In an era marked by the rapid growth of digital transactions, Bangladesh Bank (BB) has taken a significant step forward by formulating robust digital payment policies. These policies not only ensure the safety of customers and businesses engaging in online product and service sales but also establish clear guidelines for refunds and penalties.

According to the circular, When a customer cancels an order after making a digital payment, they are entitled to a refund. This refund must be processed within a maximum of three days, ensuring customer satisfaction and trust.

To maintain the integrity of the policy, Bangladesh Bank holds the authority to suspend or revoke the licenses of Payment Service Operators (PSOs), Payment Service Providers (PSPs), or Mobile Financial Service (MFS) institutions that do not adhere to the policy accurately.

This strict enforcement emphasizes the central bank’s commitment to safeguarding the interests of customers and businesses.

On Tuesday, The Payment System Department of Bangladesh Bank issued a comprehensive circular outlining these policies.

The circular’s objective is to promote the secure, effective, and convenient use of digital payment systems for customers.

Introduction of the “Merchant Acquiring and Escrow Service Policy, 2023”

With digital payments becoming increasingly popular for everyday transactions, BB has introduced the “Merchant Acquiring and Escrow Service Policy, 2023.”

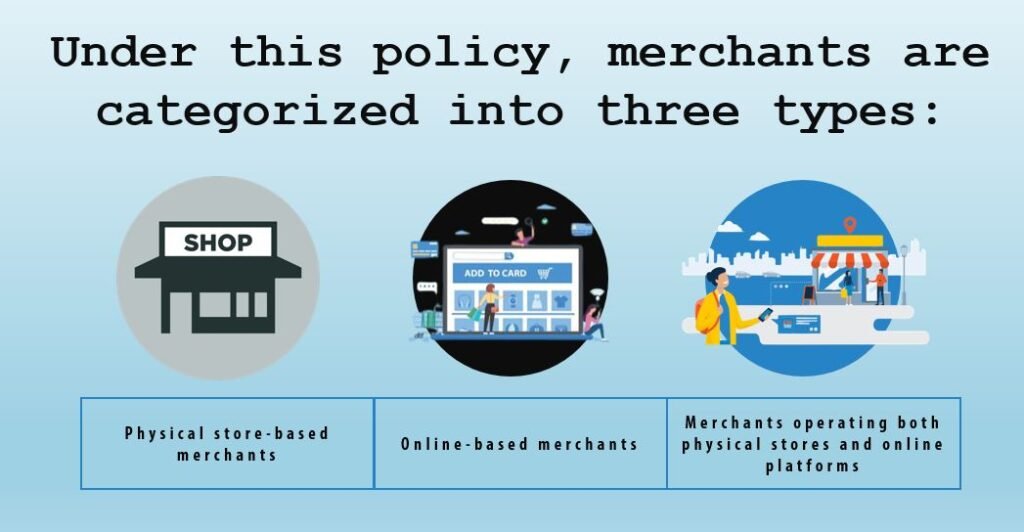

This policy aims to set standards for merchants and their operations in the digital payment ecosystem.

Addressing Risks in Merchant Business Operations

BB recognizes that merchant transactions come with inherent risks such as customer exploitation, money laundering, and fraud.

To mitigate these risks, payment service providers (e.g., bKash, Nagad, Rocket) and merchant acquirers must maintain essential information about the merchants.

For these reason Merchants are required to provide crucial information, including:

- Merchant’s name.

- Permanent and current address.

- National identification card.

- Taxpayer identification number (TIN).

- Personal retail account.

- Digital business identification number.

- Up-to-date trade license (where applicable).

- Certificate of incorporation and business identification number (BIN) (where applicable).

Risk Assessment of Merchants

Acquirer institutions are tasked with assessing the risk associated with each merchant at the end of each fiscal year.

Acquirer institutions will also monitor responsible for monitoring the business activities of merchants on an ongoing basis.

For physical regular merchants with monthly transactions exceeding Tk10 lakh, any monthly transaction growth exceeding 40 percent will trigger an explanation requirement.

Unsatisfactory responses may lead to transaction suspensions after a site visit.

Controlled Transaction Growth for Online Merchants

To ensure stability in the digital payment ecosystem, the central bank has set specific transaction growth rate limits.

Online regular merchants with monthly transactions exceeding Tk10 lakh must not exceed a 30 percent monthly transaction growth rate.

Online marketplaces are urged to keep their monthly transaction growth rate within 25 percent.

Bangladesh Bank’s proactive approach in formulating these digital payment policies underscores its commitment to ensuring the security, effectiveness, and ease of access for customers engaging in digital transactions. These policies not only establish clear guidelines for refunds and penalties but also address the unique challenges associated with different types of merchants, creating a safer and more transparent digital payment ecosystem for all stakeholders.