Key highlights:

- Vehicles with lidar-based Level 2+ (L2+) capabilities cost $1,500 to $2,000. Higher costs apply to Level 3 (L3) and L4 options.

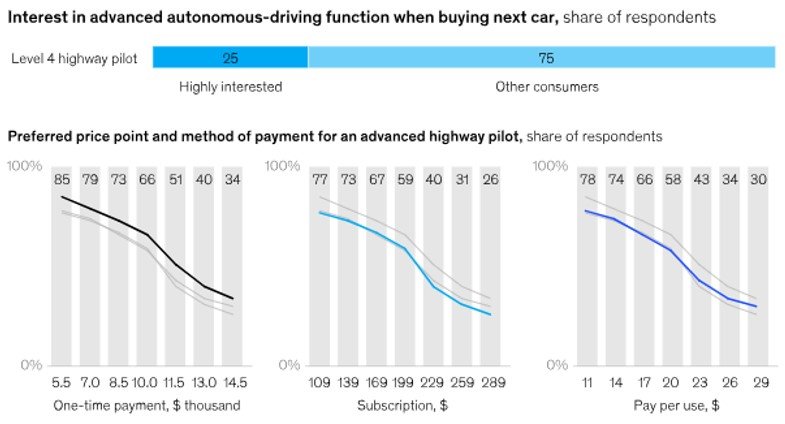

- Two-thirds of interested consumers are open to paying $10,000 for an L4 highway pilot, enabling hands-free highway driving.

- OEMs may enhance AV comfort by offering interactive experiences, addressing safety concerns, and educating on autonomous driving.

What are your thoughts on driverless cars? Are these autonomous marvels truly the way of the future, or do they present a future filled with uncertainties?

The prospect of sitting in a driverless car invites a spectrum of emotions and opinions, sparking debates on the intersection of technology, safety, and the very essence of our driving experience. For some, the idea is a thrilling leap into a new era of mobility, where roads are seamlessly choreographed by algorithms, and the stress of commuting is replaced by the serenity of a passenger’s seat.

You can also read: Export Product Diversification Boosting Bangladesh’s Economic Growth

In this exploration of the driverless future, we delve into the heart of the matter, examining not only the technological marvels that propel these autonomous vehicles but also the human psyche that grapples with the decision to ride shotgun with a robot.

Billion-Dollar Potential of Driverless Cars in the Next Decade!

Witnessing fleets of driverless cars efficiently ferrying individuals to their destinations has ignited the imagination of consumers and attracted billions in investment in recent years. Autonomous driving (AD) possesses the potential to revolutionize transportation, consumer behavior, and society on a grand scale.

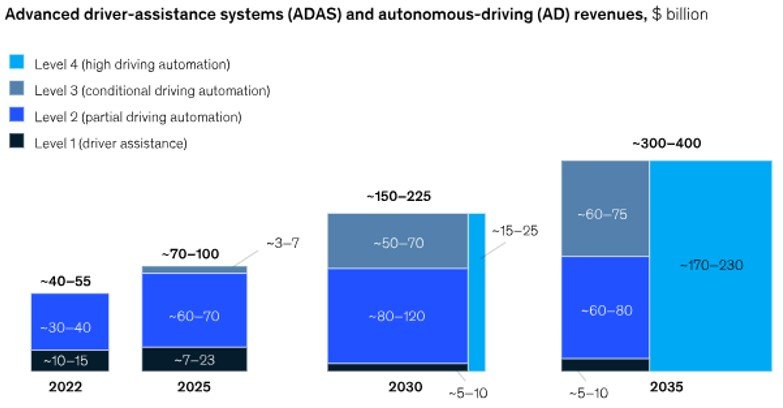

Due to this factor, autonomous driving (AD) has the potential to generate enormous value for the automotive sector, reaching hundreds of billions of dollars by the close of this decade. Presently, the majority of vehicles are equipped with basic ADAS features, but significant strides in AD capabilities are on the horizon.

