Nowadays, illegal money trading has become a disease among many businessmen. A part of the digitalized society has been gripped into this dark zone. In February 2024, the Anti-Corruption Commission Secretary made a startling revelation. The banking sector in Bangladesh is being deprived of foreign currency equivalent to approximately $9 million. This deprivation is a result of illegal activities that circumvent the proper banking channels.

The Role of Expatriate Wage Earners and Air Passengers

Expatriate wage earners and air passengers play a crucial role in bringing valuable remittances in cash and foreign currency to Bangladesh. These remittances are supposed to be deposited in the national reserve through banking channels.

You Can Also Read: A HUNDI-INDUCED ECONOMY HOW TO OVERCOME THE CRISIS?

However, unscrupulous bankers have been found to use the money without showing that it is collected in the banking channel. They sell it in the market themselves, and it is later smuggled abroad again through money laundering.

The Volume of Remittance to Bangladesh

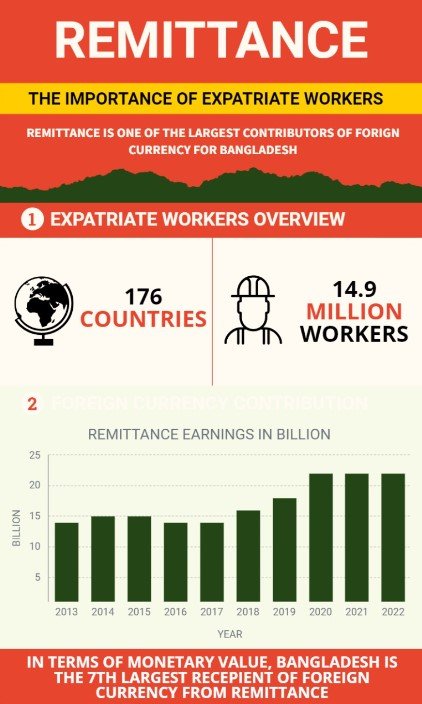

Remittance plays a significant role in the economy of Bangladesh. In 2024, remittance flows to Bangladesh are projected to remain at $23 billion. This substantial amount of money is sent by the country’s expatriate workers.

As of an estimate carried out in 2023, there are nearly 15 million Bangladeshi expatriate workers. They bring in billions of dollars in foreign currency to Bangladesh. These workers primarily work in blue-collar jobs, with the majority concentrated around Middle East-Gulf states and Western European nations.

The Reasons Behind Illegal Trading

Illegal trading in foreign currency occurs for various reasons. The potential for fraud and scams, as well as the impact that forex trading can have on the local currency, are among the primary concerns. Furthermore, the high risk associated with forex trading, especially for new traders, is a significant factor.

Another factor is the difference between the official and unofficial exchange rates of foreign currency. The official exchange rate of the US dollar to Bangladeshi taka is 110 as of February 2024, but the unofficial or black-market rate is much higher, ranging from 112 to 115.

This creates an incentive for expatriate workers and air passengers to exchange their foreign currency at the airport with bank officials and money exchangers who offer them a higher rate than the official one. The bank officials and money exchangers then sell the foreign currency in the black market at a higher rate and make a profit.

Illegal trading in foreign currency has severe consequences. It can lead to inflationary pressures and distortions in the domestic economy. Furthermore, it exposes traders to a higher risk of fraud, manipulation, and other unethical practices. Violations of forex trading regulations can lead to penalties, including fines and imprisonment.

What are the Consequences?

The illegal trading of foreign currency at the airport has serious consequences for the economy and the society of Bangladesh. First, it deprives the country of its much-needed foreign exchange reserves, which are essential for maintaining the stability of the currency, paying for imports, servicing external debts, and meeting international obligations.

The foreign exchange reserves of Bangladesh slipped below $20 billion in February 2024, down from $40.7 billion in August 2021. This puts pressure on the balance of payments and the exchange rate of the taka, which may lead to inflation and devaluation. While 9 million a day seems minuscule in comparison to a larger scale of things, $9 million a day amounts to ($9×365) $3.285 billion a year.

Second, it facilitates money laundering, which is the process of concealing the origin and ownership of illicit funds. Money laundering is a major problem for Bangladesh, as it undermines the rule of law, erodes the integrity of the financial system, and fuels corruption and crime.

According to Global Financial Integrity, an average amount of $7.53 billion is laundered each year from Bangladesh through international trade, which is equivalent to 17.95 percent of Bangladesh’s international trade with all its trading partners. Money laundering also deprives the government of tax revenue, which could have been used for public services and development.

Third, it damages the reputation and image of the country in the international arena. Bangladesh is a signatory to various international conventions and agreements that aim to prevent and combat money laundering and terrorist financing, such as the United Nations Convention against Corruption, the Financial Action Task Force, and the Asia/Pacific Group on Money Laundering.

The illegal trading of foreign currency at the airport shows that Bangladesh is not complying with its commitments and obligations, which may result in sanctions and penalties from the international community.

How to stop it

The illegal trading of foreign currency at the airport is a complex and multifaceted issue that requires a comprehensive and coordinated approach from all the stakeholders. Some of the possible measures that can be taken to stop it are:

- Strengthening the monitoring and supervision of foreign currency transactions at the airport by installing CCTV cameras, conducting regular audits and inspections, and enhancing coordination and cooperation among the relevant agencies.

- Enforcing the laws and regulations related to foreign currency transactions and imposing strict penalties and punishments for the violators, including the bank officials and money exchangers who are involved in the scam.

- Educating and raising awareness among the expatriate workers and air passengers about the legal and ethical implications of exchanging their foreign currency at the airport with bank officials and money exchangers, and encouraging them to use the official banking channels instead.

- Reducing the gap between the official and unofficial exchange rates of foreign currency by adopting a flexible and market-based exchange rate regime, increasing the supply of foreign currency in the official market, and curbing the demand for foreign currency in the unofficial market.

- Enhancing the capacity and capability of the Bangladesh Financial Intelligence Unit, the central agency to fight against money laundering and terrorist financing, to analyze and disseminate the information and intelligence related to the illegal trading of foreign currency at the airport.

Conclusion

The illegal trading of foreign currency at the airport is a serious threat to the economy and the society of Bangladesh, as it deprives the country of its foreign exchange reserves, facilitates money laundering, and damages its reputation and image.

It is imperative that the authorities take immediate and effective actions to stop this scam and ensure that the foreign currency brought by expatriate workers and air passengers is deposited in the national reserve through banking channels. This will not only protect the country’s financial stability and security but also acknowledge and appreciate the contribution of the expatriate workers and air passengers to the development of the country.