Key Highlights:

- India, China, Russia, the UAE, and Saudi Arabia, as part of BRICS, have begun utilizing local currencies for global trade transactions

- 5 American sectors could suffer if BRICS abandons the US dollar for trade including banking and financial sector

- Major currencies such as the Euro, Pound, Yen, Chinese Yuan, and the Ruble have surpassed the US dollar

Numerous analysts contend that the prolonged era of the US dollar’s worldwide supremacy, spanning nearly eight decades, may be approaching its conclusion. While the prospect is plausible, factors such as economic crises, heightened internal divisions, and significant geopolitical challenges could potentially trigger a currency downturn. The de-dollarization process might gain momentum with the rise of alliances such as the BRICS, and especially in the face of largely ineffective sanctions against Russia.

BRICS is preparing to overthrow the conventional financial world order that is controlled by the US and its Western allies. Developing countries are seeking to establish their own financial institutions by breaking away from the US dollar. The old world order is facing a challenge from BRICS who want to take over the global financial sector by ending American hegemony.

You can also read: Bangladesh Plans Contractionary Budget to Foster Economic Stability

India, China, Russia, the UAE, and Saudi Arabia, as part of BRICS, have begun utilizing local currencies for global trade transactions. China and Russia are spearheading initiatives to encourage other developing nations to abandon the US dollar. This shift could have far-reaching implications for the US economy, potentially complicating its deficit funding efforts.

Elvira Nabiullina, the Governor of Russia’s Central Bank, announced that the Kremlin intends to present significant proposals aimed at advancing BRICS countries’ interests in the foreseeable future. She affirmed that among the pivotal proposals is the establishment of novel credit rating agencies tailored to BRICS nations’ needs.

BRICS Break Away from the Dollar Dominance

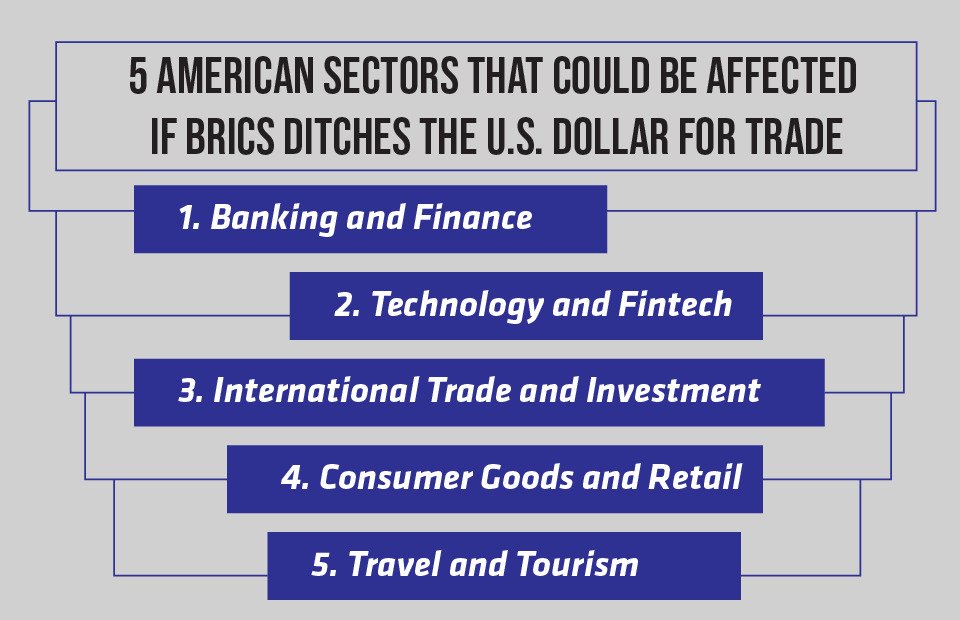

A possible consequence of the U.S. failing to import the dollar is that the currency will return to the homeland and cause inflation. This could lead to a surge in prices for housing, rent, and basic daily necessities, making them unaffordable for many. 5 American sectors could suffer if BRICS abandons the US dollar for trade.

