A flourishing export sector could incentivize environmentally sustainable practices and social responsibility, aligning with global expectations for ethical and eco-friendly business practices

The Export Promotion Bureau (EPB) released an updated report on December 5, 2023, stating that Bangladesh’s goods exports to the global market have risen by 1.30 percent in the first five months of the current fiscal year compared to the same period last year.

From July to November of the fiscal year 2023-24, Bangladesh exported products worth $22.8 billion. Although the target was to export goods worth $24.49 billion. In the corresponding period of the previous fiscal year, exports were valued at $21.95 billion.

This report, based on data from the National Board of Revenue (NBR), is regularly published by the organization under the Ministry of Commerce. The top five exported products from Bangladesh in terms of value include apparel, leather and leather products, agricultural products, jute and jute products, and home textiles.

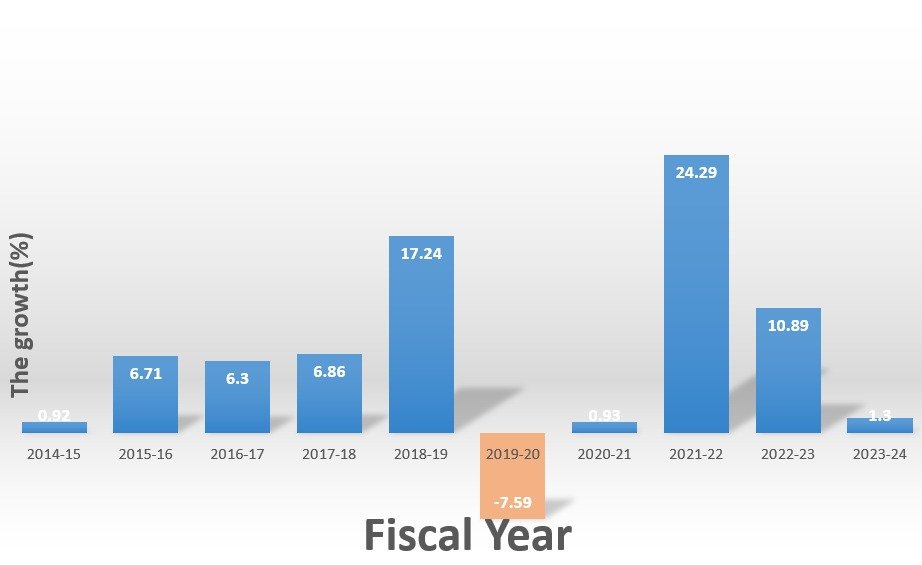

Export Growth Trends

EPB’s publication on export growth figures for the initial five months of the past 10 financial years indicates that, in the corresponding period of the 2014-15 financial year, the export growth stood at 0.92 percent. Conversely, during the 2019-20 financial year, it registered a negative 7.59 percent. The subsequent financial year witnessed a 0.93 percent growth in exports during the initial five months, and the current financial year has seen a 1.3 percent increase in the monetary value of product exports over the same period.

Bangladesh’s Top Export Products

The five highest-value goodsexported from Bangladesh are;

- Apparel

- Leather and leather products

- Agricultural items

- Jute and jute products and

- Home textiles

Statistics say that these five products accounted for 91.5 percent of the country’s total exports in the first five months of the fiscal year 2022-23.

Apparel Products

According to the latest report published by EPB, 84.72 percent of the total exports from Bangladesh are garments.

Bangladesh’s textile and garment sector plays a crucial role in the nation’s economy and holds a key position in the global textile and apparel market. In the fiscal year 2021-2022, garment exports from Bangladesh amounted to US $42.613 billion, establishing it as the world’s second-largest apparel exporter (according to data from the Export Promotion Bureau).

- Apparel makes up Bangladesh’s overall exports-84.72 %

- The world’s second-largest apparel exporter – Bangladesh

- Garment exports amounted to US $42.613 billion- In FY 2021-22

- People employed in this sector- over 4 million

- The primary export destination for Bangladesh – the USA

Furthermore, the garment industry serves as a significant generator of employment and income in Bangladesh, with over 4 million people (approximately twice the population of New Mexico) employed in this sector.

According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), BD ready-made garment (RMG) exports reached $29.825 billion in the first eight months of 2022, reflecting a notable increase of 38.39% compared to the corresponding period in the previous year.

The primary export destination for Bangladeshi garments is the United States, constituting approximately 21.50% of total exports. The European Union, including Spain, Germany, Italy, France, Belgium, and the Netherlands, ranks as the second-largest export destination for BD apparel, followed by the UK and Canada.

