The surge of liquidity woes plaguing Islamic banks stems from inherent structural issues, as highlighted by Bangladesh Bank Governor Abdur Rouf Talukder on this consequential day, January 17. Facing the inquisitive gaze of reporters post the unveiling of the monetary policy statement, he illuminated the shared affliction faced not only by Islami Bank but also echoed across the corridors of other akin financial institutions.

In a lamentation, Governor Talukder underscored the fundamental predicament these banks grapple with—being handicapped in their ability to invest in the conventional treasury bill bonds, unlike their mainstream counterparts. Strikingly, while traditional banks wield a diverse array of financial instruments, the devout Muslims find themselves disproportionately reliant on loans, unable to tap into the myriad tools readily available to their peers.

You Can Also Read: Inflation Eases Slightly to 9.41% in December

Yet, amidst the tempest of financial tribulations, Talukder interjected a note of resilience. A beacon of hope emanated from the fortitude of Islamic banks, as they weathered the liquidity storm through the fortifying embrace of various policy interventions. The nurturing hand of strategic support ushered them through the crisis, marking a testament to the adaptive prowess of these financial entities.

Conventional Banks’ Recourse vs. Islamic Banks’ Conundrum

A climactic juncture unfolded on December 31, 2023, etching a chapter of financial intervention in the annals of Bangladesh’s banking saga. A monumental infusion of Tk22,000 crore from the Bangladesh Bank breathed life into seven liquidity-stricken banks, Islami Bank being a prominent participant in this lifeline.

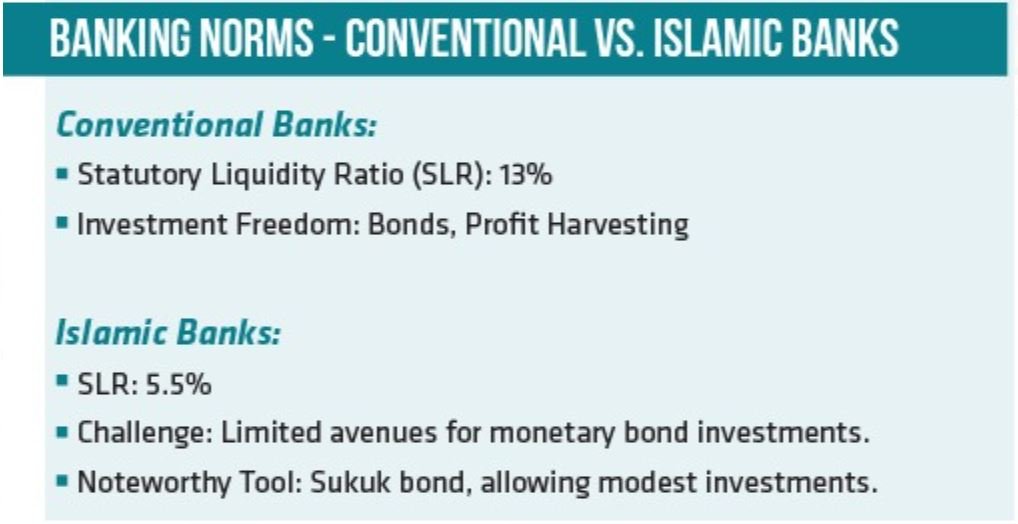

The backdrop of banking norms accentuates the divergent landscapes traversed by conventional and Islamic banks. In the former’s universe, the obligatory Statutory Liquidity Ratio (SLR) stands at a robust 13%, accompanied by the liberty to invest in bonds and harvest profits. A stark contrast materializes in the Islamic realm, where the SLR dwindles to a meager 5.5%, owing to the dearth of avenues for investing in monetary bonds. The Sukuk bond emerges as a diminutive tool, allowing for modest investments, painting a nuanced portrait of the challenges unique to Islamic banking.

In times of a liquidity squeeze, conventional scheduled banks possess the recourse of tapping into the central bank’s liquidity facilities by strategically investing in diverse securities. The landscape, however, is less forgiving for Islamic banks, lamented the governor. Unlike their non-Islamic counterparts, these financial entities find themselves constrained, compelled to invest the entirety of their funds in loans. The precarious nature of this predicament becomes apparent when faced with the inability to meet the clamor of depositors’ demands, even if a withdrawal of investments were desired during a crisis.

A Fearless Stance Amidst Potential Repercussions

Unflinchingly addressing concerns about potential repercussions for taking action against Islami Bank, the governor asserted a fearless stance. With a past adorned by a tenure as the finance ministry’s secretary, he now stands as a governor on a contractual basis, steadfast in his declaration that the specter of losing his position does not induce trepidation. A resolute proclamation underscored his autonomy: “I can quit my job if I want.”

