Key highlights:

- Regulated financial intermediary

- Focus on long-term support for residential mortgage loans

- Robust corporate structure attracts institutional investors

- Early government support through domestic capital market bonds

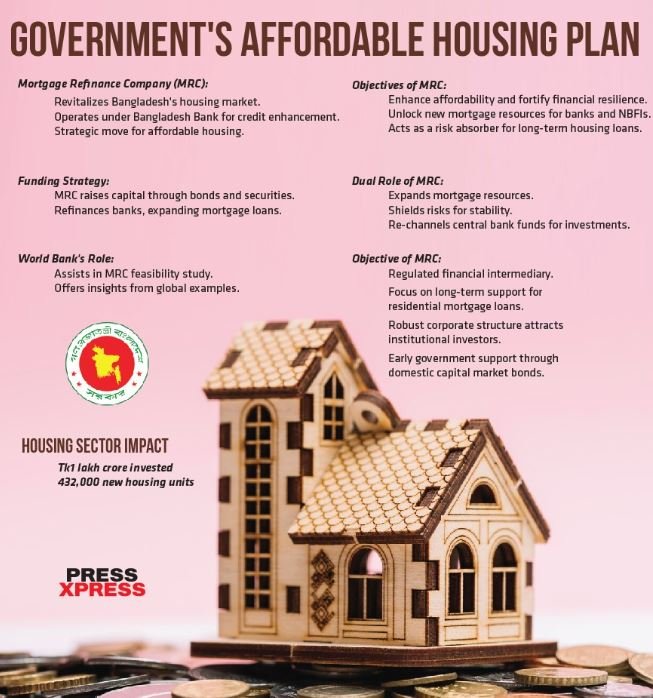

In a significant move to revitalize Bangladesh’s housing market, the government is actively pursuing the creation of a Mortgage Refinance Company (MRC). This strategic initiative is poised to bolster credit flow, stimulate long-term investment, and ensure the provision of affordable housing for the citizens. Operating under the Bangladesh Bank, the MRC is expected to play a pivotal role in reshaping the dynamics of the housing finance landscape in the country.

The proposed Mortgage Refinance Company will raise capital through the issuance of corporate bonds and mortgage-backed securities in the stock market. This innovative financing approach aims to gather substantial funds that will be used to refinance banks and other lenders, facilitating the expansion of mortgage loans in the housing sector. Finance ministry officials have highlighted the potential impact of this mechanism in injecting vitality into the housing market.

The groundwork for the Mortgage Refinance Company was laid through a workshop convened by the Financial Institutions Division in October. This event served as a platform to explore cutting-edge housing finance models from around the world, including successful examples within Bangladesh. The division received a policy note from the World Bank on MRC management, providing insights into the challenges and offering real-world examples from countries like-

- India

- Malaysia

- US and

- France

World Bank’s Involvement

The World Bank has committed to assisting with the feasibility study for the establishment of the Mortgage Refinance Company. The note provided by the World Bank not only outlines the challenges associated with MRC formation but also serves as a guide for structuring Bangladesh’s own MRC. This collaborative effort aims to leverage global expertise to create a robust and effective refinancing entity for the house. The primary objectives of the MRC initiative include making housing more affordable and fortifying the resilience of the financial sector.

The Mortgage Refinance Company is expected to play a dual role by not only expanding mortgage resources but also acting as a financial shield. By absorbing potential risks tied to long-term housing loans, the MRC aims to create a more stable environment for lenders and borrowers alike. Additionally, it will re-channel existing housing funds held by the central bank, freeing up capital for banks and NBFIs to diversify their investments.

Beside this, Entrepreneurs within the housing sector have welcomed the government’s initiative, expressing optimism that the MRC, if successfully established, will lead to a reduction in housing loan interest rates. The prospect of long-term financing is seen as a catalyst for making homeownership more accessible to a broader segment of the population, fostering economic growth and stability.

Objective of MRC

A Mortgage Refinance Company (MRC), a regulated financial institution, acts as an intermediary between primary mortgage lenders and the bond market. The primary goal of an MRC is to provide extended funds to support the long-term residential lending activities of primary mortgage lenders. Established to address the maturity mismatch in banks, MRCs primarily focus on refinancing residential mortgage loans, given their lower risk compared to infrastructure loans. Eligibility for MRC refinancing requires loans to be current, secured in favor of the MRC, and over-collateralized.

MRCs, boasting a robust corporate structure and low risk from limited wholesale lending, attract institutional investors with their bonds. These bonds often offer primary lenders access to long-term funds at more favorable rates, terms, and conditions than if they were to operate independently. In their early years, many MRCs receive government financial support. The main source of debt funding for MRCs involves issuing corporate bonds in the domestic capital market, backed by refinance assets collateralized by conventional mortgages and having recourse to primary lenders.

REHAB Supports the Initiative

The Real Estate and Housing Association of Bangladesh (REHAB) expresses support for the initiative to establish a mortgage refinance company (MRC) for long-term financing in the housing sector. REHAB has been advocating for such a company to

address the demand for long-term funds in the housing sector. Shamsul Alamin, former president of REHAB, believes that an MRC can raise funds from the capital market and invest in the housing sector, leading to significantly lower housing loan interest rates.

Alamin emphasizes that, currently, banks primarily lend to flat or house owners, neglecting developer companies. He sees the establishment of an MRC as a solution, enabling developer companies to access loans.

According to REHAB data, the housing sector has attracted a substantial investment of Tk1 lakh crore, underscoring its pivotal role in stimulating the broader construction industry. The interconnectedness of the housing market with various sectors, including cement and rods, suggests that enhancing the housing market could generate positive economic growth across multiple industries.

