Key Highlights:

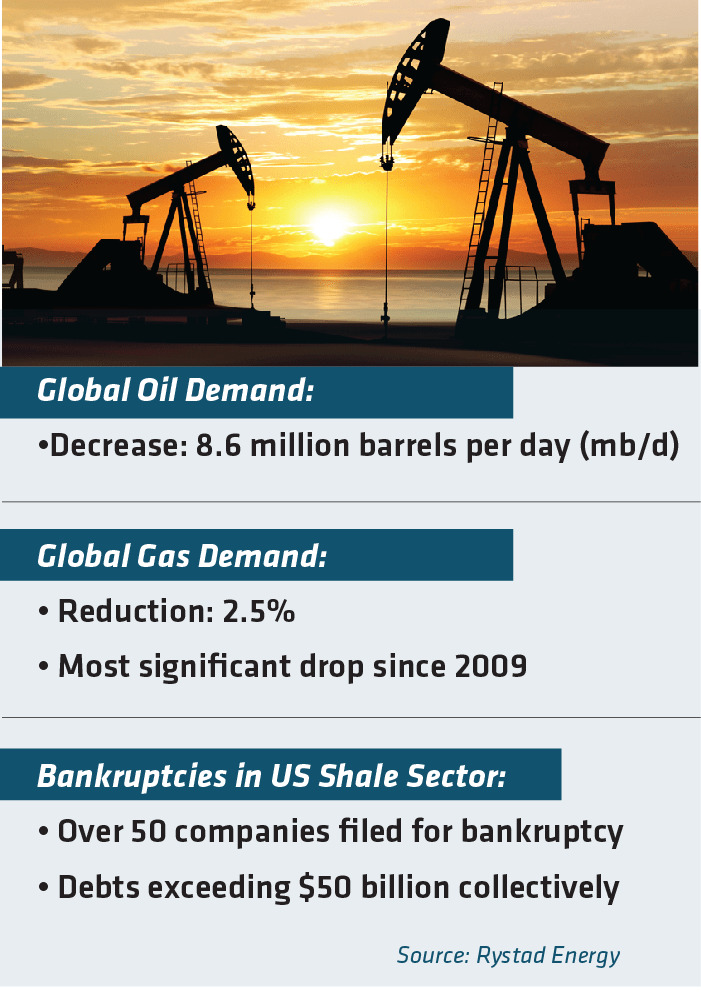

- In 2020, global oil demand plummeted by 8.6 million barrels per day (mb/d), marking the most substantial annual decrease ever recorded, as reported by the International Energy Agency (IEA).

- According to Rystad Energy, over 50 US oil and gas producers file for bankruptcy in 2020, collectively involving debts exceeding $50 billion.

- Oil prices rebounded to above $40 per barrel by June 2020, and gas prices also recovered from their lows.

- Brent crude has fallen to around $80 per barrel, and US gas prices have cooled to around $3 per gallon.

The energy market is significantly shaped by the oil and natural gas industries, which hold considerable sway in the global economy as primary sources of fuel. The production and distribution of oil and gas involve intricate processes and systems that demand substantial capital investment and cutting-edge technology.

Throughout history, natural gas has been closely associated with oil due to their intertwined production processes, particularly in the upstream sector. Despite advancements, natural gas has long been considered a byproduct of oil extraction and is still wasted through flaring in various regions, including the United States.

Shale gas developments in the United States have propelled natural gas into a more prominent position in the global energy mix, given its relatively lower greenhouse gas emissions compared to oil and coal when burned.

However, the oil and gas market has experienced unprecedented volatility in the past few years, as the Covid-19 pandemic and the Russia-Ukraine war have caused major shocks to the global supply and demand of energy.