The ultimate goal is for vehicles to attain Society of Automotive Engineers (SAE) Level 4 (L4), granting them driverless control under specific conditions. According to a 2021 McKinsey consumer survey, there is a clear consumer demand for access to AD features, and individuals are willing to invest in them. The increasing desire for AD systems has the potential to yield billions of dollars in revenue.

For vehicles equipped with Light detection and ranging systems (lidar)-based Level 2+ (L2+) capabilities, the associated component costs range from approximately $1,500 to $2,000. Cars with Level 3 (L3) and L4 options incur even higher costs. Considering the current market availability of AD features and consumer interest, it is projected that the combined market for ADAS and AD could generate between $300 billion and $400 billion in the passenger car sector by 2035.

The ripple effects of autonomous cars on various industries may be substantial. For instance, as autonomous driving technology decreases the frequency of car accidents, there is potential to diminish the demand for roadside assistance and vehicle repairs among consumers.

Why AD Features Are the Hottest Trend in Car Buying?

Users find various advantages in employing AD systems, such as enhanced safety, simplified parking and merging, increased fuel efficiency due to the system’s ability to maintain optimal speeds, and more available quality time. Our research indicates that consumers recognize and are highly inclined to consider adopting AD features.

Among the highly interested consumers, a significant two-thirds would be willing to pay a one-time fee of $10,000 or an equivalent subscription rate for an L4 highway pilot, allowing for hands-free driving on highways under specific conditions.

Delving into the preferences of diverse consumer personas could empower OEMs and dealerships to customize their value propositions and pricing strategies. For example, they might introduce a versatile pricing model encompassing a fixed one-time fee, subscription options, and, potentially, an on-demand choice like paying an hourly rate for each utilization of a traffic jam pilot.

Consumers are Pumping the Brakes on Fully Autonomous Vehicles

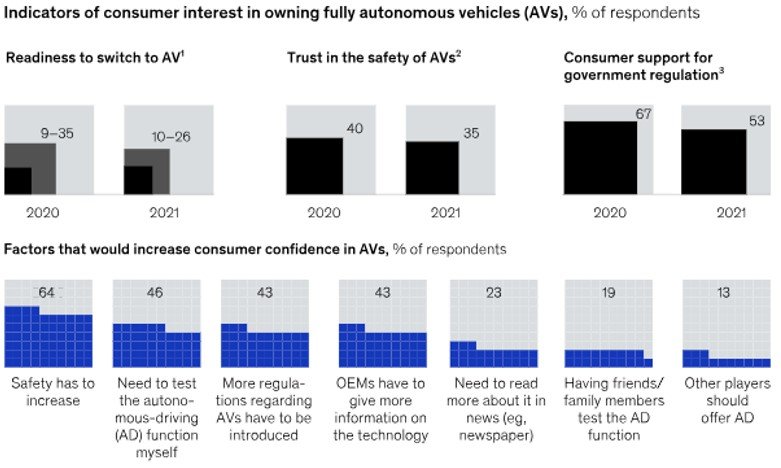

Although consumers continue to be very interested in autonomous driving, they are also adopting more cautious and realistic attitudes toward self-driving cars. For the first time in 5 years, consumers are less willing to consider driving a fully autonomous vehicle.

The study also indicates a 5% decrease in confidence regarding the safety of Autonomous Vehicles (AVs), and there has been a notable 15% decline in the proportion of consumers endorsing government regulation of fully self-driving cars. Although safety remains a primary concern, consumers express a desire for chances to experience test-drives of Advanced Driver Assistance (AD) systems and seek additional information about the underlying technology.

To foster a greater sense of comfort with AVs, Original Equipment Manufacturers (OEMs) may need to provide interactive experiences with autonomous vehicles, address safety apprehensions, and educate consumers on the mechanics of autonomous driving.

In this dynamic convergence of technology, consumer sentiment, and industry evolution, the road to autonomy is paved with potential and challenges alike. As we navigate this transformative journey, the driverless future remains a tantalizing prospect, but the destination is yet to be fully unveiled.

The billion-dollar question persists: are we prepared to embrace the autonomy that lies ahead, or do uncertainties still loom on the horizon? Only time will unveil the true trajectory of our journey into the era of autonomous marvels.