Despite the ongoing global economic crisis, Bangladesh’s apparel industry remains robust. The sector has maintained its competitive edge, offering “Made in Bangladesh” products that are in high demand worldwide.

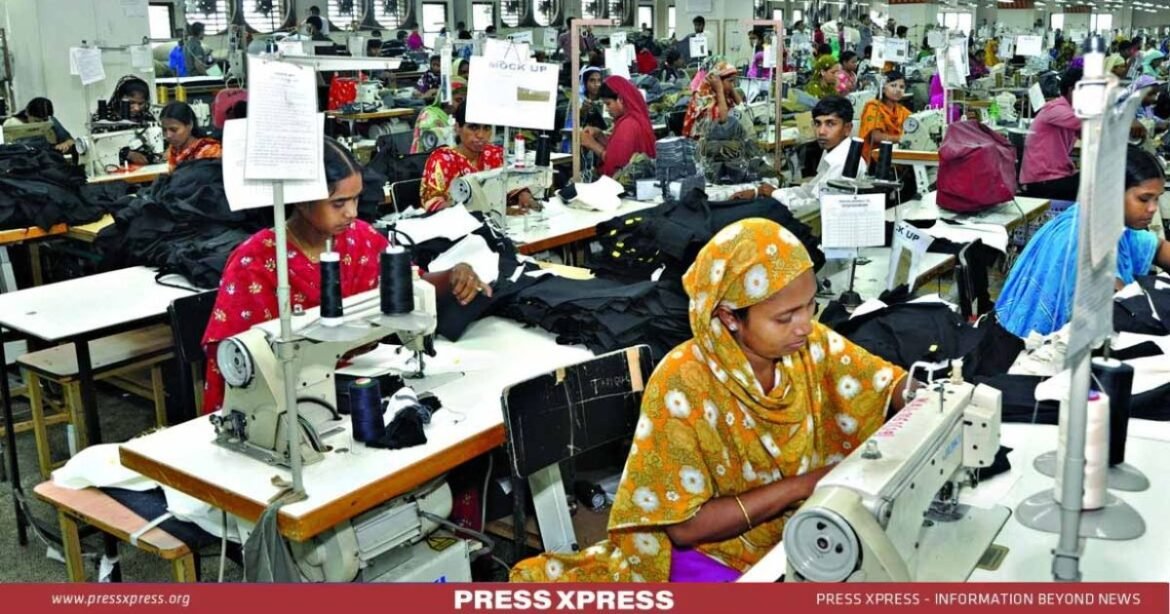

Bangladesh’s textile and apparel sector is a vital component of the national economy and a significant player in the global textile and clothing market. In the fiscal year 2021-2022, the country achieved garment exports worth US $42.613 billion, solidifying its position as the world’s second-largest apparel exporter, according to data from the Export Promotion Bureau. This sector is also a major source of employment, with over 4 million individuals working in it. In the first eight months of 2022, BD ready-made garment (RMG) exports reached $29.825 billion, a notable 38.39% increase compared to the previous year.

The United States is the primary destination for Bangladeshi garment exports, accounting for about 21.50% of the total exports. The European Union, particularly Spain, Germany, Italy, France, Belgium, and the Netherlands, is the second-largest export destination, followed by the UK and Canada.

Projections suggest that Bangladesh’s textile and garment industry will continue to grow and is expected to capture over 10% of the global market share by 2025, as reported by BGMEA. The industry also stands to benefit from the evolving global sourcing practices, with more countries seeking to diversify their supply chains. For that, Bangladesh wants to achieve the ambitious goal of $100 billion in apparel exports by 2030. To achieve the ambitious goal of $100 billion in apparel exports by 2030, proactive measures from the government and industry stakeholders are crucial.

Bangladesh International Garment & Textile Industry Exposition

The 7th Bangladesh International Garment & Textile Industry Exposition commenced on October 26, 2023, at the International Convention City Bashundhara in Dhaka. This three-day event, running from 10:30 a.m. to 7:30 p.m. daily, welcomes both general and trade visitors.

The expo presents around 160 stalls representing 12 countries across Asia and Europe. These stalls exhibit the latest machinery, technologies, dyes/chemicals, yarn, and fabric available for the Bangladeshi market, and they feature manufacturers and suppliers from around the world.

