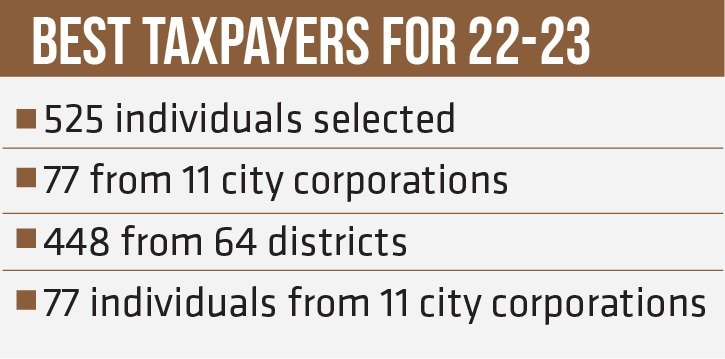

The National Board of Revenue (NBR) has recently announced a commendable initiative to appreciate and encourage tax compliance. The selection of 525 individuals from city corporation and district areas as the best taxpayers for the tax year 2022-2023 marks a significant step towards recognizing fiscal responsibility.

In an official notification released on Tuesday, the NBR unveiled the list of exceptional taxpayers. Among them, 77 individuals from 11 city corporations and 448 people from 64 districts have been distinguished for their contribution to tax compliance.

Diving into the specifics of the selection process, the criteria encompass a diverse range of contributors. Notably, two individuals from each City Corporation and district were honored for their prolonged service, while three individuals were acclaimed as the highest taxpayers. Additionally, a singular standout taxpayer was recognized for their exceptional contribution in the women and youth category, emphasizing inclusivity in this commendation.

Categories and Criteria

The selection criteria encompass various categories, honoring both highest income taxpayers and those exhibiting longstanding commitment to tax payment. Notably, within each City Corporation and district, two individuals have been recognized for their extended commitment to tax payments, while three stand out as the highest taxpayers. Additionally, one individual each has been acknowledged as an exemplary representative in the women and youth category.

Ministry of Finance’s Recognition

The Ministry of Finance played a pivotal role in this initiative, unveiling the names of these distinguished taxpayers under the framework of the Tax Payers Policy-2008. Earlier, 141 individuals, institutions, and organizations were identified as top taxpayers for the same tax year, comprising 76 individuals, 53 companies, and 12 entities falling under diverse categories.

Tax Regime in Bangladesh

There’s a widely held view that Bangladesh’s current tax laws, rooted in British origins and encompassing Income Tax, VAT, and Customs regulations, are overly complex and challenging to enforce.

The historical backdrop of the Indian Mutiny in 1857 prompted significant changes in taxation under British rule. James Wilson, serving in a pivotal financial role, introduced the first general income tax in India to counter the financial fallout of the mutiny.

Income tax in Bangladesh was initiated in 1860 during British rule through the Income Tax Act. Over time, this taxation system has undergone numerous alterations.

In 1991, Bangladesh introduced the Value Added Tax (VAT). A standard rate of 15% is applied to the transaction value of the majority of imports and the supply of goods and services.

Present efforts emphasize the need to revamp these laws, urging for comprehensive reforms that consider global best practices and stakeholder input. Advocates suggest restructuring proposals should be presented in understandable language to facilitate comprehension and modifications.

The goal for the restructured tax laws is simplicity, clarity, and fairness. Stakeholder perspectives are crucial in creating user-friendly laws, ensuring equitable application across the board. The emphasis lies on creating digestible, implementable tax laws devoid of bias or complexity.

Taxpayers in Various Categories

On December 2022, the Revenue Board revealed the names of 525 leading taxpayers nationwide for the 2022 tax year, encompassing seven individuals each from city corporations and districts.

In journalism, luminaries like Faridur Reza Sagar of Impress Telefilm Limited (Channel i), Mahfuz Anam of Daily Star, Matiur Rahman of Prothom Alo, Shykh Seraj of Channel i, and Naem Nizam of Bangladesh Pratidin were acknowledged.

