The surge in remittance inflow in October, driven by a stronger dollar and government incentives, highlights the responsiveness of this vital economic lifeline. Recently, remitters offered an extra Tk2.75 per dollar, i.e. Banks have been allowed to take remittances by offering an additional Tk2.75 to Tk112.75 per dollar in a desperate effort to boost the inflow of the greenback, which went down to a 41-month low in September.

You can also read: Government Measures and Cash Incentives Boost Remittance Inflows in Bangladesh

Remittances have emerged as a pivotal economic factor in Bangladesh, significantly influencing economic growth, bolstering the balance of payments, boosting foreign exchange reserves, augmenting national savings, and accelerating the velocity of money. Over the past two decades, remittances have consistently accounted for approximately 35% of the country’s export earnings. In the current climate, remittances have gained significant momentum, securing their position as the second-largest source of foreign currency earnings in Bangladesh, trailing only the dominant garment sector.

In October, Bangladesh recorded its highest monthly inward remittances in four months, totaling $1.98 billion, driven by a strengthening dollar and government incentives aimed at encouraging remittances. According to central bank statistics, expatriates increased their remittance transfers by $643 million in October compared to September, marking a substantial 48.2% surge. In September, remittances reached their lowest point in 41 months, totaling just $1.33 billion.

The nation’s remittances in October last year amounted to $1.59 billion, as reported by official sources. As stated by a senior central bank official, expatriates have been gravitating towards remittance options offering more attractive exchange rates, causing a decline in the use of the banking channel for remittances over the past few months. On the other hand, remittance inflow began to climb once the government upped the incentive from 2.5% to 5% on October 22,” he reported.

Inside information from a private bank, official revealed that penalties were levied against the treasury divisions of certain banks for the excessive pricing of the dollar. Concurrently, the central bank verbally directed a select group of banks to increase their remittance rates, leading to an augmentation in remittance inflows.

Remittances in the Fiscal Year 2023-24

Bangladesh received remittances amounting to $6.88 billion in the first four months (July-October) of the fiscal year 2023-24, showing a 4.36% reduction when contrasted with the corresponding period in the preceding fiscal year.