According to BGMEA, Bangladesh’s textile and apparel sector is predicted to grow further and be worth more than 10% of the world market by 2025. Growing efforts by nations to diversify their supply chains will also help the industry, as global sourcing practices continue to change.

Leather and LeatherProducts

The Leather and Leather Goods industry holds significance as the second-largest contributor to the country’s foreign exchange earnings. Approximately 600,000 individuals are employed directly in this sector, with an additional 300,000 in indirect employment.

- Country’s second-largest foreign exchange earner- The Leather and Leather Goods

- Directly People employed in this sector – 600,000

- Indirect employment – 300,000

- The industry constitutes – 4% of total exports

The industry constitutes 4% of Bangladesh’s total exports, equivalent to 0.5% of the country’s overall GDP. Due to its substantial value addition, substantial growth potential, and employment prospects, the leather sector has been designated as a top-priority industry. Bangladesh commands a 3% share in the global leather and products market.

Agricultural Products

Over the last few years, Bangladesh has achieved significant advancements in the agricultural sector. The combination of the country’s fertile land, favorable climatic conditions, and effective government policy support has generated extensive opportunities for agri-business. With a growing demand for high-quality agricultural products in global markets, Bangladesh holds substantial potential to enhance its agri-export earnings. In recent years, the country’s agri-food exports have witnessed a notable increase, surpassing $1 billion in value and reaching diverse international markets.

- The country’s agri-food exports increase – $1 billion

- Bangladesh currently exports more than – 700 items

- Bangladesh currently exports to more than – 140 countries

- Labor force engage – 40.6%

- It contributes to the GDP- 14.23%

Bangladesh currently exports more than 700 items, encompassing 63 fundamental agro-processed products, predominantly cereal grains, frozen fish, processed meat, tea, vegetables, tobacco, cut flowers, fruits, spices, dry food, and various other processed agricultural products, including livestock, poultry, and fish feed, to over 140 countries. The agricultural sector is a significant employer, engaging approximately 40.6% of the labor force and contributing 14.23% to the GDP.

Presently, the agro-food processing industry makes a noteworthy contribution, accounting for about 1.7% of the GDP and providing employment opportunities for approximately 250,000 individuals. Its proportion of total exports stands at approximately 3.5%.

Jute and JuteProducts

- The sector experienced a 3 percent increase – in FY 2023-24

- Export earnings to reach – $63 million

In the fiscal year 2023-24, the sector experienced a 3 percent increase in export earnings to reach $63 million. According to the Export Promotion Bureau’s data, jute and jute goods exports declined by 19 percent year-on-year to $912 million in the fiscal year 2022-23, marking the second consecutive year of reduction.

Home Textiles Products

- Bangladesh started home textile production – In the 1980s

- Initial export revenue was – $150 million

- It was in the – FY 2004-05

- The market has surged to an unprecedented – $1 billion

- The government’s ambition to achieve – $100 billion

In the 1980s, Bangladesh embarked on its venture as a producer of home textiles, achieving an initial export revenue of $150 million in the fiscal year 2004-05. In recent times, the market has surged to an unprecedented $1 billion, positioning itself as a promising avenue for realizing the government’s ambitious $100 billion export target.

Bangladesh’s Export Growth Benefits

Bangladesh stands to gain significantly from the positive export growth trends it is currently experiencing. A surge in exports can bolster the nation’s economic resilience and contribute to sustainable development. The foremost benefit lies in increased revenue, as rising export figures translate into greater foreign exchange earnings, strengthening the country’s financial position.

This growth in exports can foster job creation, a crucial factor in addressing unemployment and poverty. The expansion of industries linked to export activities, such as manufacturing and agriculture, can generate employment opportunities across diverse sectors. This, in turn, improves the standard of living for the population, promoting social welfare and reducing income inequality.

Furthermore, a thriving export sector enhances global competitiveness, positioning Bangladesh as an attractive destination for foreign investment. The positive export trends may attract international investors seeking to capitalize on the country’s economic momentum. Increased foreign direct investment can lead to the modernization of infrastructure, technology transfer, and the overall enhancement of industrial capabilities.

The benefits extend beyond economics, touching environmental and social dimensions. A flourishing export sector could incentivize environmentally sustainable practices and social responsibility, aligning with global expectations for ethical and eco-friendly business practices. In essence, Bangladesh’s export growth trends hold the potential to usher in a new era of prosperity, transforming the nation into a dynamic player in the global economy.