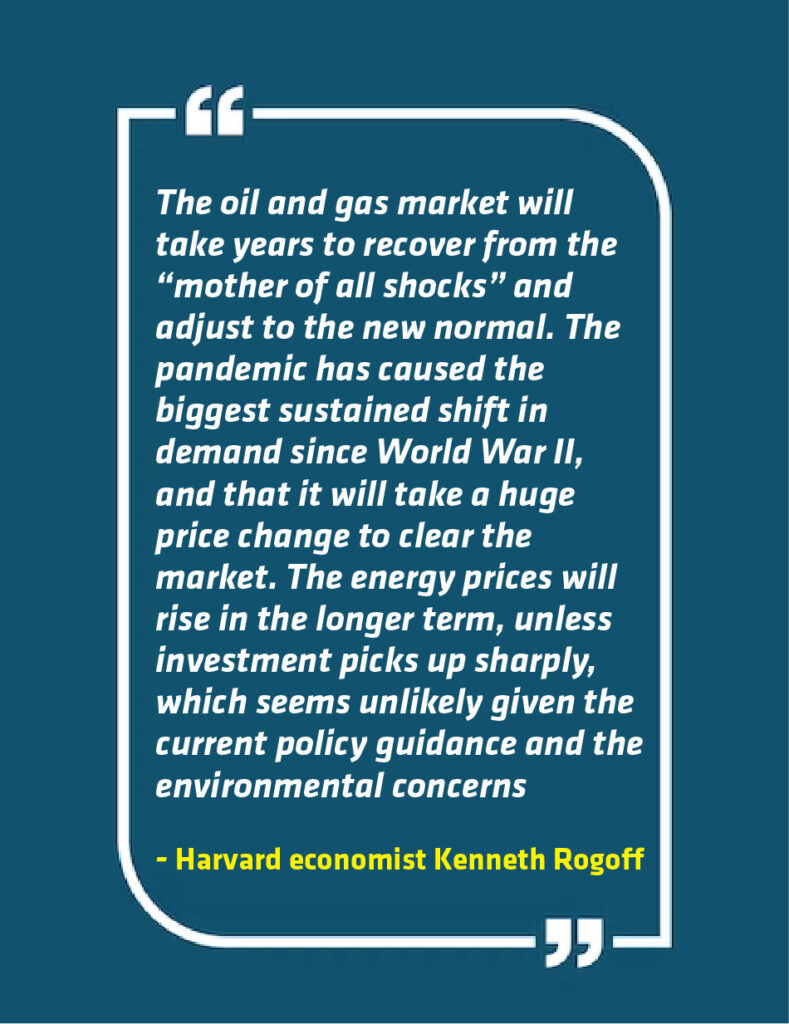

According to Harvard economist Kenneth Rogoff, it will take years for the market to recover from the “mother of all shocks” and adjust to the new normal.

The pandemic shock

The onset of the Covid-19 pandemic in late 2019 instigated an unprecedented downturn in oil and gas demand worldwide. Lockdowns, travel limitations, and social distancing protocols substantially curtailed the utilization of transportation fuels, industrial goods, and electricity, resulting in a historic decline.

In 2020, global oil demand plummeted by 8.6 million barrels per day (mb/d), marking the most substantial annual decrease ever recorded, as reported by the International Energy Agency (IEA). Concurrently, global gas demand experienced a 2.5% reduction, the most significant drop since 2009. Alongside demand disruptions, the pandemic disrupted the operational landscape for oil and gas producers, as they grappled with operational hurdles, financial strains, and regulatory ambiguities.

Initially, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) struggled to reach a unified response to the demand shock, precipitating a price conflict and a surge in output in early 2020. This escalation worsened the oversupply predicament, plunging oil prices to historic lows.

The unprecedented price collapse compelled numerous oil and gas companies to slash their capital investments, downsize their workforce, and devalue their assets. Several entities, particularly in the US shale sector, succumbed to bankruptcy due to the confluence of high debt and minimal profitability. According to Rystad Energy, over 50 US oil and gas producers file for bankruptcy in 2020, collectively involving debts exceeding $50 billion, underscoring the severity of the industry’s financial distress.

