In the context of emerging Asian economies, Bangladesh is often overlooked. Nonetheless, recent economic indicators and prevailing trends are pointing towards significant growth opportunities, positioning this South Asian nation as a potential top contender in the region’s economic landscape. Bangladesh, with a total GDP of USD 460 billion, ranking second in South Asia, and a GDP per capita of USD 2,734, clearly showcases its economic potential.

You can also read: ADB Distinguishes Strides in Utilizing Funds

On 20 September, the Asian Development Bank announced that it has revised its growth forecast for Bangladesh’s economy to 6.5 percent for the current fiscal year. In its recently released “Asian Development Outlook (ADO) September 2023” report, the global lending institution provided its latest projection.

ADB’s projections indicate that Bangladesh’s GDP is poised to grow at a rate of 6.5% in fiscal year 2024, surpassing the estimated 6% growth in the previous fiscal year, 2023.

Factors driving growth

The ADB reported that the growth outlook points to an upswing in domestic demand and a more robust export performance, driven by the economic resurgence in the Eurozone. Bangladesh’s economy in fiscal year 2022 saw a boost from exports, remittances, and domestic consumption, resulting in a 7.1% growth in gross domestic product, up from 6.9% in FY 2021.

Export-driven sectors are pivotal to fueling Bangladesh’s economic expansion. Significant infrastructural enhancements and the creation of Special Economic Zones and Export Processing Zones have notably improved connectivity and business-friendly conditions in the nation.

The Ready-Made Garments (RMG) sector in Bangladesh shines brightly, making up a remarkable 82% of the country’s total exports in 2023. Bangladesh’s strong export performance has allowed it to reach customers in 181 nations around the world. Besides, Bangladesh has effectively controlled its debt. Furthermore, the government’s ambition to attain a trillion-dollar economy by 2040 underscores its commitment to long-term growth and development.

Inflation to ease up

The report suggests that inflation is likely to see a reduction from 9.0 percent in FY2023 to 6.6 percent in FY2024. As per the report, the current account deficit is predicted to narrow slightly, moving from 0.7 percent of GDP in FY2023 to 0.5 percent of GDP in FY2024 due to improved remittance growth. Anticipated factors such as a decrease in global nonfuel commodity prices, an expected boost in agricultural production, and the initial implementation of a more stringent monetary policy framework are projected to lead to a reduction in inflation.

Contributors to economic revival

This growth was tempered by the global economic slowdown triggered by the Russian invasion of Ukraine, leading to an expanded external trade deficit and increased inflation within Bangladesh. Edimon Ginting, the ADB Country Director, expressed that the government is handling external economic uncertainties adeptly, all the while pushing forward with infrastructure development and vital reforms to bolster the investment landscape.

These critical structural reforms, including strengthening public financial management, increasing domestic resource mobilization, optimizing logistics, and deepening the financial sector, are essential for fostering private sector growth, diversifying exports, and facilitating the creation of productive employment in the medium term.

He also remarked that the sustained high oil prices create a favorable environment for accelerating reforms to expand domestic renewable energy supply and achieve the nation’s climate change goals.

ADB’s warning on heightened risks in developing Asia

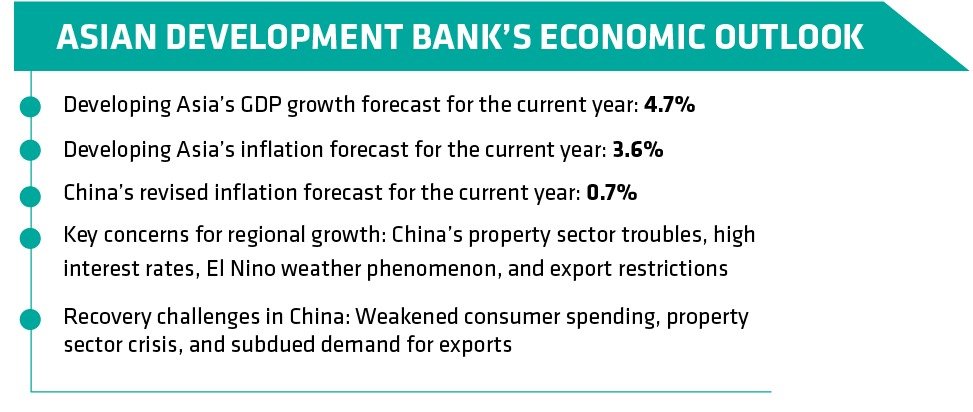

The Asian Development Bank, based in Manila, reduced its growth expectations for Developing Asia due to increased risks stemming from China’s property market troubles and elevated global interest rates. In its latest forecast update for this year and the next, the bank has highlighted an increased level of risk to the economic outlook. It specifically pointed out vulnerabilities in China’s property sector, which could impede regional growth.

Developing Asia includes a diverse group of 46 emerging member economies, extending from Central Asia’s Kazakhstan to the Pacific’s Cook Islands within the purview of the multilateral lender.

GDP growth forecast

The bank now forecasts a 4.7% GDP expansion this year, down slightly from its April estimate of 4.8%. However, it was faster than the growth rate of 4.3% recorded last year.

The ADB anticipates a drop in inflation to 3.6% for this year, down from 4.4% the previous year, signaling a deceleration in economic activity. The bank has significantly revised its inflation projection for China, now estimating it to be only 0.7% for this year, a sharp decrease from the April forecast of 2.2%.

Factors contributing to regional economic uncertainty

In its most recent report on economic forecasts, the bank expressed concerns about heightened risks. Notably, it mentioned that weaknesses in China’s property sector could impede regional growth. Other challenges cited in the report included the impact of high-interest rates and potential threats to food security resulting from the El Nino weather phenomenon, along with export restrictions imposed by certain countries.

After China, the world’s second-largest economy eased its strict zero-Covid policies in late 2022, there was a notable upswing in consumer confidence. The recovery process in China has become more intricate due to weakened consumer spending, a crisis in the extensive property sector, and subdued demand for Chinese exports.

Official data revealed that China experienced a momentary deflationary episode in July, marking the first occurrence in over two years, as prices fell by 0.3% on a yearly basis. Fortunately, it swiftly recovered in the subsequent month.

To wrap up, Bangladesh is emerging as a significant player in the Asian economy, with positive growth prospects driven by exports, infrastructure development, and economic reforms. However, it remains exposed to external risks, including those stemming from the broader Asian economic environment, particularly China’s economic challenges and global market conditions. Bangladesh’s ability to navigate these challenges and continue its growth trajectory will be critical to its future economic success.