Bangladesh is witnessing a remarkable surge in its startup scene, attracting substantial investments and garnering global attention. Supported by the government, private sector, and influential venture capital firms such as South Asia Tech, Bangladesh Angels Network, and Anchorless Bangladesh, the nation’s entrepreneurial potential is fortified. The strategic involvement of consulting agencies specializing in startup ecosystem development further contributes to this burgeoning landscape.

You can also read: PM Hasina Calls for Swift Project Completion and Thoughtful Ventures

With a median age of 28, Bangladesh’s dynamic youth is driving innovation, entrepreneurship, and economic growth. The nation’s resilience to global shocks, rapid economic expansion, and a flourishing digital economy, propelled by increased mobile subscriptions and internet services, have positioned Bangladesh as an emerging hub of entrepreneurial dynamism.

Bangladesh, The Next Startup Goldmine

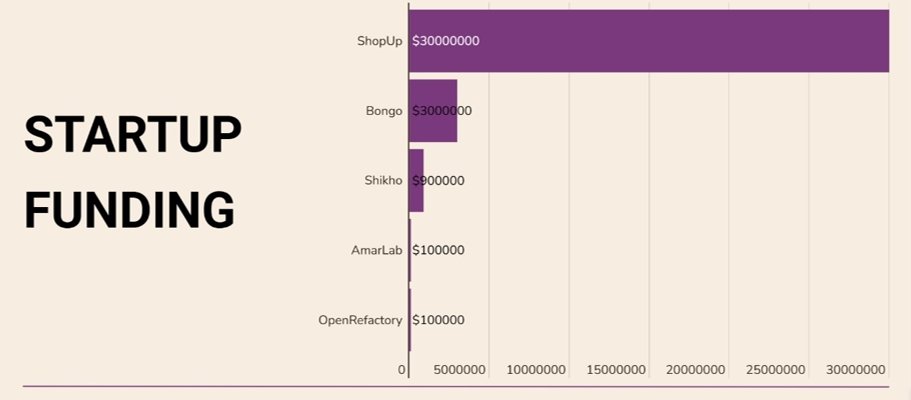

Worldwide, startup growth is on the rise, with Asian startups gaining noteworthy global recognition. Bangladesh, in particular, is poised for substantial expansion in startup funding, positioning itself as a major player in Asia’s burgeoning startup landscape. As the global startup focal point shifts to Asia, Bangladesh emerges as a distinct hub for lucrative investment prospects. The local startup ecosystem is advancing, thanks to collaborative efforts from the public and private sectors. Government initiatives and interventions have been pivotal in driving investments into the local startup scene. This progress has garnered global attention as the local startup ecosystem becomes more sophisticated. 14 Bangladeshi startups raised more than $35Mn in disclosed investments in Q1 2023.

The Startup Summit in Bangladesh, 2023

The inaugural Bangladesh Startup Summit took place on July 29, 2023, following the theme ‘Smart Bangladesh, Endless Possibilities.’ Spanning two days, the summit attracted over 100 global venture capital investors, 100 international speakers, and 600 startups across various sessions. The conference, held on July 29 and 30, featured seminars, interviews, and networking sessions addressing edu-tech, health tech, fin-tech, software services, and startup investments.

On the first day, eight local startups received ‘Startup Awards’ in different categories, including ShopUp, Pathao, bKash, 10 Minute School, UNDP YouthCo Lab, Nagad, SBK Tech Ventures, and Next Funding. Two entrepreneurs were also granted the Bangabandhu Innovation Grant.

Distinguished sessions and keynotes included the Fintech Keynote, featuring Sushmit Nath, Head of Visa Consulting & Analytics – India and South Asia, discussing ‘Embracing digital banking and the path to a cashless society.’ Noteworthy was the Logistics and Mobility Keynote by Rezwanul Haque Jami, Head of e-Commerce, a2i – Aspire to Innovate, and a panel discussion on ‘The future of movement in megacities.’

E-commerce and Retail were covered in a keynote by Waseem Alim, Co-founder & CEO of Chaldal, and a subsequent panel discussion. Additional discussions encompassed ‘Gender Lens Investment,’ exploring Bangladesh’s readiness for investment with a gender lens, and a VC Keynote by Oscar Ramos, Managing Director, Orbit Startups, unveiling the ‘Secrets of Startup Success.’ The summit also delved into interplanetary travel opportunities through a panel discussion titled ‘Going to Mars.’