Firstly, the banking and financial sector will face the most severe consequences as foreign exchanges will start to drop. BRICS is planning to develop its own internet services and avoid relying on American technology for news and social media.

Foreign investors will shun the US dollar as the debt crisis and deficit will deteriorate further. Moreover, if the US dollar returns home, the price of daily necessities will increase. Lastly, tourists will use local currencies for their travels and abandon the US dollar. China and Singapore have already implemented this policy in their respective countries and do not accept the US dollar.

How the Dollar lost its Luster?

The US dollar saw a decline against the majority of local currencies in the forex markets, including those of BRICS nations in 2023. The Russian ruble performed notably well against the US dollar, rebounding to 88.60 from 101. With the US dollar index (DXY) resting at 103, it remains in negative territory.

Major currencies such as the Euro, Pound, Yen, Chinese Yuan, and the ruble have surpassed the US dollar as well, Additionally, gold prices surged above the $2,000 threshold exerting further pressure on the USD’s outlook.

BRICS countries are exploring the option of settling oil transactions using local currencies, aiming to reduce reliance on the US dollar. This strategic move could significantly impact the USD’s prospects and its dominance in the oil sector.

USD vs. BRICS Currencies:

- The Russian ruble rebounds to 88.60 from 101 against the US dollar.

US Dollar Index (DXY):

- DXY rests at 103, indicating a decline and remaining in negative territory.

Major Currencies Surpassing USD:

- Euro, Pound, Yen, Chinese Yuan, and the Russian ruble outperform the US dollar.

Gold Prices Surge:

- Gold prices breach the $2,000 threshold, adding pressure on the USD.

China and Saudi Arabia Ditching the Dollar in Global Trade

On November 2023, China and Saudi Arabia inked a trade agreement favoring their local currencies, the Saudi Riyal and the Chinese Yuan, over the US dollar. The three-year deal allows for trade settlements in local currencies up to 50 billion Yuan or 26 billion Riyals, equivalent to $7 billion. As a result, cross-border transactions between China and Saudi Arabia will be settled in local currencies, excluding the US dollar, until reaching the $7 billion threshold.

This move underscores BRICS’ inclination to reduce reliance on the US dollar and promote the use of local currencies in global trade. China is actively encouraging African nations to shift away from the US dollar and adopt the Chinese Yuan for cross-border transactions. The Bank of China’s Zambia office is spearheading efforts to boost Yuan-based trade in Southern Africa.

Given Zambia’s status as Africa’s second-largest copper producer and China’s position as the world’s largest consumer of copper, China aims to leverage international copper trade by persuading Zambia to embrace the Chinese Yuan and abandon the US dollar.

Zambia currently exports both raw and refined copper to China, with the cross-border trade valued at $2 billion annually. The country exports $1.64 billion worth of raw copper and $340 million worth of refined copper to China, constituting 70% of Zambia’s foreign export earnings and significantly contributing to GDP growth.

If Zambia agrees to China’s proposal, $2 billion worth of copper trade will, for the first time, be settled in Chinese Yuan rather than US dollars.

China-Saudi Arabia Trade Agreement

Trade settlements in local currencies up to:

- 50 billion Yuan

- 26 billion Riyals

- Equivalent to $7 billion USD

Zambia-China Copper Trade:

- Cross-border trade valued at $2 billion annually.

- $1.64 billion worth of raw copper.

- $340 million worth of refined copper.

- Constitutes 70% of Zambia’s foreign export earnings.

Prospect of Yuan-based Trade:

- $2 billion worth of copper trade will be settled in Chinese Yuan.

Yet, amidst the tumult and upheaval, one truth remains immutable: change is inevitable. Whether the BRICS alliance succeeds in its audacious quest to overthrow the established order or merely catalyzes a broader conversation on financial sovereignty, only time will tell. But one thing is clear: the era of unchallenged American dominance may be drawing to a close, giving rise to a new chapter in the saga of global finance—one written not in dollars, but in the currencies of a multipolar world.