Amidst the uncertain economic waters, the euro zone is on the brink of another recession, causing concern about the forthcoming growth figures set to be released early next year. Despite the anxiety surrounding whether the results will be positive or negative, it is crucial to look beyond immediate worries and understand the broader picture.

A glimmer of hope appears in the resilience of the 20-nation currency union, poised to prevent a significant contraction that could have lasting impacts on businesses, households, and financial institutions. However, the shadow of concern remains, with growth teetering dangerously around zero, providing little support for a substantial recovery.

Despite the formidable economic challenges, the year ahead is predicted to be difficult. The faint flicker of growth potential indicates a struggle for the euro zone to surpass a modest 1%, even following a strong rebound. Deep-seated structural issues further emphasize that Europe is destined to lag behind other major economic players for years to come.

Near-term turbulence: a balancing act

As we navigate the near-term horizon, the outlook appears less than stellar, yet not entirely abysmal. Recent data underscores a 0.1% contraction in gross domestic product for July-September, hinting at the possibility of a shallow recession should a lackluster fourth quarter materialize, as early indicators suggest.

A poll projects a meager 0.6% expansion next year, restrained by record-high interest rates spawned from the inflation surge and tighter budgetary reins. Amidst this economic ebb, optimists, spearheaded by the European Central Bank’s chief economist Philip Lane, posit that a rejuvenation in real wages will rekindle demand and confidence among workers. The tight labor market and a rebounding global economy offer further rays of optimism, hinting at the potential for a healthier external demand.

A sea of doubt beyond ECB’s confidence gamble

As the European Central Bank (ECB) places its bets on a revival in confidence to steer the euro zone away from the brink of recession, dissenting voices emerge, casting a shadow on the anticipated rebound. Skeptics point to stubbornly high borrowing costs acting as a drag on investments, a softening labor market, and overseas demand falling short of expectations, challenging the ECB’s optimistic projections.

Erik Nielsen, an economics advisor at UniCredit, voices concern over a European economy that has languished in a year of stagnation, asserting that both monetary and fiscal policies for 2024 seem geared to restrain growth rather than foster it. According to Nielsen, the high probability of yet another lost year looms large on the economic horizon.

Persisting pessimism: A glimpse beyond 2024

Peering beyond the immediate future, the economic outlook for Europe remains bleak. The working-age population is set to dwindle, accompanied by meager productivity gains. Businesses, burdened by increasing bureaucracy, lament a diminishing competitive edge. The euro zone’s integration into an economic union has stalled, lacking the political impetus needed for progress.

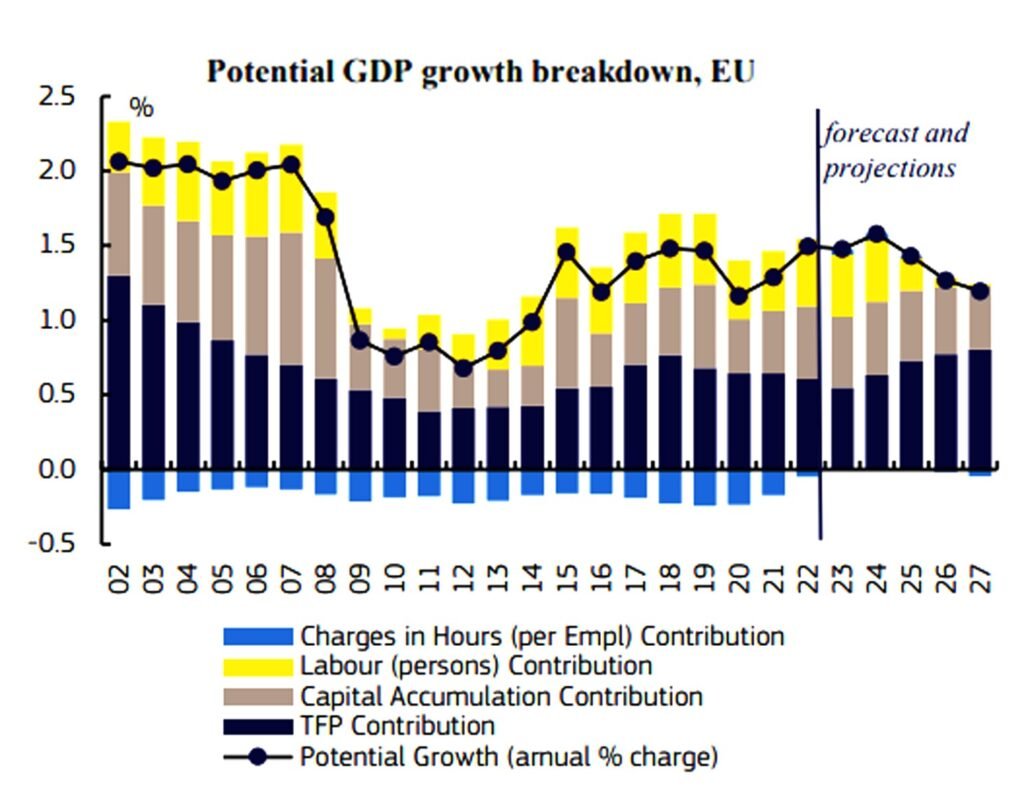

The European Commission paints a grim picture, pegging the bloc’s potential growth at less than 1.5%, with a further decline to 1.2% by 2027. This marks a stark regression from the 2%-2.5% growth witnessed at the turn of the century, primarily attributed to demographic shifts and feeble efficiency gains.