Zooming into The Local Funding Landscape

Bangladeshi startups have successfully raised over USD 909 million through a total of 377 deals since 2013, showcasing a robust trend in the nation’s startup ecosystem. The increasing global funding and active local participation are contributing to the flourishing startup landscape in Bangladesh.

Venture capital firms have taken the lead by injecting USD 674 million across 132 deals, while angel investors have played a significant role with smaller-ticket investments in 119 deals. The prevalence of early-stage investments highlights the emergence of Bangladesh as a promising startup hub.

Within sectors, the financial services sector stands out, raising nearly USD 600 million, whereas e-commerce and retail lead in terms of the number of deals. Notably, locally sourced investments have witnessed growth, accounting for 7% of all funds raised in 2022.

In terms of investor activity, venture capital investments took the lead in 2022 and 2023, contributing USD 102.6 million to the ecosystem. Both local and global investors have supported 62 unique startups during this period, with global investors making up 86% of total investments.

Despite these achievements, ongoing resilience is crucial to address emerging global and local challenges. The government of Bangladesh is committed to building a Smart Bangladesh, aiming to create five unicorns by 2025 and raise USD 2.5 billion by 2030.

Global and Local Challenges

Global and Local Macroeconomic Challenges:

Investors have become increasingly risk-averse due to factors such as inflation, exchange rate volatility, and economic downturns. These challenges have adversely affected startup investments, primarily stemming from a decline in consumer purchasing power. To address this situation, the government is implementing various mitigating measures. These include eliminating the cap on bank lending rates, introducing special lending programs tailored for startups, engaging in dual currency trade agreements with partners to alleviate forex pressure, and optimizing the balance of payments. These reforms aim to curb inflationary pressures while simultaneously fostering the growth of local businesses.

Disruption in the Global Startup Funding Market:

The collapse of prominent U.S. banks catering to tech startups, including Silvergate Bank, Signature Bank, and Silicon Valley Bank, has reverberated globally, posing additional obstacles for the startup ecosystem. To counter this, the government and ecosystem builders are taking proactive steps. Initiatives such as unlocking local early-stage funding are being implemented. Notably, Startup Bangladesh Limited (SBL), a government-backed company with a dedicated fund of USD 65 million, is actively working to unlock local capital, providing a mitigating strategy to alleviate the challenges posed by international banking setbacks.

Limited Human Capital and Resources:

Scarce opportunities for capacity building, particularly in rural and marginalized communities, result in a shortage of skilled labor in the market. To address this issue, the government has initiated numerous programs aimed at enhancing the entrepreneurial, digital, and employability skills of both rural and urban youth. These efforts serve as a mitigating measure to bridge the skill gap and empower individuals in these communities.

Limited Access to Finance and Support:

Startups encounter challenges in securing finance, with banks and financial institutions showing reluctance to offer loans at favorable rates. The scarcity of angel investors and venture capital further compounds the issue, and female entrepreneurs experience added difficulties due to institutional and cultural constraints. To address these hurdles, government initiatives such as Startup Bangladesh Limited (SBL), central bank regulations supporting startups, and the Securities and Exchange Commission’s alternative investment policy are actively promoting local funding. These measures play a significant role in fostering ecosystem development and alleviating the financial barriers faced by startups, including those led by female entrepreneurs

Market Access Challenges:

Entrepreneurs, especially those in rural and marginalized areas, encounter challenges due to intricate supply chains and value chains. To address this issue, the government is actively championing digitization efforts at both public and private levels. The aim is to harness technology for the consolidation and transparency of supply chains, offering a mitigating solution to the obstacles faced by entrepreneurs.

In recent years, Bangladesh has emerged as a fertile ground for startups, showcasing immense potential for economic growth and innovation. The nation’s vibrant and dynamic entrepreneurial ecosystem has paved the way for ambitious ventures, fueled by a burgeoning tech-savvy population and increasing access to digital infrastructure. With a large market waiting to be tapped, startups in Bangladesh have the opportunity to address diverse challenges, from healthcare to agriculture. Government support and a growing investor interest further amplify the prospects for these ventures, making Bangladesh an exciting landscape where startups can thrive, ushering in a new era of economic prosperity and technological advancements.