In the print and electronic media arena, companies such as Mediastar Ltd (Transcom Group), East West Media Group Ltd (Kaler Kantho, Bangladesh Pratidin, Daily Sun, and banglanews24.com), Shomoy Media Ltd (Somoy TV), and Times Media Ltd were recognized.

Expert Opinion

Lecturer, Department of Economics, Noakhali Science and Technology University

Sheikh Hasina is the 46th most powerful woman in the Forbes list, now how you explain Bangladesh’s position in global context?

The Forbes power list is generated following four basic standards: wealth, media presence, impact, and domains of influence. More precisely, who is molding the world today through policies, products, and political battles? That’s exactly the topic of Forbes.

According to Forbes’ list of the 100 most powerful women in the world for 2023, our Prime Minister Sheikh Hasina comes in at number 46. Bangladesh, as a developing country, has witnessed enormous development under its administrative leadership. As a result of incredibly effective political, social, and economic management, Bangladesh is progressing across all metrics. For instance, topics such as women’s empowerment, access to and safety of food, environmentally friendly production, health, education, and other connected segments. In her capacity as a visionary leader, Sheikh Hasina initiated the “Making Vision 2041 a Reality: A Plan of Bangladesh 2021-2041” initiative, which included both short-term and long-term plans and policies.

You sent

We are optimistic that Bangladesh will reach new heights of progress under the able guidance of Sheikh Hasina, aided by careful preparation and the unwavering commitment of every citizen. On top of that, it will serve as an example for other emerging nations to follow.

Sports personalities like cricketers Shakib Al Hasan, Tamim Iqbal Khan, and Quazi Nurul Hasan Sohan were among the acknowledged taxpayers.

Noteworthy actors and actresses such as Mahfuz Ahmed, Mehazabien Chowdhury, and Pijush Bandyopadhyay, alongside artists Tahsan Rahman Khan, SD Rubel, and Kumar Bishwajit, were also recognized.

The list included 88 citizens in categories ranging from war-injured freedom fighters, disabled individuals, women, youths (below 40 years), businessmen, job holders, doctors, lawyers, engineers, architects, accountants, and new taxpayers.

Notable companies like Standard Chartered Bank, Islami Bank Bangladesh Limited, Hong Kong and Shanghai Banking Corporation Limited, Dutch Bangla Bank Limited, and Grameenphone Limited were recognized as top tax-paying entities among 53 companies in various sectors.

The awards ceremony for national-level awardees is scheduled for December 28 at the Officers’ Club in Dhaka, with separate local events planned to honor top taxpayers at the city corporation and district levels.

Crafting an Efficient Tax System

The essence of a well-designed tax system lies in its economic efficiency and minimal distortion of economic decisions. Taxation inherently introduces deadweight losses, dampening economic activity. Differential tax rates among activities exacerbate these losses, urging the need for a system that curtails such economic distortions.

Efficiency isn’t solely economic; it encompasses logistical aspects, minimizing compliance costs for taxpayers. High compliance costs discourage tax payment, fostering evasion. Taxpayers bear direct costs in time and resources, while a portion of revenues is diverted towards administrative expenses.

Simplicity and fewer collection points enhance transparency, instilling public confidence in fairness and clarity. An economically neutral tax treats all economic activities equally, fostering transparency crucial for accountability. A transparent system enables citizens to gauge governmental expenditures and hold representatives accountable.

A nation’s tax system mirrors its socio-economic values, reflecting choices on tax burden distribution and expenditure allocation. In democracies, tax choices align with societal aspirations. Conversely, in systems with limited public influence, taxation mirrors the values of those in power.

Understanding a nation’s tax system unveils not just economic structures but also societal priorities, encapsulating the dynamics of power, representation, and the collective vision for a community.

The NBR’s initiative not only celebrates fiscal responsibility but also serves as a motivational beacon for others to emulate. The acknowledgment of these individuals showcases the importance of tax compliance and its positive impact on the national economy.