In a bid to control inflation, Bangladesh Bank took a two-pronged approach involving reserve money adjustments and interest rate hikes. However, the efficacy of these measures appears to be a subject of debate as inflation remains stubbornly high, prompting concerns about its impact on businesses and the economy at large.

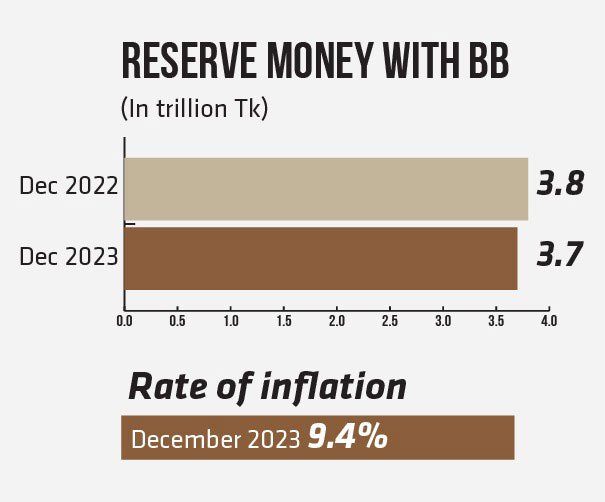

The reserve money, a crucial indicator of the money supply base in the economy, experienced a 2.0 percent negative growth, contracting to Tk 3.7 trillion by the end of December 2023. This decline from Tk 3.8 trillion in December 2022 was primarily attributed to the cessation of the “devolvement” operation by Bangladesh Bank. Devolvement involves the central bank supplying money to the government from unauctioned treasury bill-bond auctions with primary dealers.

You can also read: Import Drop Signals Bangladesh’s Economic Resilience

Bangladesh Bank Governor Abdur Rouf Talukder confirmed the halt of devolvement since August 2023, emphasizing the central bank’s commitment to contractionary stances on the monetary front. This strategic move, combined with a tight monetary policy initiated in mid-2022, aimed to alleviate inflationary pressures.

Inflationary Pressures

Despite these measures, inflation persisted at 9.4 percent in December 2023, exceeding the revised target for the fiscal year (2023-24) by 1.91 percentage points. The central bank’s net foreign assets declined due to dollar sales during forex-market volatility, revealing a complex interplay between money circulation and foreign assets.

One notable consequence of the monetary tightening is the upward trajectory of interest rates, dissuading businesses from borrowing for fresh investments. Bankers and businesspeople report a hesitancy in borrowing, leading to a slowdown in investment activities. Simultaneously, consumers are becoming more cautious about borrowing luxury goods, contributing to a reduction in overall spending.

Government Borrowing and Fiscal Implications

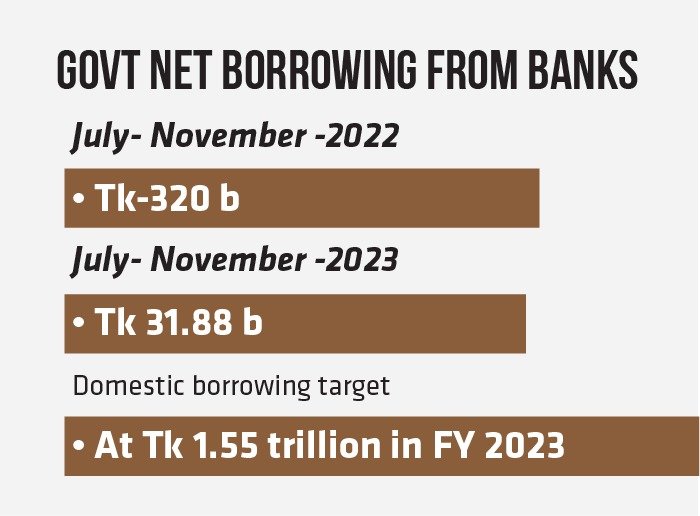

Another factor influencing the reserve money squeeze is the lower-than-expected government borrowing during the fiscal year 2023-24. Government net borrowing from the banking system plummeted by 90 percent from Tk 320 billion in the same period of the previous fiscal year to Tk 31.88 billion. The initial target for government domestic borrowing in the national budget for FY24 was Tk 1.55 trillion, with Tk 1.32 trillion from the banking system and Tk 230 billion from non-banking sources.

Earlier, the central bank of Bangladesh has recently increased the interest rate for short-term trade finance in foreign exchange by 50 basis points, responding to appeals from bankers who are closely monitoring the global market trends and navigating a high-interest rate scenario. This move, outlined in a Bangladesh Bank circular, also involves a revision of the all-in-cost ceiling per annum, introducing a mark-up or margin of 4%, up from the previous 3.5%. This markup is added to benchmark rates like the Secured Overnight Financing Rate (SOFR), Euribor, and others.

Declining Forex Reserves and Solutions

According to the BPM-6 method recommended by the International Monetary Fund, Bangladesh’s foreign exchange reserves declined by $83 million in a week, reaching $19.94 billion. Experts attribute this decline to the continuous selling of dollars by the central bank.

Former Bangladesh Bank governor Saleh Uddin Ahmed emphasized the need to increase export and remittance income to address the dollar crisis. He suggested diversifying exports, encouraging incentives in other sectors, and creating export markets outside of Europe and America. Additionally, attracting foreign investments by making the country more investment-friendly is seen as a crucial step to enhance dollar inflow.

Conclusion

Bangladesh Bank’s monetary measures, including the cessation of devolvement and a tight monetary policy, are attempts to strike a delicate balance between inflation control and economic stability. While these measures may have contributed to a decline in reserve money, their impact on inflation remains inconclusive. As businesses pause investments and consumers exercise caution, the effectiveness of these strategies will require ongoing evaluation, especially in the dynamic landscape of economic forces and global uncertainties.