Within the Government of Bangladesh’s Cabinet Division, the Executive Committee of the National Economic Council (ECNEC) plays a pivotal role. It undertakes the evaluation, endorsement, and promotion of crucial development projects of national significance, regardless of their economic context and activities within Bangladesh. Furthermore, ECNEC is responsible for project formulation, evaluation, and approval.

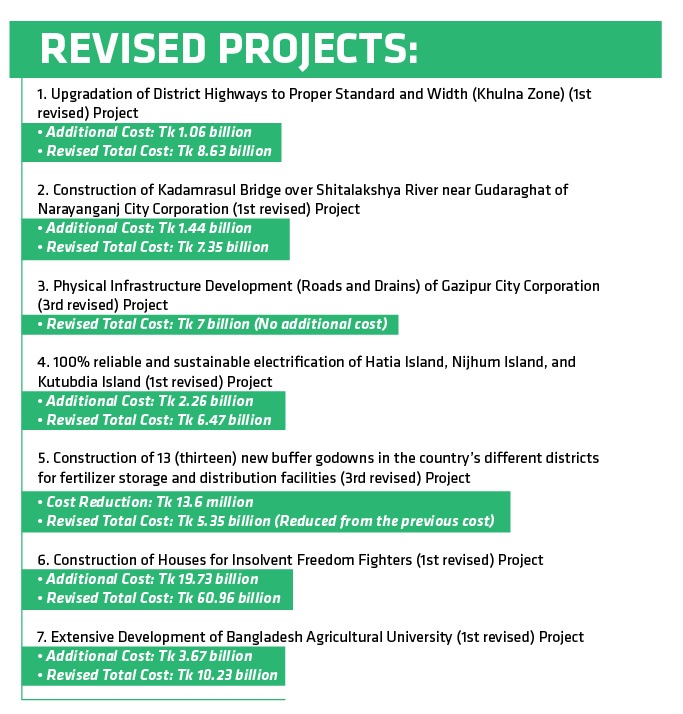

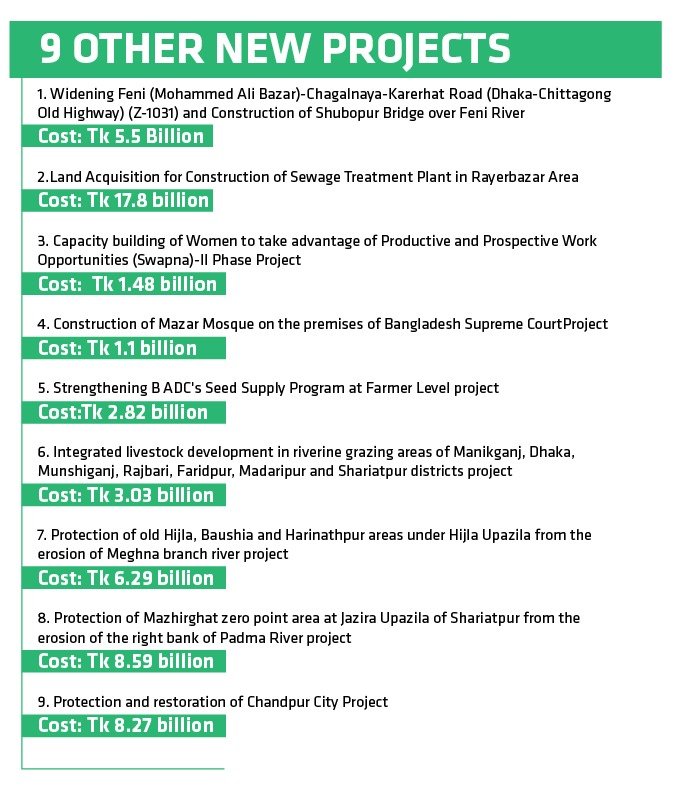

A total of 19 development projects, including one focused on the development and expansion of Mongla Port facilities, received approval from ECNEC during its Tuesday meeting. The estimated cost for these projects is Tk 180.67 billion. Prime Minister Sheikh Hasina chaired the meeting, which took place at the NEC conference room in Sher-e Bangla Nagar, Dhaka. Within the list of approved projects, there are 12 new initiatives and seven revised projects.

You can also read: ECNEC approves massive budget for infrastructure overhaul

Funding sources:

- The government will provide Tk 120.6 billion of the overall cost.

- Tk 55.55 billion will be secured through foreign assistance.

- The remaining Tk 4.5 billion will be self-funded by the relevant departments.

