Key Highlights:

- Revolutionize retirement benefits age, contributions now determine tax-free monthly pensions for retirees

- Enactment of the Public Pension Management Act in January 2023

- By 2031, over 2 crore individuals to surpass 60 years, emphasizing the need for widespread pension coverage

- Govt provides 500 taka monthly to destitute elderly over 65, yet over 40% lack any pension support

The inception of the public pension system by the Awami League government marks a watershed moment in Bangladesh’s welfare landscape. Tailored to an individual’s age and contribution, retirement benefits now beckon as a result of this groundbreaking welfare initiative.

The Awami League has recently unveiled its long-anticipated manifesto titled ‘Smart Bangladesh: Unnoyon Drisshoman, Barbe Ebar Kormoshongsthan.’ Within this comprehensive document, 11 sectors have been accorded top priorities, with the Public Pension sector securing the notable position of 8th in the list of prioritized areas.

The Election Manifesto 2024 aims to portray a transformative vision of the government under the leadership of the Awami League over the past 15 years. The promise of Smart Bangladesh revolves around the development, progress, and prosperity of the nation, emphasizing the creation of a smart Bangladesh through the fourth industrial revolution, incorporating the Delta Plan for the next 100 years, known as Vision 2041. Climate change will also be a significant focus, presented in a smart and concise format.

Awami League’s Pioneering Initiative

The Public Pension system in Bangladesh stands as a testament to the government’s commitment to welfare, initiated under the Awami League’s governance. This initiative has been designed to offer retirement benefits that hinge upon an individual’s age and contributions made throughout their working years. What sets this apart is that the received monthly pension will remain entirely tax-free, ensuring a more significant financial impact for the retirees.

The pivotal Public Pension Management Act came into effect in January 2023, marking a watershed moment in social security. Honorable Prime Minister Sheikh Hasina took the honor of inaugurating this groundbreaking scheme on August 17, 2023. This move is poised to benefit over eight crore people across the nation, a transformative step considering that, traditionally, only government, semi-government, or autonomous institution employees received pension post-retirement. This new law aims to rectify this gap by extending these much-needed benefits to all hardworking individuals, creating a robust safety net for citizens grappling with social protection, unemployment, illness, disability, or old age.

Diverse Schemes for Inclusive Benefits

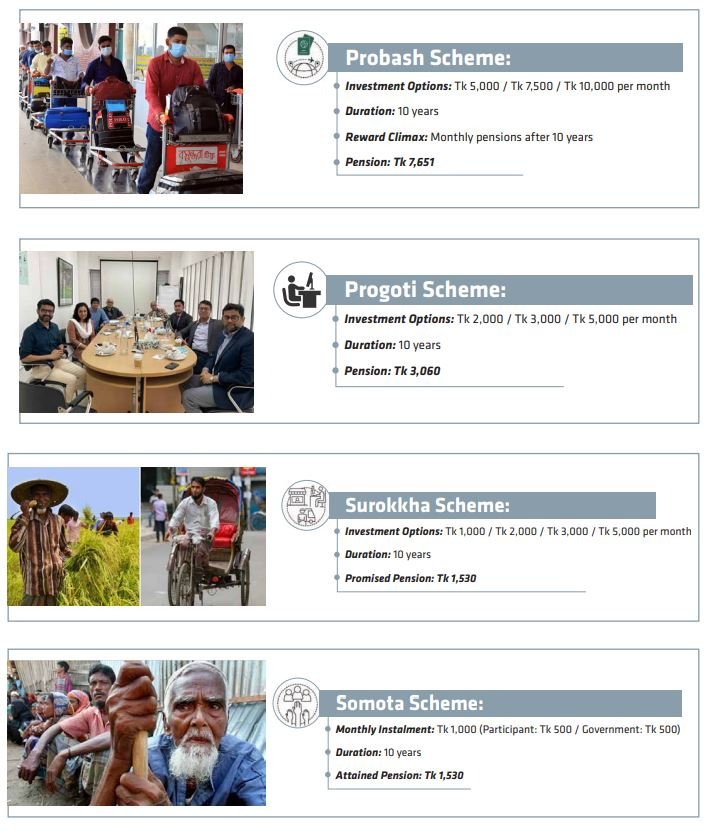

The Universal Pension Management Act was enacted in January 2023, and the Universal Pension System was inaugurated on 17 August 2023. It is for people from all aspects of the society. There are four schemes:

1. ‘Probash’ for expatriate Bangladeshi citizens

2. ‘Progoti’ for Officers/Employees of Privately Owned/Private Institutions

3. ‘Surokkha’ for self-employed citizens and

4. ‘Somota’ for the self-employed ultra-poor people

AL urges all citizens to take this opportunity to safeguard their future lives.

The Pragati scheme aids private sector employees; Surokkha supports informal workers like rickshaw pullers, artisans, fishermen, and self-employed individuals; Samata assists those with low incomes; and Prabashi caters to expatriate Bangladeshis.

Within Pragati, private sector employees can contribute Tk2,000, Tk3,000, or Tk5,000 monthly, with 50% covered by them and the rest by their companies. Post-60, contributions lead to pensions ranging from Tk68,931 to Tk1,72,327 monthly, based on the chosen amount.

The Surokkha scheme aids self-employed and informal sector workers, accepting contributions of Tk1,000, Tk2,000, Tk3,000, or Tk5,000 monthly. Those persisting with Tk1,000 monthly receive Tk34,465 as a pension post-60. Likewise, contributors at Tk2,000 monthly can access Tk68,931 per month upon reaching 60.

The Surokkha scheme caters to self-employed and informal sector workers, allowing contributions of Tk1,000, Tk2,000, Tk3,000, or Tk5,000 per month. Those who continue the scheme after providing Tk1,000 per month will receive Tk34,465 as a monthly pension after 60 years. Similarly, contributors providing Tk2,000 per month can withdraw Tk68,931 per month after 60 years.

The Samata scheme aims to uplift the ultra-poor, allowing them to contribute Tk1,000 per month while the government covers the remaining Tk500. This scheme offers a monthly pension of Tk34,465 for contributors aged 18 and above, and Tk1,530 per month for those over 50 who contribute for a minimum of ten years.

Awami-League’s Aspirations as Stated in the Manifesto

Bangladesh has witnessed a remarkable increase in life expectancy, now averaging at 73 years. However, by 2031, over two crore individuals in the country will surpass 60 years of age, signifying a demographic shift. Presently, the government provides a modest monthly allowance of 500 taka to destitute elderly people aged over 65. Nevertheless, an alarming statistic reveals that over 40% of individuals above 65 do not receive any form of pension or elderly allowance, indicating an urgent need for widespread pension coverage.

This innovative stride in public pension provision not only promises financial stability but also cultivates a heightened sense of security awareness among the populace for the future. It effectively alters the way people envision and plan their futures, creating a landscape where the fear of financial instability during old age slowly fades away. This initiative stands as a beacon of hope, promising a more secure and dignified livelihood for all citizens in their retirement years.

In summary, the public pension is not merely a financial support system; it stands as a symbol of social progress and inclusivity. As Bangladesh navigates toward a fairer future, this welfare initiative becomes a fundamental pillar in strengthening societal well-being and resilience against the uncertainties of time.