Addressing the overarching weakness permeating the financial sector, the governor assured that the identified frailties within banks would not culminate in closures. History, he emphasized, bore witness to the endurance of the banking institutions over the country’s 52-year span, and he adamantly proclaimed that closure was not on the horizon. The journey to overcome these weaknesses, however, is acknowledged as an arduous one, requiring time and steadfast commitment. In a resounding declaration, he affirmed that these institutions had not succumbed to malevolence; rather, they would triumph over their weaknesses.

The crescendo of this financial saga reverberated in the presentation delivered by Bangladesh Bank’s Chief Economist, Dr. Habibur Rahman. Within the confines of his elucidation, a poignant revelation unfolded—a stark reduction in the excess liquidity of Islamic banks over the past year. From a commanding figure of Tk15,970 crore in June 2022, the excess liquidity dwindled to a mere Tk183 crore by November 2023, encapsulating the dynamic shifts and challenges etched in the evolving narrative of Bangladesh’s financial landscape.

Inflation Battlefront to Governance Focus

The topic sparked after Bangladesh Bank declared the Nominal Policy for the second half of 2024. During the declaration, the Bangladesh Bank (BB) sounded a clarion call to action, issuing a stern warning to five Islamic banks entangled in the web of liquidity woes. In an unequivocal directive, these financial institutions are tasked with rectifying the negative balances festering within their current accounts, a mandate to be fulfilled within the crucible of 20 working days.

At the helm of this pivotal announcement stood Md Mezbaul Haque, the spokesperson for Bangladesh Bank, who, in a press conference on Sunday, affirmed the dispatch of warning missives to Islamic Bank Bangladesh PLC, Social Islami Bank Limited, Union Bank PLC, First Security Islami Bank PLC, and Global Islami Bank PLC. Haque sought to assuage concerns by elucidating that the warning, while a forceful imperative, did not signify an irrevocable decision to rescind money payment services. The locus of finality, he revealed, rested with the Payment Systems Department, an entity within the central bank’s purview.

The genesis of these liquidity predicaments lies embedded in the structural intricacies of Islamic banking, triggering a swift and decisive response from Bangladesh Bank. Haque, as the official spokesperson, underscored the unwavering commitment of the central bank to confront and surmount these challenges in the unfolding future.

In a climactic revelation, Haque outlined the current battlefield for the central bank—the prioritized containment of inflation. A tactical shift, however, looms on the horizon, as he declared, “Once we alleviate external pressure, the Bangladesh Bank will shift its focus to the governance of banks facing crises.” The underlying implication is clear: a strategic recalibration awaits, pivoting from the immediate battlefront of inflation to the nuanced governance of beleaguered banks.

The focal point of authority in deciding the fate of transactions with other banks now rests in the hands of the Payment Systems Department, signaling a consequential turning point. Failure to redress the deficits within the stipulated 20 working days hangs ominously over the prospect of transactional continuance. Haque, peeling back another layer, disclosed that ICB Islamic Bank Limited had previously received a substantial infusion of Tk700 crore in support, a testament to the multifaceted dynamics shaping the financial landscape. The stage is set for a nuanced and high-stakes drama, where the intricacies of governance and financial resilience converge in a narrative teetering on the precipice of transformation.

Negative Balances Propel Banks into the Crosshairs

The routine choreography of assistance rendered by the Bangladesh Bank to entities grappling with negative current account balances has taken an ominous turn, marked by a set of warning letters dispatched on the foreboding date of November 28. In a departure from the norm, these missives bear the weight of a decisive directive, compelling the addressed banks to promptly rectify their ailing current account balances.

Originating from the Motijheel office of Bangladesh Bank, the missive delivered a stark message. “On reviewing your current account balance, it is observed that the current account balance has been negative for a long time, which is not in line with normal banking procedures. Although the matter has been brought to your attention repeatedly, you have not taken any significant steps so far,” articulated the letter, laying bare the gravity of the situation.

The advisory tone of the communication escalated to a resolute counsel: “It is hereby advised that you must address the negative balance of your current account within 20 working days of receiving this letter.” Yet, within this advisory, a veiled ultimatum lurked, underscored by the ominous conclusion. The missive concluded with a stern warning, proclaiming that any failure to rectify the imbalance within the specified timeframe would incur severe consequences—the barring of the delinquent banks from any clearing platform. This punitive measure, as delineated by the contract inked with the Payment Systems Department of Bangladesh Bank, serves as a draconian response to the failure to maintain a requisite amount of funds in the designated account for Clearing Settlement.