In September 2023, there was a noticeable decrease in the persistent inflation affecting Europeans, raising hopes that consumers might eventually see relief from increased expenses on groceries, vacations, and haircuts. Additionally, this decline may alleviate concerns about the European Central Bank resorting to further economic constraints through interest rate hikes, especially given the already-record-high rates.

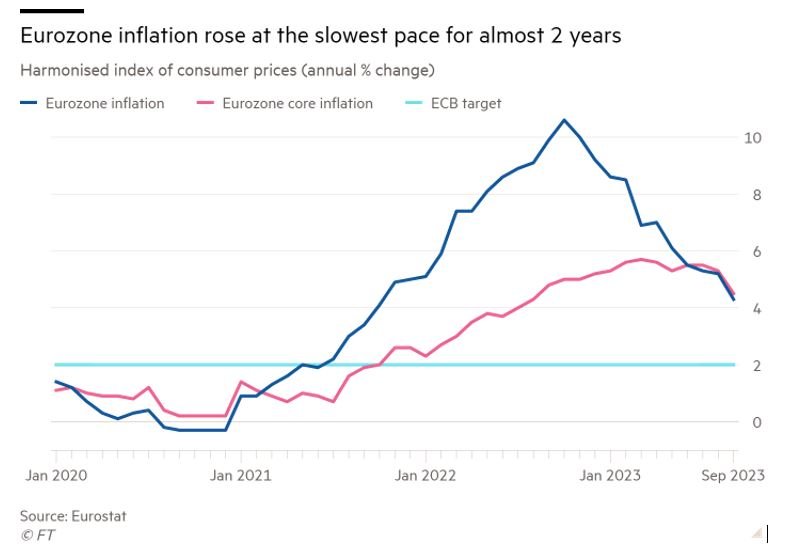

This month, the annual inflation rate stands at 4.3%, showing a decrease from the previous month’s 5.2%. However, the recent surge in oil prices is casting doubts on the feasibility of bringing inflation back down to the central bank’s target of 2%.

According to Pantheon Macroeconomics’ senior eurozone economist Claus Vistesen, “This likely is the beginning of an accelerated decline” in eurozone inflation. According to him, the most recent statistics will force a downward revision to inflation forecasts, and the European Central Bank’s forecast of 2.9 percent core inflation in 2024 “is a sitting duck.”

Country-wise Inflation

Inflation in the eurozone, which reached its highest point at an annual rate of 10.6 percent last year, has been gradually decreasing over the past year.

Core inflation, a more dependable gauge of underlying price pressures as it excludes the volatile categories of food and energy, has also shown a recent decline. It stood at 4.5 percent in September, down from 5.3 percent in August.

Germany has seen a significant decline, whereas Italy and Spain have seen increases.

Germany

Germany, the largest economy in Europe, saw its annual inflation rate drop to 4.3 percent in September, down from 6.4 percent in August. This substantial decrease is partly attributed to the fact that the figures are calculated on an annual basis. The yearlong program of subsidized rail fares that concluded in June had driven up inflation rates during the previous summer, but this effect was no longer present in the annual comparison for this month.

France

France’s inflation rate decreased from 5.7 percent to 5.6 percent compared to the previous month, while Italy’s rate rose from 5.5 percent in August to 5.7 percent.

Spain

Spain, which has experienced some of the lowest inflation rates in Europe this year, saw inflation rise for the third consecutive month, reaching 3.2 percent in September. The main factors behind this increase were rising electricity and fuel costs, according to the country’s National Statistics Institute.

Croatia

Croatia had the highest inflation rate in the eurozone at 7.3 percent, while the Netherlands was the only country where prices were lower than they were a year ago, with a negative rate of -0.3 percent.

Italy

Italy’s rate rose from 5.5 percent in August to 5.7 percent.

High interest rates are expected to persist for a while

Slowing inflation is likely to strengthen the belief that the E.C.B. might halt its campaign of raising interest rates further during its October meeting. However, it’s improbable that the elevated interest rates, which have been putting pressure on businesses and consumers, will start to decrease in the near future. Christine Lagarde, the central bank’s president, indicated this week that rates won’t be lowered until inflation moves closer to the bank’s 2 percent target.

“This is not a short-term endeavor,” Ms. Lagarde remarked regarding efforts to control inflation. “It’s a lengthy race we’re engaged in.”

The bank raised its deposit rate for the tenth consecutive time this month in its ongoing effort to combat inflation. Elevated rates increase the cost of borrowing for business expansion or purchasing items like houses, cars, or appliances on credit. This added cost curtails demand but carries the risk of rising unemployment. High rates are particularly burdensome for households with variable mortgage rates, comprising about one-third of mortgage holders in the European Union.

Consumer confidence decreased in September for the second consecutive month, according to the European Commission’s report on Thursday. Some economists are now questioning the appropriate response to persistent price increases. Europe’s inflation is driven by a series of unusual factors, including disruptions in supply chains related to the pandemic and surging energy prices following Russia’s invasion of Ukraine. It takes time for prices to readjust.

The latest Geneva Report on the World Economy, released on Thursday by a nonpartisan network of economic researchers, argues that central banks, especially in the euro area, should exercise more patience and allow prices the time to adapt.

In Conclusion, In September 2023, Europe witnessed a promising decrease in inflation, offering hope for relief to consumers burdened by rising expenses. The decline may also reduce concerns about the European Central Bank resorting to interest rate hikes. However, challenges persist as oil prices surge, impacting the feasibility of achieving the bank’s 2% target. While this decline in inflation is a positive development, it underscores the need for continued vigilance and patience in addressing the complex factors driving price increases in the eurozone.