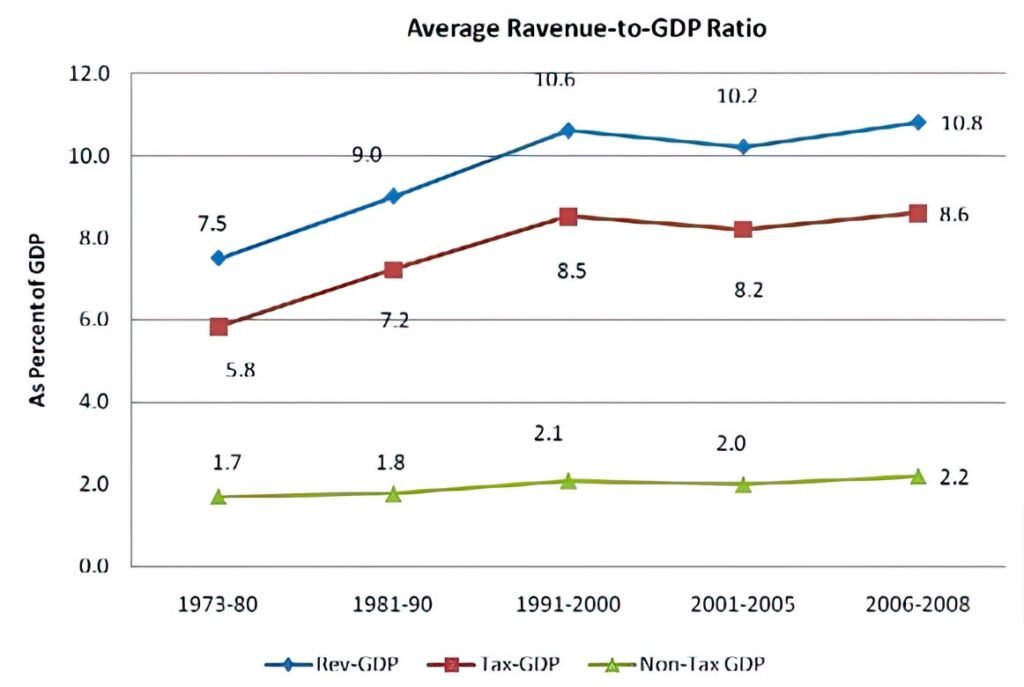

In the context of Bangladesh, a predominant reliance on indirect revenue sources, comprising over two-thirds of total revenue generation, has contributed to mounting concerns over rising income inequality. This observation comes amid a backdrop of increasing economic disparities, with the Gini coefficient climbing from 0.448 in 2010 to 0.499 in 2022, marking a significant socio-economic challenge.

An analysis conducted highlights a tenuous link between higher shares of indirect taxes and sluggish GDP growth, accentuating the complex interplay between fiscal policies, economic advancement, and inequality dynamics. Furthermore, the study underscores the critical role of progressive taxation in addressing these disparities and bolstering government revenue.

The heavy use of indirect taxes has led to limits on public spending. This affects key services like healthcare, education, and social welfare. It makes the country’s inequality issues worse. To combat this, the study advocates for a balanced approach to taxation, emphasizing the need to reevaluate the current tax framework to ensure a more equitable distribution of the tax burden and mitigate the incidence of poverty.

