…if government fiscal responsibility falters and central banks refrain from intervening, we must prepare for potential financial instability, inflation, or a mix of both

In October, the world’s focus shifts to the annual World Bank and IMF meetings, hosted this year in Marrakesh, Morocco. These gatherings unveil crucial global economic reports, portraying a complex picture of hope and concern, building toward an exciting climax. The narrative shows a slowing global economy, with persistent weaknesses in China and Europe causing uncertainty. Additionally, geopolitical conflicts in places like Gaza and Ukraine have surged, leading to higher oil prices, with Brent crude surpassing $90 per barrel.

The question that looms large is, how robust is the global financial system?

You can also read: Currencies in Crisis: Top 15 Global Underperformers of 2023

A Wake-up Call For Financial World

Earlier this year, the financial world felt unsettling tremors, notably at Silicon Valley Bank (SVB) and Credit Suisse, revealing underlying issues. However, quick actions by the Federal Reserve and Swiss authorities restored confidence. Now, amidst expectations of “higher for longer” interest rates, American and European stocks have surged by 10-12% since the year began, and overall financial conditions have improved due to accommodative monetary policies.

But the October 2023 IMF Global Financial Stability Report raises a cautionary flag about lingering vulnerabilities. Global real estate values have grown to three times the world’s GDP, making a 10% decline in real estate prices a potential shock, affecting 30% of global GDP, given that real estate often backs bank credit. The IMF reports an 8.4% drop in advanced economies’ house prices and a milder 2.4% decline in emerging markets. With interest rates nearly 500 basis points higher than in 2021, the long-term impact on real estate, especially in the commercial sector, will become apparent in the coming months.

The IMF’s scope goes beyond this, delving into the effects of climate change on bank assets.

Stability On A Knife’s Edge

A pressing global financial challenge is raising the $2 to $4 trillion needed for climate action amidst growing natural disasters and conflicts, with credit risk premiums falling short. The Financial Stability Board (FSB), formed after the 2008 crisis, released its annual report, claiming its actions in March 2023 prevented more severe financial turmoil sparked by the SVB and Credit Suisse crises. However, ongoing vulnerabilities persist in the global financial system, exacerbated by shifting risk nature, including climate-related and cyber threats, and increased focus on the crypto-asset market.

The crescendo in the global financial symphony signals the delicate balance of our financial system, with challenges and opportunities, risks and rewards, and the far-reaching impact of today’s decisions on the future financial world.

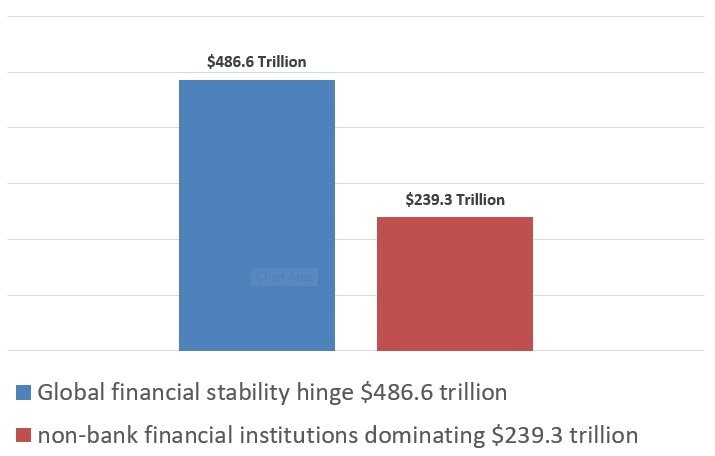

Global financial stability hinges on a massive $486.6 trillion financial system, with non-bank financial institutions (NBFIs) dominating at $239.3 trillion, representing 49.1% of total financial assets. This division shows a contrast between tightly regulated banking system assets and less regulated NBFIs.

Blindspots And The Interest Rate Impact

Following the 2008 financial crisis, the Financial Stability Board (FSB) attempted to regulate non-bank financial institutions (NBFIs) but encountered resistance from powerful fund managers. They were concerned that regulatory arbitrage might shift systemic risks to NBFIs, where hidden leverage could cause trouble. The fear of runs on money market funds during liquidity crises worried central banks, as issues in under-regulated finance could spread contagion and threaten the entire banking system.

Now, the Center for Financial Stability, a non-profit institution, has released two significant reports: “Supervision and Regulation after Silicon Valley Bank” and “The Role of Monetary and Fiscal Policies in Recent Bank Failures.” These insights, authored by experts including Sheila Bair, former chair of the FDIC, and LSE Professor Charles Goodhart, highlight groupthink and blindspots as contributing factors to the collapse of financial giants like SVB, Signature Bank, and First Republic. They criticize financial regulators for overlooking the impact of rising interest rates on financial stability.

True Culprits Of The Crises

Regulators tend to blame bank management for poor risk management, but astute bank supervisors could have detected vulnerabilities within failing banks. Early signs of SVB’s weaknesses appeared in the stock market as early as November 2021.

With hindsight, it’s clear that the lenient fiscal and monetary policies during the turbulent Covid era encouraged ill-fated banks to make risky investments in long-term treasuries, which appeared low-risk but concealed high duration and interest rate risks. When the Federal Reserve raised interest rates rapidly, these banks faced the consequences of their perilous choices.

In the realm of central bank monetary policy and financial stability, particularly macro-prudential policies, there’s a concern about the expanding “safety net” provided by central banks. This expansion involves central banks using their balance sheets to acquire a variety of assets. For instance, the Federal Reserve’s Bank Term Funding Program (BTFP) was established after SVB’s failure in March 2023 to provide support to banks facing significant unrealized losses from government bond holdings, making them susceptible to large deposit withdrawals. The BTFP allowed banks to exchange assets like US Treasuries for cash at face value, disregarding their market value. Essentially, the crisis was resolved by shifting mark-to-market losses from banks to the Federal Reserve’s balance sheet.

Who Bears The Weight Of Central Bank Actions?

The heart of the matter lies in the perceived stability of the global financial system. Central banks have significantly expanded their balance sheets to $44 trillion, comprising 9.1% of global financial assets. This shift involves absorbing substantial government and private debt burdens, with some central banks already facing marked-to-market losses. The central issue is this: if governments with reserve currencies maintain unsustainable fiscal deficits backed by unsustainable debt, who will ultimately bear these looming losses? What we witness is the transfer of private risks to the public ledger.

In the investor realm, there’s a dangerous complacency. Many seem indifferent to lurking financial risks, accumulating modest gains under the assumption that central banks will always provide protection. However, if government fiscal responsibility falters and central banks refrain from intervening, we must prepare for potential financial instability, inflation, or a mix of both.

The stage is set for a dramatic climax, a showdown that could shake the foundations of our global financial system. The unfolding narrative is one of delicate balance, uncertain outcomes, and the looming question of who will shoulder the consequences of our collective financial decisions.