Key Highlights:

- Current transit agreement expires at the end of this year

- Austria, Slovakia, Czech Republic most reliant on Russian gas

- In 2023, the delivery of natural gas from Russia to Europe drop about 55.6%

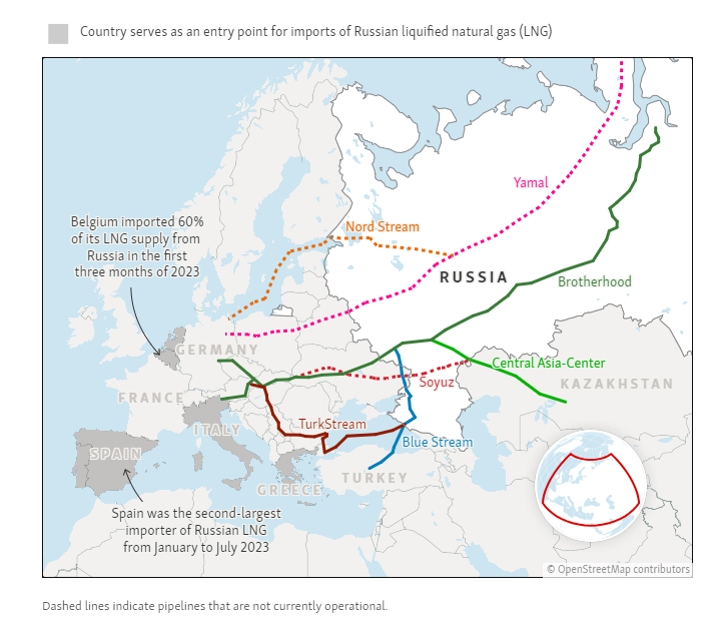

The European Union is preparing to decline the extension of the gas pipeline agreement with Russia, scheduled to expire by the year’s end. The rationale behind this decision lies in the belief that even nations most reliant on Russian gas, such as Austria and Slovakia, could secure alternative sources should there be any supply disruptions. The European Commission has conducted an initial evaluation of potential consequences if the transit agreement ceases, including assessing the capacities of other connections like TurkStream to compensate for any shortfall.

You can also read: NAM’s Vital Role in Charting Global Harmony

The EU’s executive branch will hold discussions with member states in February before formally presenting the plan to energy ministers at a Brussels meeting on March 4th. One proposed strategy involves Russia delivering gas to the Ukrainian border, with an EU entity, then negotiating with Kyiv’s transmission system operator to transport it to Austria, Slovakia, or the Czech Republic—the three nations most dependent on Russian supplies. Despite suggestions from Slovakia’s Prime Minister, Robert Fico, Ukraine has denied any willingness to renegotiate the transit deal with Russia.

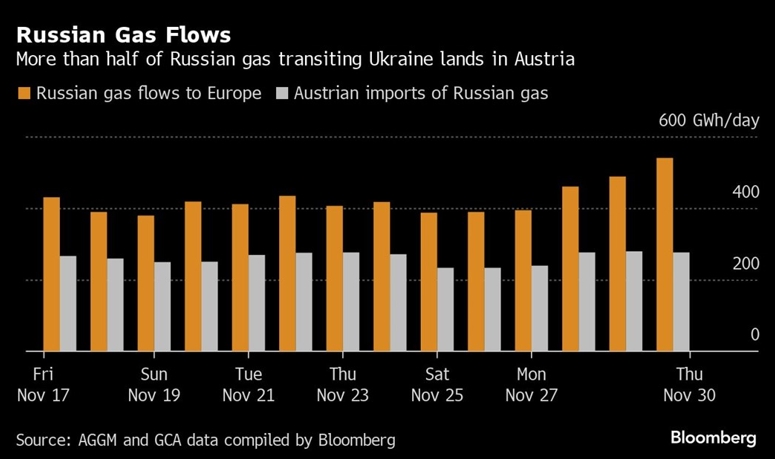

Although the EU has avoided imposing sanctions, it has stressed the importance of reducing the bloc’s dependence on Moscow for gas. Russia stands as the second-largest supplier of liquefied natural gas to the region. Austria, for instance, continues to receive over half of its gas from Russia, leading to increased payments to Gazprom under their long-term contract due to heightened fuel prices since the conflict’s outset.