In a candid assessment, ECB’s Philip Lane acknowledges the lack of progress and even a regression in some countries, attributing it to the unraveling of various reforms. He deems this a self-inflicted wound, an avoidable misstep that compounds the challenges faced by the euro zone.

Euro’s conundrum

In a stark juxtaposition to the United States’ steady 1.8% potential growth, Europe grapples with a myriad of challenges, offering a troubling glimpse into its economic future. The impending drop in the working-age population takes an unexpected turn as firms, anticipating future hiring difficulties, cling onto workers, inadvertently intensifying labor market tightness, potentially setting the stage for wage growth while simultaneously weakening productivity.

Germany, a cornerstone of the European economy, emerges as a significant drag. Its reliance on external demand for growth, particularly in energy-intensive heavy industries, leaves it ill-equipped to face the new realities of expensive energy and escalating trade tensions. The potential growth rate for Europe’s largest economy now languishes below 1%, painting a grim picture of its economic trajectory.

Compounding the challenges is the struggle within European Union governments to reach consensus on pivotal questions that will shape the bloc’s future. Issues such as the role of migration in alleviating labor shortages, the establishment of a true banking union, and the consideration of centralized spending to address concerns across the 27-nation bloc linger without resolution.

Economies grapple with lingering shadows of energy crisis

Recent survey data unveils a disheartening narrative, signaling a downward spiral in the manufacturing and services sectors of the Eurozone. The demand for goods and services appears poised for a further dip, amplifying concerns about the region’s economic trajectory.

As Europe’s largest economy contracted in the third quarter, ominous clouds loom over the prospect of a robust recovery. Economists caution that, even if a recession is averted, a meaningful resurgence remains distant, shackled by tight financial conditions.

Official GDP data from Germany and France, the Eurozone’s powerhouses, mirrors this bleak outlook. French GDP eked out a mere 0.1% growth in the third quarter, a stark contrast to the previous quarter’s 0.6% expansion. Meanwhile, Germany saw a slight contraction in output, deepening the region’s economic woes.

Spain experiences a deceleration in economic growth, Italy stagnates, and Ireland’s volatile GDP takes a sharp 1.8% plunge, contributing to the overall contraction. While a sharp recession might not be imminent, economic uncertainties, geopolitical tensions, and the ripple effects of higher interest rates are expected to cast a shadow over Eurozone economic activity in the upcoming quarters, warns Bert Colijn, a senior eurozone economist at Dutch bank ING.

Middle East conflict ripples

Moreover, as tensions escalate in the Middle East, economists sound alarm bells over the possibility of a spill-over effect that could engulf the region in turmoil, with Israel and Lebanon exchanging missiles and Gaza facing continued bombardment, leading to widespread civilian casualties and a deepening humanitarian crisis.

While concerns grow about the impact on European economic activity, particularly through lower trade with the Middle East, experts emphasize that Europe’s direct exposure is limited. The euro area exports only about 0.4% of its GDP to Israel and neighboring countries, and the British trade exposure is even less, at under 0.2% of GDP.

However, the primary avenue through which tensions could reverberate into the European economy is the oil and gas markets. Since the conflict erupted, commodities markets have experienced heightened volatility, with Brent crude oil and European natural gas prices spiking by around 9% and 34%, respectively, at their peak.

Goldman Sachs’ commodities team explores downside scenarios where oil prices could rise by 5% to 20% above the baseline, contingent on the severity of the oil supply shock. A sustained 10% increase in oil prices typically leads to a 0.2% reduction in Euro area real GDP after one year and a nearly 0.3 percentage point boost in consumer prices over the same period.

Consumer confidence emerges as another potential channel for spillover effects, with Goldman Sachs highlighting a historical downturn in the euro area following Russia’s invasion of Ukraine in March 2022. While such effects haven’t been observed consistently during tensions between Israel and Hamas, Goldman’s measure of conflict-related uncertainty reached record highs in October, underscoring the broader economic apprehensions associated with the ongoing Middle East conflict. “Eastern Europe’s Wage Surge Sparks IMF Warning – Unprecedented Increases Pose Economic Risks”.

In the second quarter, annual wage increases in the region hit double-digit figures, ranging from 16.9% in Hungary to 9.9% in Slovakia, surpassing the EU average of 4.5%. However, inflation in these countries has also outpaced the EU average, creating economic concerns. The IMF projects a weighted average wage growth of 11% for 2023, anticipating a slowdown to 7% next year and 6% in 2025.