The government and the Bangladesh Bank are confident that a review of the reasons why requirements were not met in the two sectors will result in no problems receiving the second tranche of money from the International Monetary Fund (IMF).

As part of the process for releasing the second tranche of the $4.70 billion loan, a delegation from the International Monetary Fund (IMF) is currently studying Bangladesh’s economic performance with an emphasis on foreign exchange reserves. Bangladesh could not fulfill two pivotal conditions set by the International Monetary Fund (IMF) to secure the next part of its financial assistance package.

You can also read: Bangladesh Bank embraces dual foreign exchange reserve calculation methods

Concerns have been raised about the potential repercussions if the second installment is not timely received. In contrast, the facts indicate that the situation should be under control, as the Bangladesh Bank (BB) actively offers explanations for the non-fulfillment of these conditions.

Bangladesh is not in critical economic jeopardy despite difficulties in meeting the conditions set by the International Monetary Fund (IMF) for a $4.7 billion budget support package. The government and the Bangladesh Bank are confident that a review of the reasons why requirements were not met in the two sectors will result in no problems receiving the second tranche of money from the IMF.

Understanding Bangladesh Bank’s response

Together with the National Board of Revenue (NBR), Bangladesh Bank has been striving to meet the IMF’s requirements for the budget support package. However, it was revealed at the most recent IMF meeting that two conditions had not been fulfilled.

Bangladesh Bank has not yet met one of these crucial conditions, which required a minimum of $25.32 billion in net international reserves by September 30. According to data from the Bangladesh Bank as of Tuesday, October 3, the reserves stood at $26.93 billion, whereas the IMF-recommended formula, the Balance of Payments and International Investment Position Manual (BPM6), calculated the reserves at $21.03 billion.

Another difficulty was, that the National Board of Revenue (NBR) collected Tk14,000 crore less than the IMF’s revenue projection for the last fiscal year. This required NBR to collect an additional 0.5% of GDP-related revenue in the current fiscal year. According to the IMF’s conditions, the NBR will be required to collect approximately Tk25,000 crore more in revenue than planned in FY24.

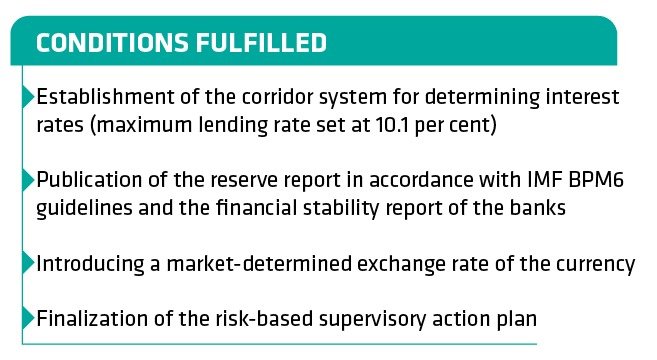

Nonetheless, Bangladesh Bank has made considerable progress in achieving several other IMF objectives, including implementing an interest rate corridor system and issuing financial stability reports. Bangladesh Bank has effectively met a number of IMF requirements, and some requirements are currently being implemented. In addition, a market-fixed exchange rate for the currency was implemented.

“The IMF gave us some conditions while approving the loan, some of these have been fulfilled.”

Bangladesh Bank’s Executive Director and spokesperson Mezbaul Haque told reporters on Wednesday

“I have mentioned the conditions given by the IMF which have been achieved and those which have not been achieved. It has also been informed why it did not happen,” said Mezbaul.

| IMF loan tranches and conditions Bangladesh obtained a $4.7 billion loan from the IMF, which was comprised of $3.3 billion under the ECF/EFF programme and $1.4 billion under the Resilience and Sustainability Facility (RSF) programme for climate resilience. The loan comes with certain conditions aimed at stimulating growth, lowering inflation, increasing competitiveness, and addressing balance of payments issues. These conditions consist of fiscal austerity measures, monetary policy reforms, reforms of the financial sector, and climate-related expenditures. |

Risk Assessment

Resilience to climate change: Bangladesh is at the forefront of addressing climate change and has made significant progress in implementing climate-related policies. Bangladesh has developed a National Adaptation Plan (NAP) and approved a Resilience and Sustainability Facility (RSF) arrangement to support climate resilience initiatives. The RSF aims to increase fiscal resources, bolster institutions, and strengthen the financial sector’s resilience to climate-related risks.

The IMF has allocated a portion of the loan to support climate resilience initiatives in recognition of Bangladesh’s efforts in this regard. The IMF also commended Bangladesh’s prioritization of climate-responsive public investment management reforms and enhanced climate fiscal management in order to promote green and resilient infrastructure.

Debt-to-GDP ratio: The most recent World Economic Report reveals that Bangladesh maintains a debt-to-GDP ratio of 26.9%, which is lower than neighbouring countries such as India, Pakistan, and Sri Lanka. This ratio indicates a nation’s capacity to manage its debt, thereby reducing the danger of financial instability.

“Bangladesh is at low risk of debt distress even if the current growth and financing conditions change in unfavourable ways but within foreseeable bounds,”

Zahid Hussain

Former lead economist at World Bank Bangladesh

Economic stability: The economic stability of Bangladesh is evident in its consistent development over the past decade. The IMF loan is intended to assist with addressing temporary difficulties, and the government is taking steps to strengthen fiscal and monetary policies. The government’s commitment to reform, including increased tax collection and the elimination of inefficient subsidies, demonstrates Bangladesh’s fiscal prudence. These measures not only comply with IMF conditions, but they also allow for the reallocation of funds to vital social programmes.

Salman F. Rahman, advisor to the prime minister, has stated that the new government intends to implement necessary financial sector reforms following the elections in order to address inflationary pressures and reserve challenges. Nevertheless, he has also expressed confidence that there are no impediments to obtaining the second installment of the IMF loan.

The monetary policy reforms of Bangladesh, such as the interest rate corridor system and the unification of the exchange rate, promote financial sector stability and transparency, thereby fostering an investment-friendly environment. The robust export sector, especially the garment industry, is a reliable source of foreign exchange earnings. Efforts to diversify the economy beyond traditional sectors also contribute to resilience.

The International Monetary Fund (IMF) review team led by its senior economist in the Asia Pacific Department, Rahul Anand, will assess the accomplishments and failures of the goals and establish new ones for December and June 2024. As Bangladesh missed the overall condition fulfillment with a narrow margin in two cases only, it appears that the nation will be less likely to face any repercussions with an IMF loan.

Lastly, the IMF loan is intended to assist the nation in overcoming short-term obstacles and investing in long-term resilience. Bangladesh is well positioned for future development due to its efforts to combat climate change, maintain a favourable debt-to-GDP ratio, and maintain economic stability. It is essential to evaluate the IMF’s conditions in light of the country’s specific circumstances and commitment to sustainable development.