Key highlights:

- According to the Bangladesh Jute Mills Corporation (BJMC), 16 closed government jute mills have been leased and invested by private sector entrepreneurs

- The government in 2020 gave a generous severance package to around 26,000 workers of the closed jute mills

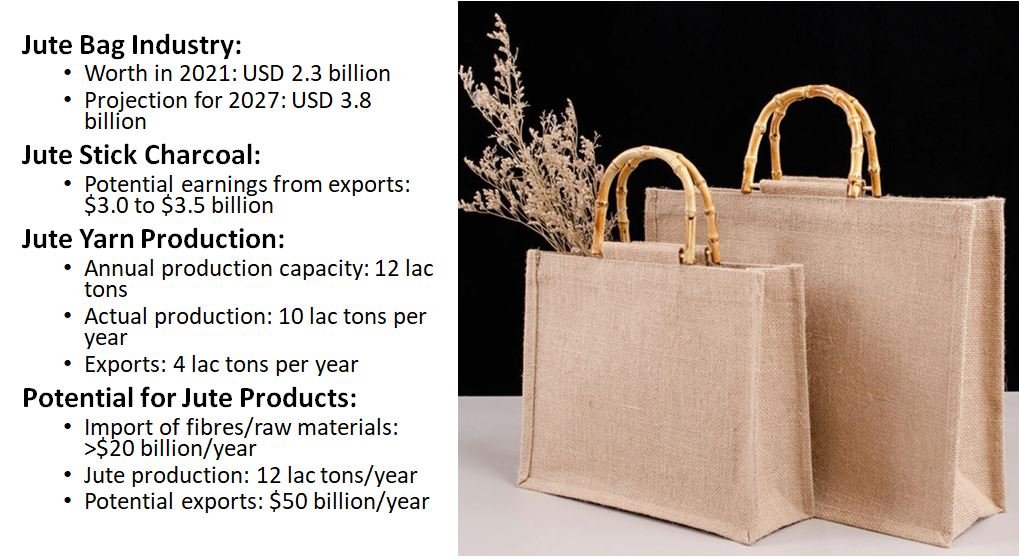

- The jute bag industry was worth USD 2.3 billion in 2021 and is projected to reach $ 3.8 billion by 2027

- Bangladesh produces about 3 million jute sticks every year

On July 1, 2020, the government shutdown 25 jute mills run by the Bangladesh Jute Mills Corporation (BJMC). This was one of the tough political choices made by the ruling party since it came to power in 2009 as Bangladesh holds the title of being the world’s primary exporter of raw jute, while also ranking as the second-largest producer globally.

However, the situation has changed now. 5 of the 25 mills, which were closed due to mounting losses, have resumed production, while the joint stock of 8 more has been finalized before they can start production. The private sector investments brought the magic touch after the government decided to lease them out.

According to the Bangladesh Jute Mills Corporation (BJMC), 16 closed government jute mills have been leased and invested by private sector entrepreneurs, including 2 Indian firms. The corporation officials say the aim is to reopen all these mills within this 2024, a goal that has been conveyed to the entrepreneurs who have leased the mills.

Private Sector Bids for 17 Jute Mills as Government Hopes for Resurgence

In April 2021, the government decided to lease out 17 of the 25 state-owned jute mills to the private sector for 5 to 20 years. To this end, the BJMC launched an international tender so that local, foreign and partnership firms could join the bidding process.

The BJMC says the tender process is currently ongoing for 4 other mills, which will end on 6 February. The mills are Platinum Jubilee Jute Mills, Star Jute Mills, Rajshahi Jute Mills and Co-operative Jute Mills. The BJMC says 10 companies have submitted 13 expressions of interest to lease these four mills. They have been asked to submit the final proposals by 6 February.

The government in 2020 gave a generous severance package to around 26,000 workers of the closed jute mills. They think that if the mills are reopened, new investments will lead to a revival of the jute sector and the creation of new jobs. The companies that have already begun commercial production include Unitex Composite Mills Ltd, Jute Alliance Limited – a joint venture with the major stakeholder Bay Group and TK Group; Akij Jute Mills, Rashid Automatic Rice Mills, and Uniworld Footwear Technology.

At the same time, Jute may regain its former glory as a versatile and eco-friendly fibre if local garment exporters use it as a substitute for imported cotton and non-cotton materials in their apparel production.

How Past Glory Slipped into Present Obscurity

As the world’s second largest jute producer, Bangladesh has a very small domestic market for jute and jute products. The industry has depended mostly on exports from the beginning. Bangladesh exports mainly yarn and twine, which have a lower global demand than jute sack and bag. Bangladesh’s export basket has not changed much from twine, unlike China and India, whose exports are mainly jute sack and bags.

The jute industry lost orders since the 1980s, when plastic products (bag, sack, etc.) became cheaper and more preferred. The growing use and production of plastic items have negatively impacted the current and potential market for jute.

Despite the government passing the Mandatory Jute Packaging Act 2010, which was effective from January 2014, to support the country’s jute sector, the law is not enforced well. Bangladesh has not made any target or comprehensive plan to cut down the use of plastic.

Bangladesh to Revive its Historic Cash Crop

A UN report states that the consumer market for natural products is growing at an annual rate of 2%-3%. The jute bag industry was worth USD 2.3 billion in 2021 and is projected to reach $ 3.8 billion by 2027.

Bangladesh boasts of its wide variety of 285 jute products, which are exported to over 100 countries across the globe. These products include raw jute, jute hessian, bags, sacks, ropes, carpets, caps, mats, carpet backing cloth, chair covers, jute sheets, canvas, pulp and paper, household items, and non-woven textiles, among others. Jute stick charcoal products, a byproduct of jute sticks, are also part of this industry.

Bangladesh produces about 3 million jute sticks every year. The country can earn between $3.0 to $3.5 billion from potential exports of jute stick-based charcoal.

Also, Bangladesh imports an average of more than $20 billion worth of fibres or raw materials such as knit and woven fabrics, yarn and cotton every year to supply the export-oriented garment factories and the local market to some extent and produces 12 lac tons of jute annually and has an installed capacity of 12 lac tons of jute yarn production. The actual production of jute yarn in the country is 10 lac tons per year.

Bangladesh exports 4 lac tons of jute yarn per year, mainly for making jute carpets. If the garment fibre is made by blending cotton and jute, it is possible to export $50 billion worth of jute products per year. This means that jute can be used for more value addition.

In conclusion, Bangladesh’s jute industry, once a cornerstone of its economy, faced decline due to the rise of cheaper plastic alternatives. However, recent initiatives aim to rejuvenate it. The government leased closed mills to private entities, hoping for a resurgence in production and job creation. With rising global demand for eco-friendly products, there’s potential for Bangladesh to reclaim its position as a leading jute exporter, fostering economic growth and sustainability.