As the implementation progresses, it is anticipated that these initiatives will contribute significantly to closing financial gaps and fostering a more transparent and efficient tax ecosystem

In a groundbreaking move, the National Board of Revenue (NBR) has unveiled plans to implement four specialized tax wings aimed at revolutionizing direct tax collection from foreign companies and eliminating missing revenue sources. The initiative, approved by the Ministry of Finance (MoF), is set to bridge financial gaps and enhance overall revenue. The wings will focus on international taxes, automated tax collection and taxpayer services, tax intelligence and investigation, and source-tax management. The expansion plan involves 56 tax zones, with 25 new ones, operating in phases to improve services and increase direct tax collection.

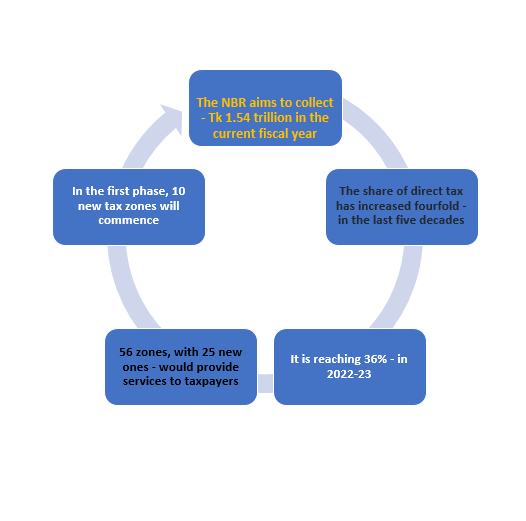

The NBR aims to collect Tk 1.54 trillion in the current fiscal year, anticipating a two-fold increase in direct tax collection. The expansion plan, implemented in three phases over two years, addresses challenges such as manpower and infrastructure scarcity. The country’s tax-GDP ratio is currently below 8.0%, and the plan aims to double this ratio with specialized units detecting anomalies and handing over cases to tax commissioners for punitive action. The share of direct tax has increased fourfold in the last five decades, reaching 36% in 2022-23.

“The expansion of the tax zones would pay off to increase the country’s tax-GDP ratio to double digits. The specialized units would not have any judicial power and work intensively to detect anomalies. The units would hand over the cases to the tax commissioners to take punitive steps in case of any irregularities identified.”

– Syed Mohammad Abu Daud, Member, Tax Admin & Human Resource Management Wing

Four Specialized Tax Wing

Here’s a detailed look at the four specialized tax wings;

International Taxes Wing

The first specialized wing focuses on international taxes, reflecting a proactive approach to ensure that foreign companies contribute their fair share to the national revenue. This move aligns with the global trend of tightening tax regulations for multinational corporations. The International Tax Unit will play a crucial role in facilitating compliance and enhancing transparency in cross-border financial transactions.

Automated Tax Collection and Taxpayer Services Wing

With the advent of technology, the NBR recognizes the importance of streamlining tax collection processes. The Automated Tax Collection and Taxpayer Services wing aims to leverage automation to provide efficient services to taxpayers. This move is expected to enhance the overall taxpayer experience, making compliance more accessible and user-friendly. Taxpayers can look forward to a more streamlined and convenient tax payment process.

Tax Intelligence and Investigation Wing

The third wing focuses on tax intelligence and investigation, signaling a proactive stance against tax evasion and irregularities. This unit will work intensively to detect anomalies and hand over identified cases to tax commissioners for punitive action. By targeting potential irregularities, the Tax Intelligence and Investigation Wing aims to create a deterrent effect, discouraging individuals and businesses from engaging in tax evasion.

Source-Tax Management Wing

The Source-Tax Management Wing addresses the critical aspect of withholding tax. This unit plays a pivotal role in ensuring that taxes are deducted at the source, preventing revenue leakage. By managing withholding tax effectively, the NBR aims to plug potential gaps in revenue collection and strengthen the overall tax ecosystem.

Implementation and Expansion Plan

A reorganized format would see a total of 56 tax zones, including 25 new ones, offering services to taxpayers in different phases. Upon full implementation of the new tax zones, tax officials anticipate a twofold increase in the collection of direct taxes. The National Board of Revenue (NBR) aims to collect Tk 1.54 trillion in direct taxes in the current fiscal year.

