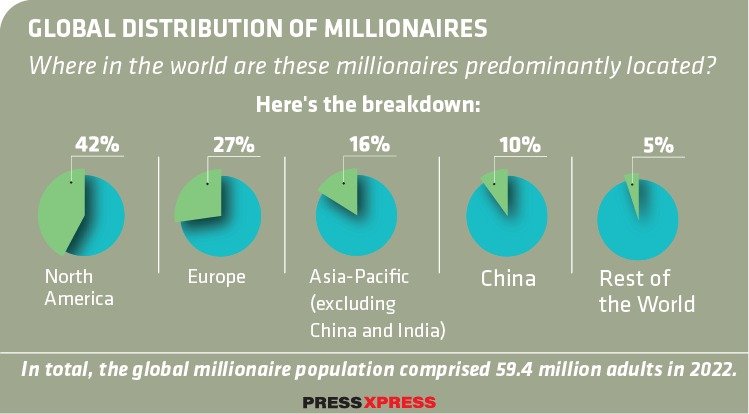

In the last decade, we’ve witnessed an unprecedented surge in the number of millionaires worldwide. This extraordinary growth can be attributed to various factors, including technological advancements, market expansions, and more. In this listicle, we’ll explore the data from the 2022 Global Wealth Report by Credit Suisse to gain insights into the thriving millionaire population. From wealth distribution to future predictions, we’ll cover it all in a concise and informative manner.

You Can Also Read: Dollar Surge Shakes the Nation: Implications on Import Costs, Inflation, and Lives

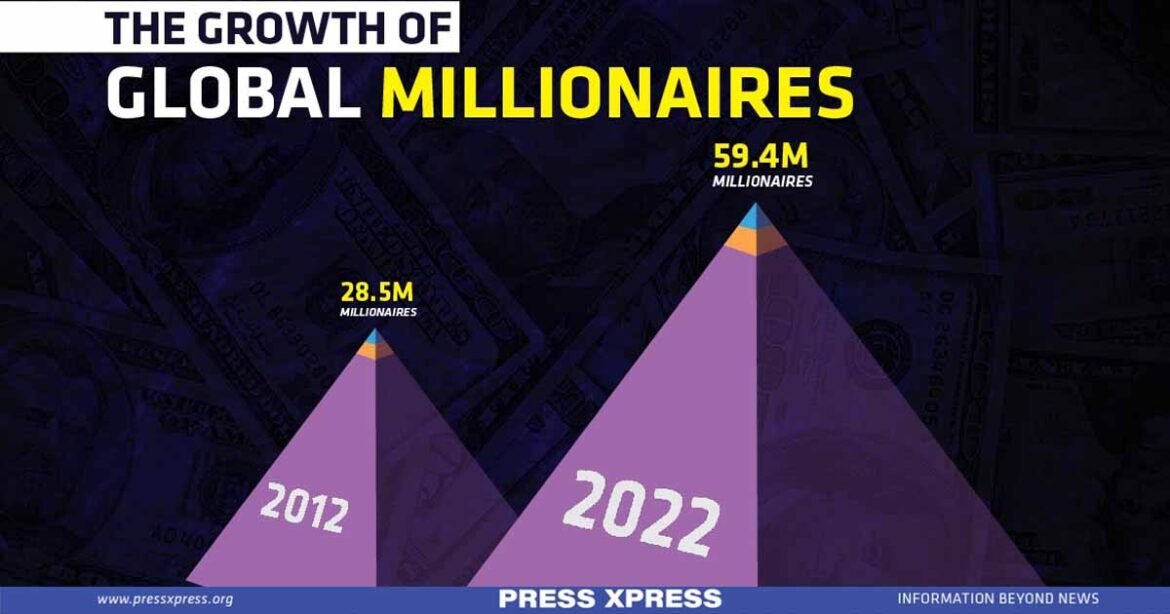

A Comparison of World’s Millionaires

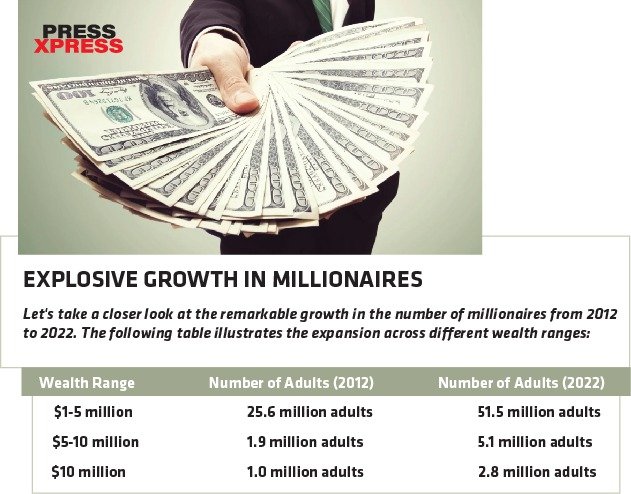

In 2022, the combined wealth of millionaires worldwide reached an astounding $208.3 trillion, constituting a whopping 45.8% of global wealth. This marks an astonishing 138% increase from 2011 when millionaires held $87.5 trillion in wealth. While various factors have contributed to this surge, financial assets have played a pivotal role, especially since the 2008 Financial Crisis, as per Credit Suisse’s analysis.

Notably, at the highest echelons of wealth, the number of ultra-high-net-worth individuals, those holding $50 million or more, has nearly tripled over the past decade.

Projections of Future Millionaires

Despite challenges like inflation, fluctuating interest rates, and current market conditions, Credit Suisse remains optimistic. They forecast that the number of millionaires will continue to rise, reaching an estimated 86 million by 2027. This represents a staggering 45% increase from the 2022 figures. The worldwide millionaire population is poised for remarkable expansion in the coming years.

Wealth Inequality Still a Concern

While the millionaire population flourishes, global wealth inequality remains a pressing issue. In 2022, despite a slight reduction in inequality, a significant portion of global wealth remains concentrated among the wealthiest individuals. In perspective, 52.5% of adults worldwide held less than $10,000, accounting for just 1.2% of global wealth.

Over the past two decades, global wealth inequality generally trended downward. However, the period between 2020 and 2021 brought a temporary reversal due to the pandemic and the subsequent surge in share and house prices. Looking ahead to 2027, Credit Suisse’s forecasts suggest that the share of adults with less than $10,000 in wealth will decrease. This implies that more adults will transition into the middle and upper-income levels. The question of whether global wealth inequality will sustain its prolonged decline remains uncertain.

The past decade has witnessed an extraordinary rise in the global millionaire population, driven by various factors, particularly the growth of financial assets. Millionaires Worldwide now hold a substantial portion of global wealth, and their numbers continue to grow. Despite wealth inequality challenges, the future looks promising, with projections indicating a significant increase in millionaires worldwide by 2027. As we move forward, it will be crucial to monitor the evolving landscape of wealth distribution and strive for a more equitable global economy.