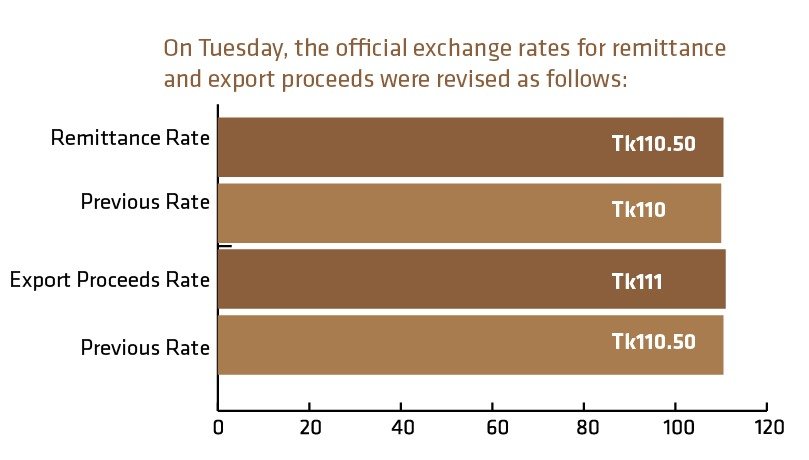

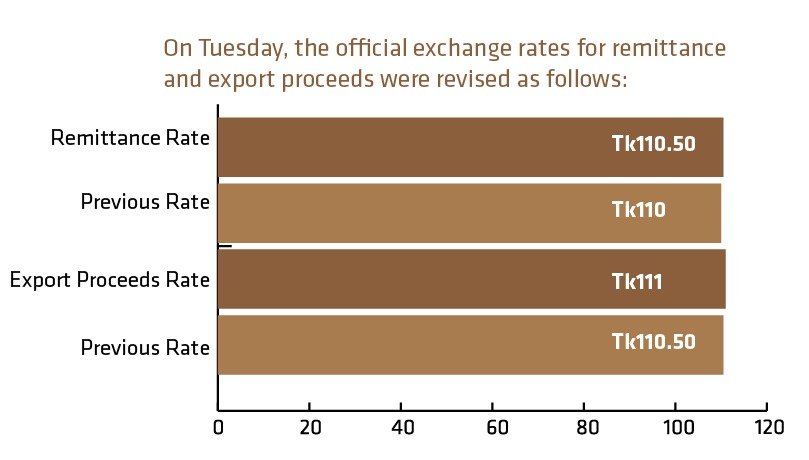

The managing directors of two private banks have reported that the decisions were solidified in a meeting involving the Association of Bankers, Bangladesh (ABB) and the Bangladesh Foreign Exchange Dealers’ Association (Bafeda). State-owned banks reported $154 million in remittances for October, with private banks handling a significant $1.75 billion during the same period.

Dollar Crisis and Forex Reserves

Dr. Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), pointed out that while incentives may provide a short-term boost in remittance inflow, they are not a sustainable, long-term solution. To quote “If we aim to boost remittances, we must tackle the issues of hundi and money laundering. A significant amount of money is illicitly sent abroad, and it must be controlled through any means necessary.” He added that hundi operators consistently offer more favorable rates than banks.

The dollar crisis that hit Bangladesh became apparent in March 2022, coinciding with the escalation of the Russia-Ukraine conflict. Initially, the Bangladesh Bank attempted to stabilize the dollar price, which unfortunately exacerbated the issue.

Remittances: The Rural Game Changer in Bangladesh

With the help of remittances, the families of Bangladeshi migrant workers are actively contributing to the growth of the country’s rural economy, not only through consumer spending but also by channeling their funds into various small-scale income-generating ventures. In addition to farming, remittances play a significant role in boosting the rural economy by increasing the demand for goods and services.

Professor Mustafizur Rahman, a renowned fellow at the Centre for Policy Dialogue, highlighted the substantial impact of remittances on the growth of non-agricultural sectors in the last few decades. He added:

“Remittances positively affect the rural non-farm economy, play a role in the commercialization of agriculture, and contribute to the advancement of small-scale industries in rural areas”

In this context, the purchase of construction materials like rods and bricks by migrant worker families can indirectly spur production. This implies that remittances have a positive “multiplier effect” on the local economy, as they encourage job growth and boost overall demand.

Zahid Hussain, former lead economist of the World Bank’s Dhaka office, mentioned that a significant portion of the funds sent by migrant workers is initially allocated to repay the loans used for their overseas migration. However, once these debts are settled, the remittances aid recipients in enhancing their quality of life.

Upon closer examination, various studies indicate that families receiving remittances allocate a larger share of their income towards education, healthcare, nourishment, and sanitation when compared to other demographic groups. In summary, remittances play a crucial role in elevating the living standards of rural families and ensuring their financial stability, as affirmed by Mr. Hussain.

Quantifying the influence of successful migrants on the rural economy is a complex task, but it is undeniably significant. Remittances are an integral part of promoting sustainable agricultural production, as rural families who receive these funds invest significantly in irrigation as well.

In conclusion, remittances have cemented their status as a driving force behind Bangladesh’s economic stability and growth. While incentives provide short-term boosts, addressing issues like hundi and money laundering remains crucial for long-term sustainability.

Notably, remittances aren’t just an urban phenomenon; they are actively contributing to the growth of the country’s rural economy. They empower families of migrant workers to invest in small-scale income-generating ventures, non-agricultural sectors, and infrastructure development, further accelerating job growth and raising living standards. In the intricate tapestry of Bangladesh’s economic landscape, remittances stand as a vibrant thread, weaving together prosperity, growth, and resilience, ultimately forging a brighter future for the nation and its people.