During the initial phase, approximately 10 new tax zones would commence operations alongside existing ones. Additionally, tax intelligence and investigation units, as well as e-tax-management and source tax (withholding tax) management units, would become operational. In the subsequent phase, tax zones in Chattogram, Cox’s Bazar, Faridpur, Narsingdi, Jashore, Kushtia, Dinajpur, and Noakhali would resume operations, along with the initiation of the International Tax Unit and Tax Zones in Pabna. Two tax-appeal zones in Dhaka, and one each in Chattogram and Rangpur, would also commence operations.

Syed Mohammad Abu Daud, Member of Tax Administration and Human Resource Management at the NBR, conveyed to the FE that the expansion of tax zones would contribute to doubling the country’s tax-GDP ratio into double digits. He emphasized that the specialized units would lack judicial power and focus on intensive anomaly detection. Cases identified would be handed over to tax commissioners for punitive measures in the event of irregularities. Despite the positive outlook, Mr. Daud acknowledged that the three-phase expansion plan for tax offices would require at least two years for implementation.

Challenges and Future Outlook

The existing network of 31 income tax offices spans the country and was originally established to cater to 1.1 million individual taxpayers back in 2011 during the last expansion. As of now, the number of registered taxpayers or Taxpayer Identification Numbers (TIN) has surpassed 9.0 million, while the count of tax offices remains unchanged. Tax authorities point to a shortage of manpower, infrastructure, and logistics as the primary hurdles in delivering enhanced services to taxpayers and curbing tax evasion.

During the 2011 expansion, each tax zone was tasked with serving an average of 50,000 to 60,000 taxpayers, a number that has now surged to over 250,000. The National Board of Revenue (NBR) envisions that executing the expansion plan will enable the challenging task of generating revenue from growth centers in upazilas. Presently, the country’s tax-GDP ratio stands below 8.0 percent, marking one of the lowest figures in this continent.

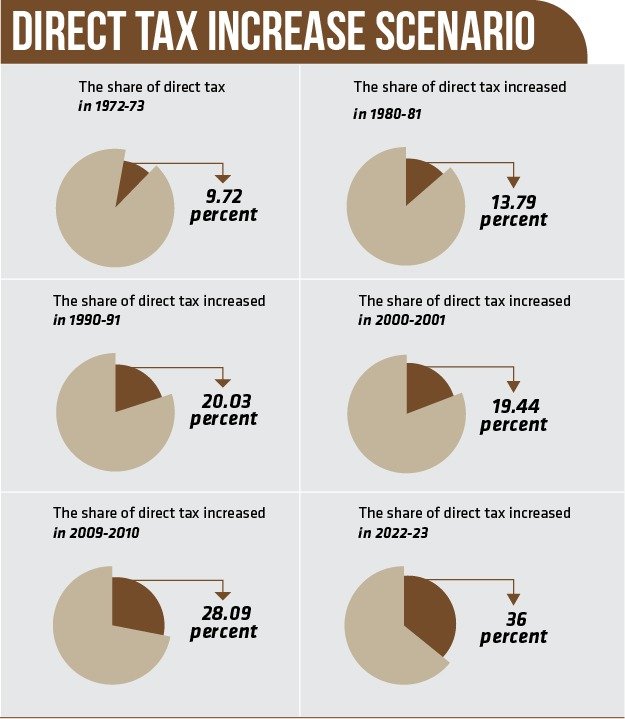

Despite limitations, the share of direct tax has seen a fourfold increase, rising to 34 percent over the last five decades. In 1972-73, the share of direct tax was a mere 9.72 percent, escalating to 13.79 percent in 1980-81, 20.03 percent in 1990-91, 19.44 percent in 2000-2001, 28.09 percent in 2009-2010, and reaching 36 percent in the fiscal year 2022-23, as per NBR data.

Conclusion

The NBR’s innovative approach to tax collection through specialized wings and an expansion plan reflects a commitment to modernize and optimize the revenue collection process. As the implementation progresses, it is anticipated that these initiatives will contribute significantly to closing financial gaps and fostering a more transparent and efficient tax ecosystem.