Key projects and costs

1. Expansion and Development of Mongla Port Facilities

Estimated Cost: Tk 42.82 billion

Objective: Enhance and expand the facilities at Mongla Port to accommodate increased cargo traffic and improve logistics. Apart from these, the other objectives include enhancing container handling capacity, constructing a container terminal, and developing a container delivery yard.

Scope: Construction of new port infrastructure, including berths, warehouses, and handling equipment.

2. Development of Transmission Infrastructures of the Southern Region of Chittagong Division and Bangabandhu Hi-Tech City at Kaliakore

Estimated Cost: Tk 27.62 billion

Objective: Improve the transmission infrastructure in the southern region of Chittagong Division and support the development of the Bangabandhu Hi-Tech City at Kaliakore.

Scope: Upgrade and expand the electrical transmission network, including substations and transmission lines.

3. Emergency Restoration and Reconstruction of 2022 Flood-Affected Various Roads, Bridges, and Culverts under Sunamganj and Habiganj Road Division

Estimated Cost: Tk 26.81 billion

Objective: Address the damages caused by the 2022 floods to critical road infrastructure in the Sunamganj and Habiganj Road Division.

Scope: Repair and reconstruction of damaged roads, bridges, and culverts, and implement flood-resilient design measures.

Delta Plan-2100 Integration

MA Mannan revealed that during the meeting, the Prime Minister emphasized the importance of aligning development projects with Delta Plan-2100 in order to qualify for funding from the $1 billion Climate Fund allocated for Bangladesh.

On September 4, 2018, the government of Bangladesh gave its approval to the Delta Plan 2100, which aims to safeguard water resources and combat the anticipated impacts of climate change and natural disasters.

Delta Plan (BDP) 2100 is an extensive, long-term integrated plan that consolidates all delta-related sectoral plans and policies. It encompasses a Delta Vision and strategic approaches designed to enable the long-term integration of sectoral plans and policies, offering a roadmap for tangible interventions.

Successful execution of the Delta Plan will eradicate extreme poverty, generate additional employment opportunities, and maintain GDP growth at or above 8% until 2041. This will also enhance trade prospects, bolster navigational options, and fortify food security.

Macron’s Visit and G20 summit has elevated Bangladesh’s global reputation

Commencing the meeting, the Planning Minister commended the Prime Minister for her outstanding and lively participation in the G20 Summit held in New Delhi, which has elevated the Prime Minister’s and the country’s global profile.

On Monday, a bilateral meeting took place between Prime Minister Sheikh Hasina and French President Emmanuel Macron at Dhaka. Several issues were discussed with the aim of advancing their bilateral relationship including the subject of aiding $1 billion from the climate fund.

The meeting also included a discussion about Bangladesh’s potential to become one of the top 20 economies by 2040, according to the report from the Economic Intelligence Unit (EIU).

How can Climate Funds Mitigate Climate Change Challenges in Bangladesh?

Green Climate Fund is a recently established fund under the United Nations Framework Convention on Climate Change (UNFCCO), designated to route $100 billion annually from developed nations to developing ones. Bangladesh will have to participate in a competitive process alongside other countries to secure funding from the GCF.

Bangladesh’s most recent National Adaptation Plan emphasizes the necessity of securing $230 billion in funding from 2023 to 2050 for the implementation of adaptation strategies in sectors including water resources, agriculture, and ecosystems. Despite this substantial need, the Government of Bangladesh has only elevated its climate-focused budget allocations by a modest 1.1% between FY15 and FY22.

It is critical to enhance Bangladesh’s fiscal capacity to boost budget allocations for relevant ministries and agencies. To alleviate this challenge, the country can consider pursuing grant-based or heavily concessional climate assistance, while also exploring opportunities to renegotiate and restructure current development loans.

Inflation concerns

Regarding the August inflation figures, Mannan acknowledged the rise and emphasized that the government is well-informed about it. He stated, “We will approach this challenge with the same effective strategies that we’ve employed in the past.”

To combat inflation effectively, Bangladesh Bank needs to act decisively by revisiting the 6/9 interest rate policy, demonstrating flexibility in setting interest rates. Simultaneously, expediting the development of a secondary market for T-bills is vital for effective interest rate-based monetary policy management.

The government’s cooperation is essential in supporting the Bangladesh Bank’s strategy to control inflation. This includes maintaining fiscal deficits below 5% of GDP, implementing capital-intensive projects gradually, and securing low-cost foreign financing to address the budget deficit.

To mitigate price shocks, fixed dollar prices were established. However, this approach has led to a shock in terms of quantity. The availability of dollars in the market has dwindled as a consequence. Had the government adopted a flexible exchange rate for the dollar, there wouldn’t be such stringent limitations on Letters of Credit (LCs). While prices may have initially increased, a supply-side response would likely have emerged, eventually lowering prices.