How Geopolitical Tensions Ignited Oil and Gas Prices

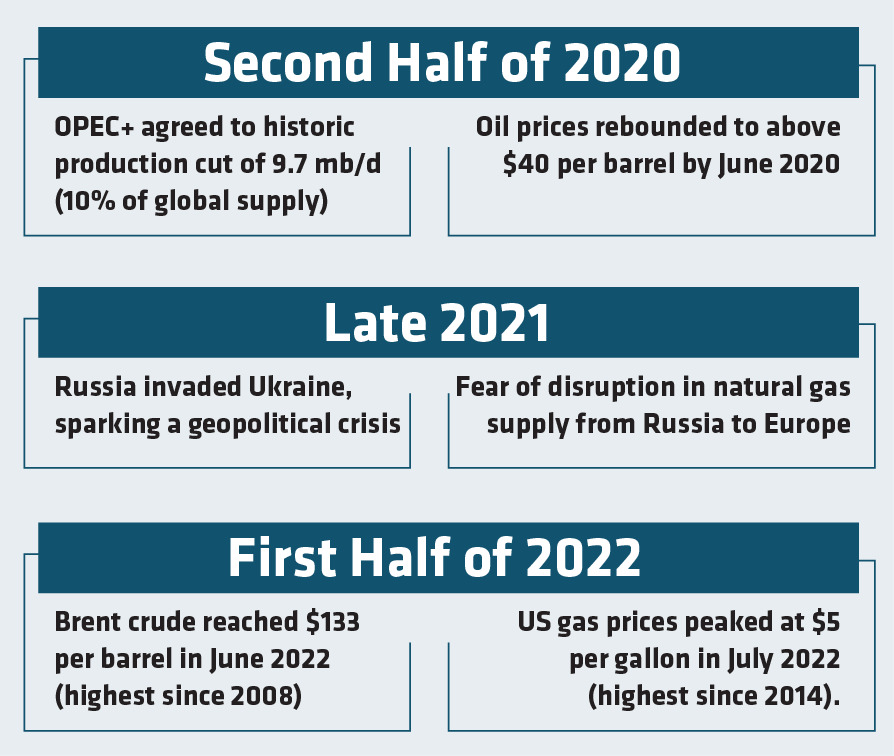

The oil and gas market started to recover in the second half of 2020, as the pandemic situation improved, the economic activity resumed, and the OPEC+ group agreed to implement a historic production cut of 9.7 mb/d, equivalent to 10% of global supply. Oil prices rebounded to above $40 per barrel by June 2020, and gas prices also recovered from their lows.

However, the recovery was interrupted by another shock in late 2021, when Russia invaded Ukraine and sparked a geopolitical crisis that threatened the stability and security of Europe and the world. The conflict raised fears of a disruption in the supply of natural gas from Russia to Europe, which accounted for about 40% of Europe’s gas imports in 2020. The uncertainty also boosted the demand for oil and gas as a hedge against potential shortages and price spikes.

As a result, oil and gas prices soared to multi-year highs in the first half of 2022, with Brent crude reaching $133 per barrel in June 2022, the highest level since 2008, and US gas prices peaking at $5 per gallon in July 2022, the highest level since 2014. The high energy prices added inflationary pressures to the global economy, which was already facing supply chain bottlenecks, labor shortages, and fiscal stimulus withdrawal.

The long-term outlook

The oil and gas market has moderated in recent months, as the Russia-Ukraine war has de-escalated, the OPEC+ group has gradually increased its production, and the US has released some of its strategic petroleum reserves.

Brent crude has fallen to around $80 per barrel, and US gas prices have cooled to around $3 per gallon. However, the market remains vulnerable to further shocks, as the pandemic situation is still uncertain, the geopolitical tensions are still unresolved, and the energy transition is still underway.

Kenneth Rogoff’s admonition rings loud and clear: the journey ahead demands fortitude and foresight from policymakers. Flexibility and pragmatism must guide their decisions, balancing immediate recovery needs with the imperatives of long-term transition. Collaboration becomes paramount – bridging the chasm between energy security, climate imperatives, and global trade.

In this context, the transition towards a more sustainable and diversified energy portfolio emerges as a pivotal imperative. The ascent of natural gas, propelled by technological advancements and environmental considerations, offers a glimpse into a future where cleaner energy sources play a central role in the global energy mix.