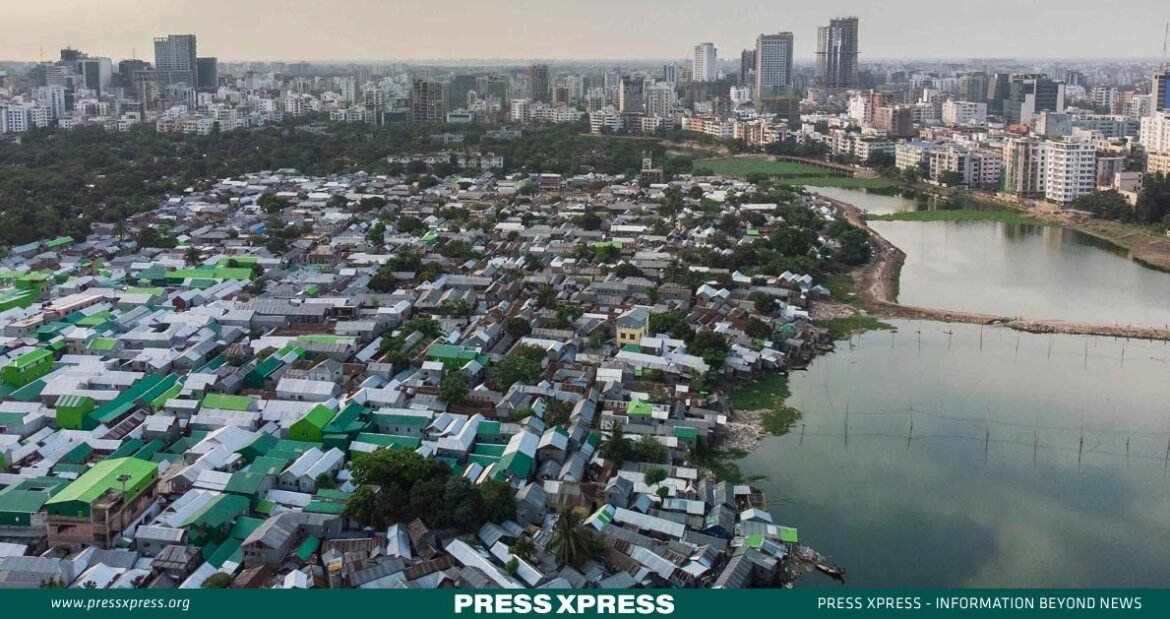

The WB emphasizes that the country needs over 432,000 new housing units annually, excluding the existing housing quality backlog and overcrowding issues. However, the nation falls short in housing finance development compared to countries with similar economic profiles.

World Bank’s note

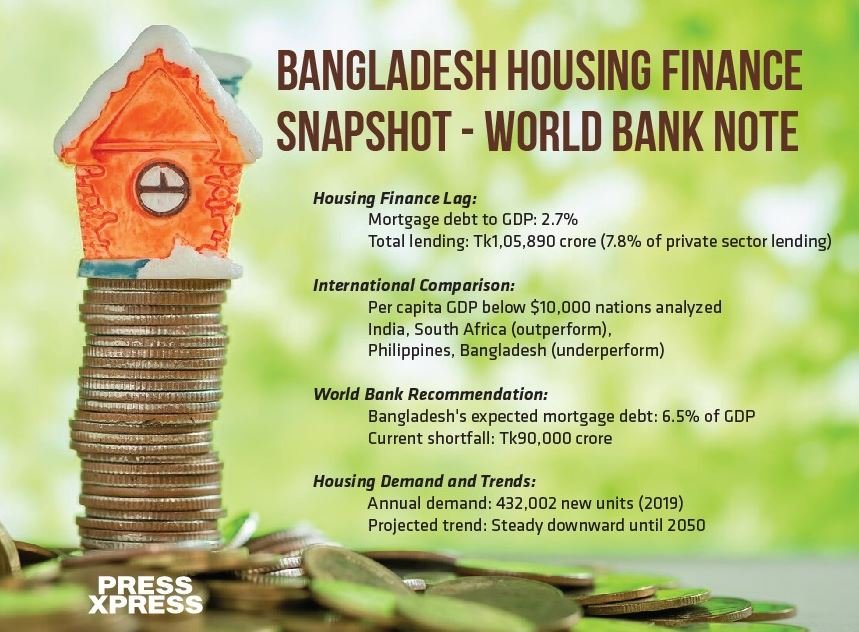

World Bank data reveals that Bangladesh’s housing finance sector, measured by mortgage debt relative to GDP, significantly lags behind comparable economies. As of June 2022, total lending for housing finance in Bangladesh stood at Tk1,05,890 crore, accounting for only 7.8% of total private sector lending and a mere 2.7% of FY22 GDP.

In comparison to countries with a per capita GDP below $10,000, including Bangladesh, the World Bank notes discrepancies. While some nations like India or South Africa outperform their expected mortgage market size, others, such as the Philippines or Bangladesh, are underperforming.

The World Bank suggests that Bangladesh’s expected mortgage debt should be around 6.5% of GDP, implying that the country’s mortgage market is less than half its potential size. This shortfall indicates a need for an additional Tk90,000 crore in mortgage loans.

Officials from the Financial Institutions Division highlight that Bangladesh’s housing requirement for 2019 is 432,002 new units annually, mainly concentrated in urban areas due to the declining rural population. Despite a slight recent upturn, the annual housing demand is projected to follow a steady downward trend until 2050, adding urgency to addressing the housing finance gap.