The release of the hostages was cited as a humanitarian gesture by Hamas in response to Qatari mediation efforts in the ongoing conflict with Israel.

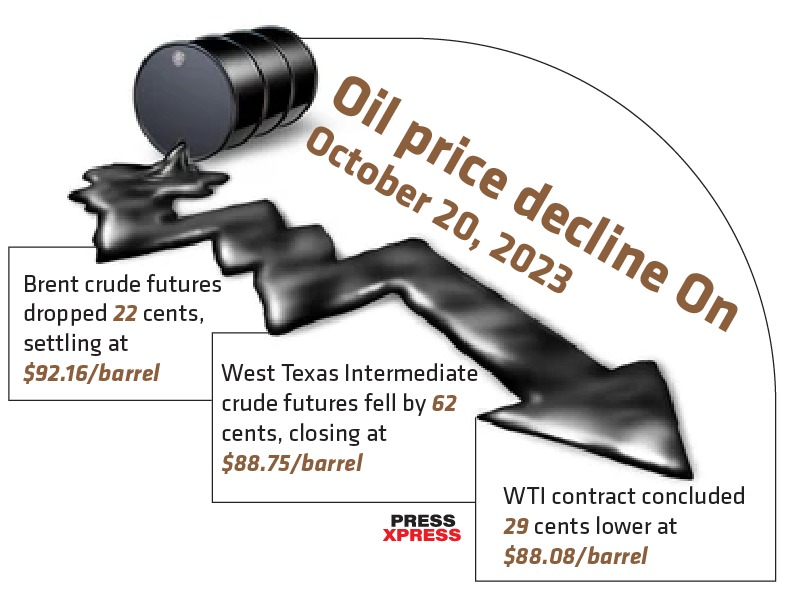

Oil prices declined on Friday, October 20, 2023, following the release of two U.S. hostages from Gaza by Hamas. This development has raised hopes that the Israeli-Palestinian crisis may de-escalate without spreading further across the Middle East and disrupting oil supplies. Brent crude futures dropped 22 cents, settling at $92.16 per barrel.

U.S. West Texas Intermediate crude futures for November delivery, which expired after settlement on Friday, fell by 62 cents, closing at $88.75 per barrel. The more-active December WTI contract concluded 29 cents lower at $88.08 per barrel.

You can also read: Saudi Arabia’s Role in De-Escalating the Israeli-Hamas Crisis

Hamas’ armed wing released the two U.S. hostages – a mother and her daughter – citing “humanitarian reasons” in response to Qatari mediation efforts in the ongoing conflict with Israel, according to the group’s spokesman, Abu Ubaida.

Fear of oil supply disruption persists

Phil Flynn, an analyst at Price Futures Group, noted, “The report took some of the risk premium out of the market. The market shifted from starting the day with little hope to seeing possible signs of a way out of this crisis.”

Both oil contracts had earlier surged by over a dollar per barrel during the session due to concerns about the escalating conflict. Over the week, both front-month contracts recorded a second consecutive weekly increase of over 1%.

On Thursday, October 19, 2023, Israeli Defence Minister Yoav Gallant hinted at an impending development at the Gaza border, while the Pentagon reported intercepting missiles fired from Yemen toward Israel.

John Kilduff, a partner at New York-based Again Capital, stated, “The Middle East remains a significant concern for the market due to fears of a region-wide conflict that could disrupt oil supplies.”

Although supply disruptions may now appear less likely, Kilduff emphasized that the market must remain vigilant, especially over the weekend when circumstances can change rapidly, and trading is halted. Price support was also derived from predictions of a tightening market in the fourth quarter, as top producers Saudi Arabia and Russia extended supply cuts through the year.

UBS analyst Giovanni Staunovo pointed out significant inventory draws, primarily in the U.S., supporting the notion of an undersupplied market. UBS expects Brent prices to trade within the $90 to $100 per barrel range in the upcoming sessions.

Additionally, the U.S. Commodity Futures Trading Commission (CFTC) reported that money managers reduced their net long U.S. crude futures and options positions by 56,850 contracts to 183,351 in the week ending October 17.

A rollercoaster week for oil

In a previous update, oil prices surged above $91 per barrel on Monday as diplomatic efforts to address the Middle East crisis intensified, only to later slip back, dropping below $90. This decline was prompted by reports suggesting that the U.S. was nearing a deal to ease sanctions on Venezuela.

On 16 October, prices took a downturn following a report in the Washington Post, indicating that the United States and Venezuela had reached an agreement to relax restrictions on Venezuela’s oil industry in exchange for a more open presidential election in the country next year.

Brent crude futures, the global oil benchmark, soared to as high as $91 a barrel during Asian trading hours on Monday, a slight increase from October 13, Friday’s closing price of $90.89.

Potential impact of Middle East conflict on oil supply worries analysts

Investors remain on edge, fearing that the Israel-Hamas conflict could escalate into a broader regional war, leading to a further squeeze on global oil supply. The surge in oil prices on Friday was triggered by Israel’s military warning to over a million people in northern Gaza.

US National Security Adviser Jake Sullivan stated that while there was no new intelligence indicating a change in the threat level from Iran, there is a genuine risk of an escalation in the conflict. ANZ Research analysts anticipate oil prices hitting $100 per barrel in the near term due to the escalating regional risks.

While neither Israel nor Gaza is a major oil supplier, the threat to oil markets would significantly increase if the conflict were to expand, as highlighted in their research note recently. They noted that if Iran were to become involved, up to 20 million barrels per day of oil could be at risk of disruption directly and through obstructed logistics.

Managing Partner at SPI Asset Management, Stephen Innes, emphasized that the “Middle East risk” is currently the dominant factor influencing global asset prices. He further pointed out that the ongoing conflict could exert even greater pressure on global oil supply over time. It can further potentially reduce the likelihood of Saudi-Israeli normalization and presenting downside risks to Iranian oil production, possibly leading to a further surge in oil prices.

Since late June, global oil prices have been rising, fuelled by production cuts from Saudi Arabia and Russia, which have raised concerns about reduced global supply. Additionally, new US measures unveiled last week aimed at increasing the cost of Russia’s attempts to bypass a cap on the price of its oil may have further contributed to the upward trend in oil prices.

In the currency markets, the shekel experienced a weakening on Monday, dropping below 4 per US dollar for the first time since 2015. The Israeli currency has depreciated by close to 4% in the past 10 days. Israel’s central bank announced last week that it intends to sell up to $30 billion of foreign exchange to stabilize the shekel after it saw a sharp decline following the attacks by Hamas.

On the other hand, US stocks closed higher on Monday, as investors seemed to shrug off concerns about escalating geopolitical tensions in the Middle East. The Dow closed 314 points, or 0.9%, higher; the S&P 500 saw a 1.1% increase, and the Nasdaq Composite gained 1.2%.