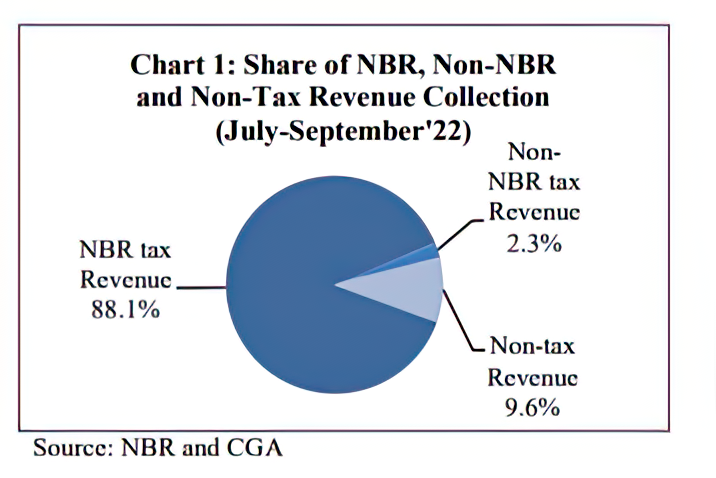

Bangladesh faces historical challenges in tax revenue generation, evidenced by a tax-GDP ratio of only 8.0 percent, notably lower than comparable nations like China, India, and Japan. Despite incremental increases in direct tax collection, the direct tax-GDP ratio remains modest at just 2.5 percent.

The urgency of reforming Bangladesh’s taxation system was echoed at a seminar.

Indirect Tax Burden Households

The study, underscored a significant escalation in the indirect tax burden on households below the poverty line, soaring from 2% in 2000 to 7% in 2016. Conversely, those above the poverty threshold bore a comparatively lighter burden.

In light of government data indicating a declining poverty rate, Mohammad Abdur Razzaque, Chairman of RAPID, lamented that the proliferation of indirect taxes has hindered the pace of poverty reduction.

He said that because of the higher indirect tax, the decrease in poverty hasn’t been as fast as expected. He mentioned data from the Household Income and Expenditure Survey (HIES), which shows that poverty in Bangladesh has gone down by more than half in the last twenty years, now less than 20%.

Direct taxation, such as income tax, targets individuals’ earnings. Presently, individuals earning an annual income of Tk3.5 lakh or less are exempt from income tax, thereby exempting those below the poverty line from this tax burden.

Conversely, indirect taxes, including VAT on goods sold domestically and taxes on imported goods, are borne by the buyer. This includes individuals grappling with poverty who are also subject to VAT when purchasing goods. Moreover, taxes on imports contribute to inflated product prices, exacerbating the financial strain on consumers.

Recommendations

The study advocates for a phased tax reform initiative spanning 10-15 years, with a primary focus on broadening the tax base and modernizing tax administration. It proposes a transition from conventional enforcement methods to more user-friendly and automated technology to improve tax compliance.

Furthermore, the study recommends investing in advanced systems for tax notification and reminders, as automation enhances efficiency and reduces errors. It emphasizes the importance of adopting a service-oriented approach in tax administration to encourage voluntary compliance, prioritizing taxpayer education and assistance over enforcement measures.

A well-structured plan, incorporating short, medium, and long-term strategies, is deemed essential to gradually achieve these objectives, ensuring transparency and fairness. The study suggests conducting comprehensive cost-benefit analyses before granting tax exemptions to eliminate arbitrary exemptions and ensure fiscal incentives align with job creation and economic growth.

To enhance tax compliance, the government is urged to invest in advanced systems for taxpayer notification and reminders, facilitating easier return filing. Moreover, expanding the tax net through innovative technologies can increase revenue collection from direct sources while fostering a fair, transparent, and efficient tax system aligned with economic growth objectives and mitigating income inequality.

Efforts to Boost Direct Tax

The National Board of Revenue (NBR) has been exploring various methods to enhance direct tax collection, including several initiatives implemented in the previous budget. A senior NBR official informed The Business Standard that as a result of these efforts, the number of taxpayers has exceeded one crore, with an anticipated 40 lakh tax returns expected to be submitted this year.

Former NBR chairman Muhammad Abdul Mazid emphasized to TBS the indispensable role of automating NBR operations to boost direct tax revenues. Additionally, he stressed the importance of establishing a taxpayer-friendly environment. “Effective automation is essential not only for collecting direct taxes but also for indirect taxes,” he remarked.