With sustained efforts, inclusive policies, and continued collaboration, Bangladesh is poised for continued success on the global stage

Bangladesh, in its remarkable five-decade journey, has consistently carved out a distinctive global position. With an eye on achieving Vision 2041, the nation is diligently constructing a robust economic foundation, leveraging its status as the 9th largest consumer market and a youthful population by 2030. Emphasizing business, investment, and advanced communication systems as primary drivers of development is deemed crucial to realizing this objective.

You can also read: Bangladesh Targets 9th Global Consumer Market by 2030: PM

The speakers at the ’60th Anniversary Celebration and Investment Fair 2023,’ organized by the Foreign Investors Chamber of Commerce and Industry (FICCI), underscored the significance of robust and persistent efforts to enhance Bangladesh’s global standing through comprehensive policy research, strategic reforms, and initiatives. They stressed that the alignment of trade, investment, and connectivity endeavors is pivotal for sustainable growth, positioning Bangladesh prominently on the world stage.

The event, held with the theme ‘Investment Climate: Current Landscape and Vision 2041,’ featured speakers who highlighted the imperative for heightened competitiveness to realize Vision 2041.

Tofazzal Hossain Mia, the Principal Secretary to the Prime Minister, took center stage to emphasize the government’s commitment to facilitating capital flow and fostering an investor-friendly environment. In addressing investment challenges, he advocated for the promotion of diversification and the enhancement of logistics policies, including Public-Private Partnership (PPP) projects and exploration in the blue economy. These initiatives, he stressed, are integral to engaging the private sector in a collaborative effort for sustainable development. The ultimate objective is to establish Bangladesh as an enticing investment destination among the world’s fastest-growing economies.

Foreign Investment Scenario of Bangladesh

Foreign direct investment (FDI) increased by 20.2% to $3.48 billion in Bangladesh in 2022, marking the second-highest level in the country’s history, as reported in the World Investment Report 2023 by the United Nations Conference on Trade and Development (Unctad).

The peak FDI, amounting to $3.61 billion, occurred in 2018, according to the World Investment Report 2023 released on July 5 by Unctad. The report highlighted that as of 2022, the cumulative FDI inward stock reached $21.1 billion.

Unctad noted that the recent enactment of the “Bangladesh Patents Bill 2022” extended the duration of patent protection from 16 to 20 years in 2022, aiming to boost FDI. This legislative change is believed to have contributed to the upsurge in FDI inflows.

The “Bangladesh Patents Bill 2022” was introduced to modernize a century-old patent law and attract foreign investment by safeguarding intellectual property rights.

Additionally, Unctad commended Bangladesh, along with other Asian countries such as China, Egypt, India, and Malaysia, for implementing measures mandating financial institutions and companies to disclose sustainability information, including carbon emissions.

In the ongoing year of 2023, Bangladesh has secured foreign investments totaling $900 million, according to Mohsina Yasmin, the Acting Executive Chairman of the Bangladesh Investment Development Authority (BIDA), announced at a recent press conference in Dhaka.

Meanwhile, in the fiscal year 2022-23 (FY ’23), the textile sector in Bangladesh witnessed the highest FDI at $1.229 billion, as per recent data released by the country’s central bank, Bangladesh Bank.

A Sectoral Analysis of Foreign Investments in Bangladesh

In the 2022-23 fiscal year, a Bangladesh Bank report reveals that the United States, China, and the United Kingdom are the top three investors in Bangladesh, collectively contributing 44 percent of the total Foreign Direct Investment (FDI). The United States led with an 18 percent share, amounting to $3.948 billion, primarily invested in the gas and petroleum sector, dominated by Chevron. Notably, 71.29 percent of U.S. investment focused on the gas sector, with significant allocations to the insurance, non-bank financial institutions, banking, electricity, and textile sectors.

China secured the second position, investing $2.85 billion, equivalent to 13.05 percent of Bangladesh’s FDI stock. The power sector received the lion’s share of Chinese investment, reaching 78.85 percent of their total investment, followed by contributions to the textile, trading, and construction sectors.

The United Kingdom held the third spot, injecting $2.82 billion, constituting 12.92 percent of Bangladesh’s FDI stock. The UK’s major investments were concentrated in the banking and textile sectors, with substantial allocations to the food, electricity, and chemical and petrochemical sectors.

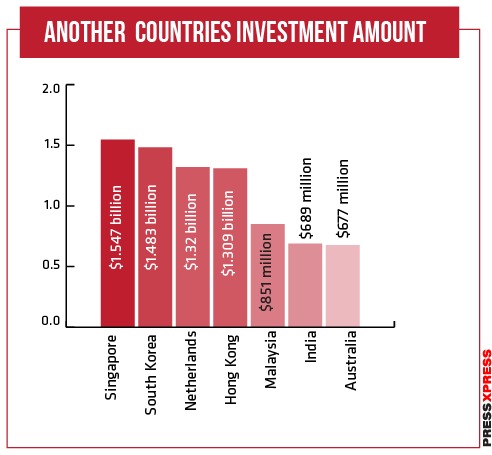

Singapore, positioned outside the top three, accounted for 7.08 percent of Bangladesh’s FDI stock, totaling $1.547 billion, with significant investments in the power, telecom, textile, agriculture, and fisheries sectors.

South Korea followed with a 6.79 percent share, investing $1.483 billion, primarily in the textile, leather, and leather products, and banking sectors. The Netherlands and Hong Kong held shares of 6.04 percent ($1.32 billion) and 5.99 percent ($1.309 billion), respectively. The Netherlands directed its investments toward the food, power, and cement sectors, while Hong Kong focused on textiles, power, and banking.

Additionally, Malaysia, India, and Australia contributed $851 million (3.89 percent), $689 million (3.15 percent), and $677 million (3.10 percent) to Bangladesh’s FDI stock, respectively. The United Arab Emirates (UAE) and Japan also made noteworthy investments, amounting to $486 million and $453 million, respectively.

What is FICCI

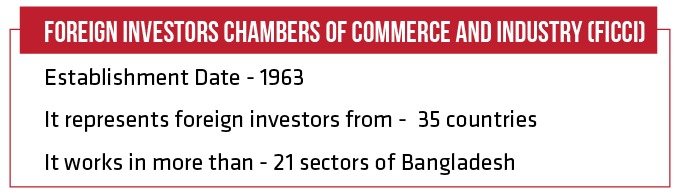

Foreign Investors Chambers of Commerce and Industry (FICCI), the apex chamber of multinational corporations, started its journey in 1963. Since then, it has played a significant role in the overall development of Bangladesh, including its economic growth. As a leading chamber, FIKI represents foreign investors from 35 countries of the world in more than 21 sectors of Bangladesh. In this unique journey of six decades, more than 200 member institutions of the Chamber contribute to nearly 30 percent of the government’s inward revenue and represent more than 90 percent of inward FDI in Bangladesh. FICI’s member institutions are working towards the government’s goal of building a Smart Bangladesh and contributing to social welfare for the country’s development.

In conclusion, Bangladesh’s strategic focus on economic development and Vision 2041 is evident in its growing foreign direct investment (FDI) landscape. Bangladesh is an attractive destination for global investments. The role of organizations like the Foreign Investors Chambers of Commerce and Industry (FICI) is pivotal in fostering international collaboration and contributing significantly to Bangladesh’s economic growth. With sustained efforts, inclusive policies, and continued collaboration, Bangladesh is poised for continued success on the global stage.