Alternative Routes

According to Dmitry Peskov, the Kremlin spokesperson, Russia will depend on alternative routes and shipments of liquefied natural gas transported by sea if Ukraine does not prolong the agreement for Russian gas transit to Europe. Peskov made these comments during a press conference on January 26th. He also mentioned that if the agreement is not extended, the logistical chains for Russian gas exports will be reorganized.

Several media reports have cited statements from the Ukrainian government indicating that Kyiv has no intention to negotiate with Moscow regarding the potential extension of the gas transit deal. Peskov stressed the importance of discovering alternative routes for gas delivery to Europe, citing existing pathways through Turkey and the rising demand for liquefied gas supplies. However, Peskov acknowledged that these alternative routes are already heavily utilized, necessitating changes in all logistical processes.

In the past, Ukraine served as Russia’s primary pathway for gas exports to Europe. However, gas deliveries through Ukraine have dwindled due to the construction of the Nord Stream pipeline, which is currently damaged and inactive, connecting Russia to Germany via the Baltic Sea, and the TurkStream pipeline, which links Russia to Turkey via the Black Sea. Additionally, Russian gas exports to Europe have declined significantly amidst the political tensions arising from the conflict in Ukraine. Consequently, Norway has surpassed Russia as Europe’s leading natural gas provider.

Ukraine’s gas transit

Robert Fico, a politician known for his pro-Russia views, who assumed office as Prime Minister of Slovakia in October last year, recently proposed that Slovakia aims to secure greater long-term access to Russian pipeline gas. According to Sergiy Makogon, an analyst in the Ukrainian gas industry, Ukraine’s main goal is to reduce Russia’s export earnings, which Moscow currently utilizes to finance its military operations in Ukraine.

Starting from January 2025, Slovakia technically has the option to reserve and pay for transportation capacities through Ukraine and directly purchase gas from Russia at the Russia-Ukraine border. However, this contradicts the European Union’s unified stance to halt imports of Russian gas by 2027. Makogon emphasized that the issue goes beyond simply negotiating a new transit contract; it involves deciding whether to permit Russia to continue supplying gas to various Eastern European nations that maintain allegiance to Moscow. This scenario would lead to Russia earning annual revenues of around $6 billion and exerting political pressure on these countries.

Gas exports to Europe down 56% last year

In 2023, there was a significant drop of 55.6% in the delivery of natural gas from the Russian energy giant Gazprom (GAZP.MM) to Europe, totaling 28.3 billion cubic meters (bcm). These figures, derived from data provided by the European gas transmission group Entsog and Gazprom’s reports on gas transit via Ukraine, underscore that the average daily pipeline exports of Russian gas to Europe decreased from 174.8 million cubic meters (mcm) in 2022 to 77.6 mcm in 2023.

In 2022, Gazprom’s data indicated that Russia had supplied approximately 63.8 bcm of gas to Europe through various channels. However, since the beginning of 2023, Gazprom has refrained from publishing its own statistics and has not responded to requests for comment. The notable decline in Russia’s gas exports to Europe, which had previously been its primary export destination, is attributed to the political tensions arising from the conflict in Ukraine. During the peak years of 2018-2019, annual flows reached levels ranging between 175-180 bcm.

Forecast for the next years

Mikhail Krutikhin, a well-known analyst in Russia’s oil and gas sector, predicts that in 2024, Gazprom will ship 30 billion cubic meters (Bcm) of gas to China via the Sila Sibiri pipeline, 23 Bcm to Europe, and possibly even less than 20 Bcm to former Soviet countries in Central Asia. This projection indicates a further decline compared to the officially reported pipeline gas exports from the previous year.

During a conference in St. Petersburg, Uzbekistan’s Energy Minister Zhurabek Mirzamakhmudov was quoted by the Russian state news agency Ria, stating that the country is preparing a new gas supply agreement with Gazprom. Deliveries are expected to begin closer to the onset of the high-demand winter season. Although Gazprom committed to supplying 2.8 Bcm of pipeline gas to Uzbekistan under a contract signed last year, this agreement is due to expire later in 2024.

Similarly, authorities in Kazakhstan are poised to finalize a gas supply agreement with Gazprom to commence deliveries of Russian gas to the northern and northeastern regions of the country. Meanwhile, Hungary, a key ally of Russia in Europe, witnessed an increase in Gazprom’s gas deliveries in January to 18 million cubic meters per day, equivalent to an annual total of 6.5 Bcm, as reported by Hungary’s Foreign Minister, Peter Szijjarto.