Freedom Fighter Mohammad Mozaffar Hossain, MP, inaugurated the exhibition. The primary goal of this exhibition is to target untapped markets that are flexible and significant for Bangladesh. Additionally, participants have the opportunity to establish business contacts for potential future negotiations. Concerns about Instigators

A notable concern voiced by apparel manufacturers is the presence of individuals attempting to destabilize the industry and incite labor demonstrations. These actions not only disrupt production but also impact the nation’s economic stability and law enforcement. Identifying and bringing these instigators to justice is imperative.

Bangladeshi Garment Sector’s Remarkable Progress

In 2020, Bangladesh lost its second-place position as an apparel exporter to Vietnam, with earnings of $27.47 billion compared to Vietnam’s $29.80 billion. However, Bangladesh reclaimed the second spot in 2021, boasting export earnings of $35.81 billion, which it successfully defended in 2022. Bangladesh’s share of the global apparel market now stands at 7.9 percent.

According to the World Statistical Review 2023 by the WTO, Bangladesh secured the second position in garment exports globally, recording $45 billion in apparel exports in 2022, with China maintaining its top position.

The World Trade Statistical Review 2023 report provides insights into the top 10 countries in apparel exports. China continued to dominate the global clothing export market in 2022, with apparel exports worth $182 billion, though its share declined from 32.8% in 2021 to 31.7% in 2022. Vietnam remained in third place with $35 billion in apparel exports and a 6.1% market share. Turkey emerged as the fourth-largest apparel exporter with a 3.5% market share and $20 billion in exports. India closely followed with a 3.1% market share and $18 billion in apparel exports.

The WTO report also highlighted fluctuations in the market share of leading countries in global apparel exports, comparing statistics from 2000, 2005, 2010, and 2022. China’s market share rose from 18.2% in 2000 to 36.6% in 2010 but declined to 31.7% in 2022.

Bangladesh’s Growing Apparel Export

In fiscal year 2022, Bangladesh’s exports to Japan witnessed a substantial increase, reaching $754.72 million, marking a remarkable 42.54% year-on-year growth from the previous year’s figure of $529.46 million. Notably, Bangladesh achieved a significant milestone by earning $1.09 billion through apparel exports to Japan. This growth is further supported by Japanese ready-made garment (RMG) manufacturers relocating their overseas production from China due to rising labor costs and stringent zero-Covid policies.

Bangladesh’s Export year-on-year growth in fiscal year 2022

| Japan | 42.54% |

| India | 49.99% |

| Australia | 29.52% |

| South Korea | 35.66% |

| Mexico | 51.12% |

Japan’s total apparel imports from global sources in 2021 amounted to $23.83 billion, with Bangladesh capturing a notable 4.58% market share. Japan remains a vital destination for Bangladeshi exports due to its strong purchasing power and dual significance as an emerging and high-value market.

Bangladesh’s exports to India also experienced robust growth, with earnings reaching $548.87 million in the first half of fiscal year 2022-23, reflecting a significant 49.99% year-on-year increase. This growth is attributed to India’s improving socio-economic conditions, which have led to increased production costs and a more import-oriented approach.

Moreover, exports to Australia, South Korea, and Mexico showed substantial growth, with increases of 29.52%, 35.66%, and 51.12%, respectively. Australia’s imports of apparel items from global suppliers, amounting to $7.8 billion in 2021, indicate expanding opportunities for Bangladesh’s apparel industry.

Conclusion

Despite challenges such as rising production costs and energy prices, Bangladesh maintains its position as the world’s second-largest apparel exporter, following China. This achievement is credited to Bangladesh’s focus on value-added products and the redirection of orders from China. The expectation is that exports will continue to grow with essential government support, including consistent energy provision and favorable tax and duty policies.

The ready-made garment industry in Bangladesh is on a path to achieving its ambitious goal of $100 billion in exports by 2030. Despite global economic challenges, this sector continues to thrive. Addressing non-tariff issues and eliminating instigators of labor demonstrations are essential steps in securing this growth. Furthermore, resolving issues related to customs, cargo handling, and energy supply will pave the way for a stronger RMG sector, benefiting both the industry and the nation as a whole. The BIGTEX Exposition serves as a pivotal platform to unite industry stakeholders and move towards this shared vision of success.