Bangladesh Bank (BB) has directed the managing directors (MDs) and Chief Executive Officers (CEOs) of scheduled banks to promote participation in the pension scheme among employees of private banks.

In a significant stride to enhance social security, the Bangladesh government launched the Universal Pension Scheme (UPS) on August 17, 2023. With an aim to provide lifelong financial support to citizens above the age of 60, the UPS marks a pivotal moment in the country’s welfare initiatives. However, despite the promising potential of the scheme, initial participation has been relatively modest.

You can also read: Fed Expected to Cut Rates: Dollar Dips, Asia Soars!

Recent data reveals that approximately 19,158 individuals have contributed to the UPS within a span of six months, accumulating around Tk28.67 crore in deposits. This information was disclosed by Md Golam Mustafa, a member of the National Pension Authority (NPA) and additional secretary of the finance division.

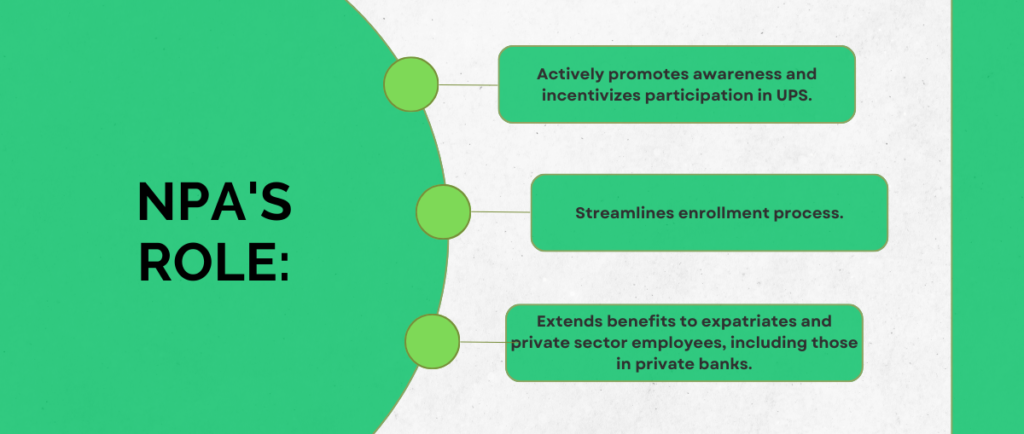

Since its inception, the NPA has been actively engaged in promoting awareness and incentivizing participation in the Universal Pension Scheme (UPS) across various sectors of society. Recognizing the need for widespread engagement, efforts have been made to streamline the enrollment process and extend the scheme’s benefits to expatriates and employees in the private sector, including those working in private banks.

Promoting Awareness and Participation

“Regarding the poor response of people in the scheme, that different developed countries introduced universal pension schemes in 1960. After so many years, the universal pension has reached a stage in those countries.”

– Md Golam Mustafa, additional secretary of the finance division.

Md Golam Mustafa, representing the government within the NPA, he highlighted the importance of drawing lessons from the experiences of other nations, such as Japan and Korea, which introduced similar pension schemes decades ago. Drawing parallels, he expressed optimism that Bangladesh could achieve success in implementing the UPS more swiftly, leveraging the knowledge gained from these precedents.

Md Golam Mustafa emphasized the potential for accelerated progress, drawing parallels with countries like Japan and Korea, which introduced similar schemes in the 1960s.

Financial Transparency

However, despite these strides, there remains a considerable segment of the population unaware of the benefits offered by the pension scheme. To address this gap, concerted efforts are being made to extend outreach, particularly targeting expatriates and other underserved groups. Bangladesh Bank has issued directives to scheduled banks, urging them to encourage their employees to enroll in the scheme, thereby broadening its reach within the private sector.

Moreover, recent recommendations from the NPA advocate for tax exemptions and excise duty waivers on bank accounts associated with public pension schemes, further incentivizing participation and streamlining financial processes. These measures, if implemented, could potentially alleviate concerns regarding taxation and bolster confidence in the UPS among the general populace.

The aim of the new legislation is to include private sector employees in the pension scheme.

Why is a Universal Pension Scheme needed?

It is disheartening to acknowledge that many individuals in our society face a challenging and unhappy old age. Sadly, some of them do not have the comfort of their own children by their side. This is often due to a lack of savings, which puts them in a vulnerable position. In this context, Prime Minister Sheikh Hasina of Bangladesh, who has shown immense generosity and compassion towards ending the suffering of all citizens in her country. Her efforts to improve the lives of those facing hardship in their old age are truly commendable.

The NPA has been actively engaged in awareness campaigns and incentive programs to bolster participation from diverse sectors. Recognizing the importance of public outreach, efforts have been directed towards highlighting the benefits of the scheme, streamlining enrollment processes, and ensuring expatriates and private sector employees, including those from private banks, are well-informed and encouraged to participate.

Govt’s vision

The vision of Bangladesh is to assure security and dignity for every age of citizens through the Universal Pension Scheme. It promises a future for an equal and prosperous society.

How to register?

The video offers comprehensive insights into the registration procedure for the universal pension scheme. Moreover, it provides clear explanations of its assorted advantages and regulations.

The introduction of a website named ‘Upension’ marks the launch of the universal pension scheme.

Individuals wishing to enroll in the scheme can complete the registration process by accessing the National Pension Authority’s website at: www.upension.gov.bd People who are interested need to make sure they fill out every section of the registration form with correct info. If you put in wrong or false details during registration, they’ll scrap your application and you won’t get your money back.

Conclusion

As Bangladesh navigates the complexities of implementing its universal pension scheme, the journey ahead is characterized by both promise and challenges. By fostering greater awareness, promoting financial transparency, and strengthening institutional governance, the nation stands poised to realize the full potential of the UPS, ushering in a new era of financial security and prosperity for its citizens.