Remittances to Bangladesh surged by 7.69% year-on-year, reaching $2.10 billion in January. This marks the highest monthly inflow in the past 7 months. December saw $1.98 billion in remittances, with an impressive $2.19 billion arriving – the highest for a single month.

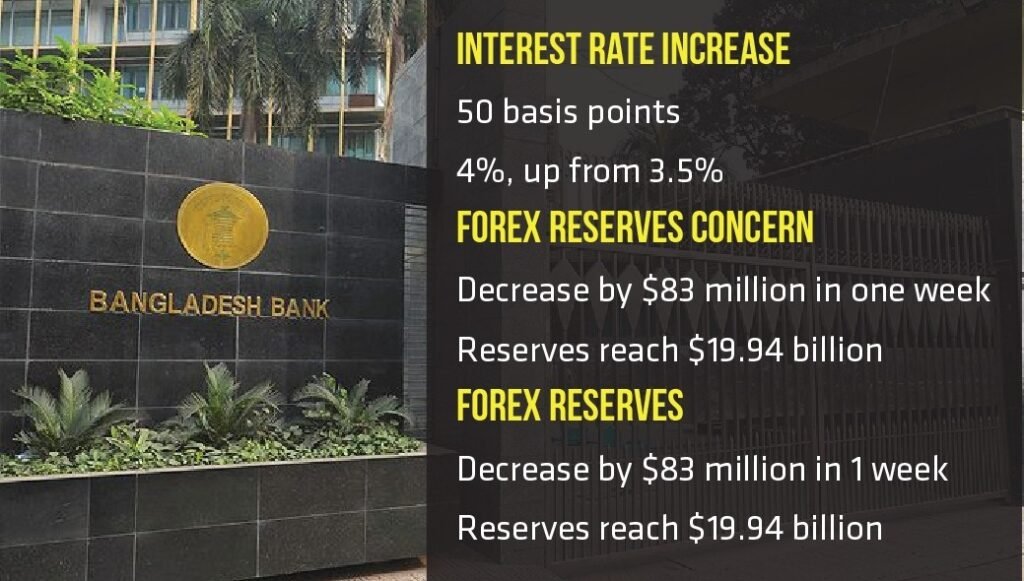

The central bank of Bangladesh has recently increased the interest rate for short-term trade finance in foreign exchange by 50 basis points, responding to appeals from bankers who are closely monitoring the global market trends and navigating a high-interest rate scenario. This move, outlined in a Bangladesh Bank circular, also involves a revision of the all-in-cost ceiling per annum, introducing a mark-up or margin of 4%, up from the previous 3.5%. This markup is added to benchmark rates like the Secured Overnight Financing Rate (SOFR), Euribor, and others.

Bankers, while acknowledging that the heightened markup might impact the overall cost for importers seeking financing for their foreign trade activities, assert that it serves a more significant purpose. They believe it will enable local banks to attract foreign funds, meet customer needs, and address the ongoing challenge of falling foreign exchange reserves.

Boosting Foreign Funds and Cross-Border Trade Finance

Demand from bankers to increase their markup for short-term trade finance in foreign exchange by 100 to 150 basis points underscores the urgency of the situation. Foreign lenders have shown diminished interest in Bangladesh following a rise in international interest rates and the country’s increased risk profile, resulting in a downgrade in ratings.

Post the rate hike, a bank can now charge a customer a maximum of SOFR+4%, totaling 9.3%. This calculation is based on the 180-day average SOFR, standing at 5.38% on Thursday. The SOFR, a benchmark interest rate for determining short-term interest rates in financial markets, plays a pivotal role in this adjustment.

Sarwar Hossain, director of the Foreign Exchange Policy Department of the Bangladesh Bank, expresses optimism, stating that the decision will not only help Bangladesh attract foreign funds but will also facilitate cross-border trade finance.

Despite the potential within the Bangladesh market, foreign lenders have been hesitant due to dwindling forex reserves and volatility in the exchange rate. The head of the treasury department of a leading private commercial bank highlights that borrowing from foreign sources has significantly reduced margins, leading to losses for banks.

With a 50 basis points hike in markup, banks borrowing from foreign lenders, including Mashreq, JP Morgan, Citi, and the International Finance Corporation (IFC), are expected to show increased interest in lending to Bangladesh. Bangladeshi banks typically avail $3 billion to $4 billion annually from foreign lenders for trade finance, also known as offshore finance, according to treasury officials.

This strategic move is anticipated to boost the supply of dollars in the country. Additionally, lending from the bank’s offshore unit is expected to bring some profit, compensating for previous losses.

However, the rate hike will not be without repercussions, particularly for importers, as their borrowing costs are set to increase by 50 basis points. A top treasury official emphasizes the need for adjusting foreign currency loans to align them with the local market’s increased interest rate, which has surpassed 12%.

Declining Forex Reserves and Solutions

According to the BPM-6 method recommended by the International Monetary Fund, Bangladesh’s foreign exchange reserves declined by $83 million in a week, reaching $19.94 billion. Experts attribute this decline to the continuous selling of dollars by the central bank.

Former Bangladesh Bank governor Saleh Uddin Ahmed emphasized the need to increase export and remittance income to address the dollar crisis. He suggested diversifying exports, encouraging incentives in other sectors, and creating export markets outside of Europe and America. Additionally, attracting foreign investments by making the country more investment-friendly is seen as a crucial step to enhance dollar inflow.

Central Bank Continues to Sell Dollars

Amidst a surge in expatriate income, the central bank grapples with a further decrease in foreign exchange reserves, underscoring the lingering effects of a two-year-long dollar crisis that shows no signs of resolution.

To meet import liabilities, the central bank persists in selling dollars from its reserves to banks, amounting to almost $8 billion in the first seven months of the current fiscal year, despite the ongoing dollar crisis.

Despite a record 1.3 million workers leaving the country in 2023, remittances have failed to keep pace with the rising number of workers going abroad. Last year, remittances through banking channels reached $21.92 billion, registering a modest 2.88% increase from the previous year.

However, this growth in remittances falls short of 2021 levels, primarily due to the substantial demand for informal remittance channels, such as “hundi.” As a result, remittances through official banking channels are not seeing the anticipated upswing.

Despite this surge in overseas employment, expatriate income saw only a modest uptick of 2.88%. When accounting for inflation, the actual increase in expatriate income remains relatively insignificant.

Furthermore, the gender dynamics of overseas employment witnessed a notable shift, as the export of female workers decreased by 27% compared to the preceding year, despite an overall increase in the number of male workers seeking employment abroad.

As Bangladesh confronts these economic challenges, the central bank’s ongoing dollar sales and the persistent disparity between expatriate income and remittance growth highlight the pressing need for strategic interventions to address the prolonged dollar crisis and ensure sustained economic stability.